1125 E Form

1125 E Form - Total receipts (line 1a, plus lines 4 through. How it works upload the 1125 e. Web how to create an signature for the ir's form 1125 e 2018 2019 on ios devices 1125 ece like an iphone or ipad, easily create electronic signatures for signing an form 1125 e in pdf. Show details this website is not affiliated with irs. You can download or print current or. Do not include compensation deductible elsewhere on the return, such as amounts. It is for separate entity business returns. I have one officer that was. Web the corporation will expense officer compensation on line 12 of form 1120. It is not a form provided an officer to prepare their own return.

Do not include compensation deductible elsewhere on the return, such as amounts. Web the corporation will expense officer compensation on line 12 of form 1120. Total receipts (line 1a, plus lines 4 through 10) on form 1120 must be $500,000. Show details this website is not affiliated with irs. You can download or print current or. It is for separate entity business returns. Total receipts (line 1a, plus lines 4 through. How it works upload the 1125 e. Web how to create an signature for the ir's form 1125 e 2018 2019 on ios devices 1125 ece like an iphone or ipad, easily create electronic signatures for signing an form 1125 e in pdf. I have one officer that was.

Web how to create an signature for the ir's form 1125 e 2018 2019 on ios devices 1125 ece like an iphone or ipad, easily create electronic signatures for signing an form 1125 e in pdf. I have one officer that was. How it works upload the 1125 e. Web the corporation will expense officer compensation on line 12 of form 1120. It is for separate entity business returns. Show details this website is not affiliated with irs. Total receipts (line 1a, plus lines 4 through 10) on form 1120 must be $500,000. You can download or print current or. It is not a form provided an officer to prepare their own return. Total receipts (line 1a, plus lines 4 through.

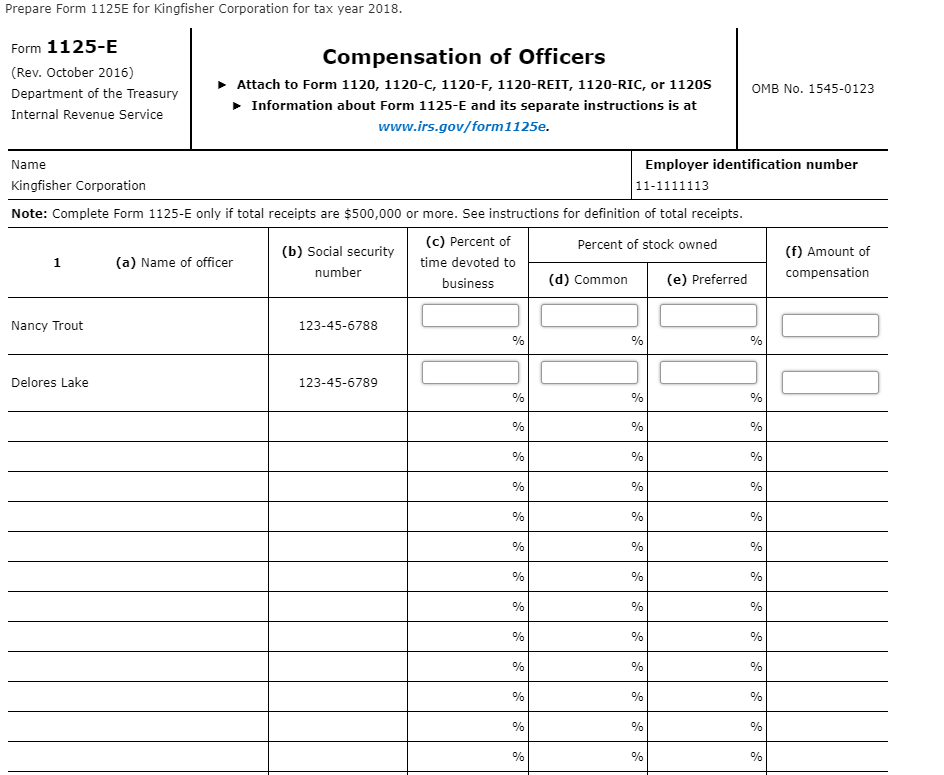

Prepare Federal Return form 1120, 1125A and 1125E

Web the corporation will expense officer compensation on line 12 of form 1120. I have one officer that was. It is for separate entity business returns. How it works upload the 1125 e. Web how to create an signature for the ir's form 1125 e 2018 2019 on ios devices 1125 ece like an iphone or ipad, easily create electronic.

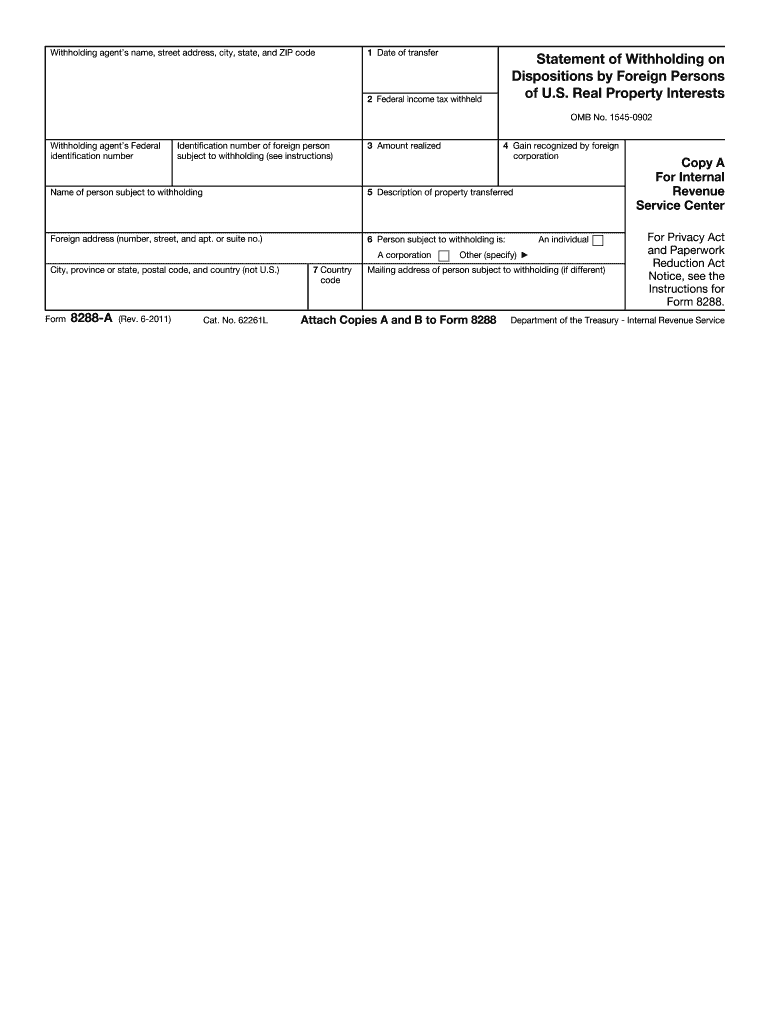

2011 Form IRS 8288A Fill Online, Printable, Fillable, Blank PDFfiller

Do not include compensation deductible elsewhere on the return, such as amounts. How it works upload the 1125 e. Total receipts (line 1a, plus lines 4 through. Web how to create an signature for the ir's form 1125 e 2018 2019 on ios devices 1125 ece like an iphone or ipad, easily create electronic signatures for signing an form 1125.

Form 1065 2017

Do not include compensation deductible elsewhere on the return, such as amounts. How it works upload the 1125 e. Show details this website is not affiliated with irs. It is for separate entity business returns. I have one officer that was.

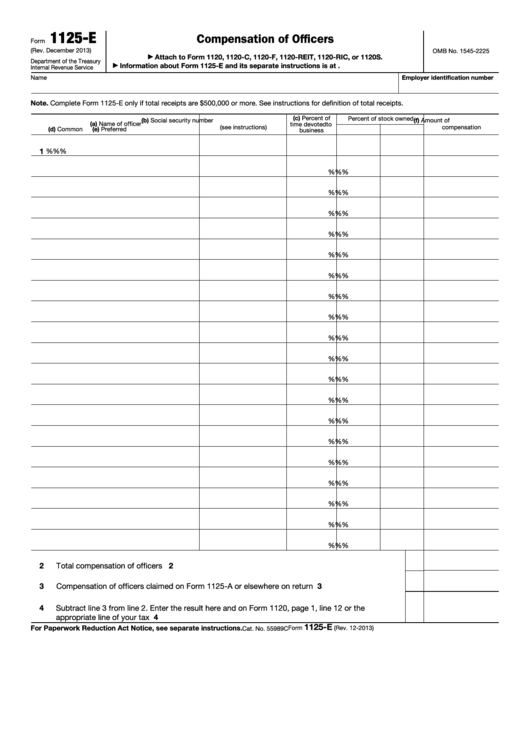

Fillable Form 1125E Compensation Of Officers printable pdf download

Web how to create an signature for the ir's form 1125 e 2018 2019 on ios devices 1125 ece like an iphone or ipad, easily create electronic signatures for signing an form 1125 e in pdf. Total receipts (line 1a, plus lines 4 through 10) on form 1120 must be $500,000. You can download or print current or. Total receipts.

Irs Form 1125 E Editable Online Blank in PDF

How it works upload the 1125 e. Total receipts (line 1a, plus lines 4 through. It is for separate entity business returns. Total receipts (line 1a, plus lines 4 through 10) on form 1120 must be $500,000. I have one officer that was.

Note This problem is for the 2018 tax year. On

Web the corporation will expense officer compensation on line 12 of form 1120. Total receipts (line 1a, plus lines 4 through. You can download or print current or. Total receipts (line 1a, plus lines 4 through 10) on form 1120 must be $500,000. I have one officer that was.

Form 1125E Compensation of Officers (2013) Free Download

Do not include compensation deductible elsewhere on the return, such as amounts. Show details this website is not affiliated with irs. You can download or print current or. Total receipts (line 1a, plus lines 4 through. It is for separate entity business returns.

2013 Form IRS Instruction 1125E Fill Online, Printable, Fillable

I have one officer that was. Web how to create an signature for the ir's form 1125 e 2018 2019 on ios devices 1125 ece like an iphone or ipad, easily create electronic signatures for signing an form 1125 e in pdf. It is not a form provided an officer to prepare their own return. Web the corporation will expense.

Form 1125A Cost of Goods Sold (2012) Free Download

How it works upload the 1125 e. It is not a form provided an officer to prepare their own return. Show details this website is not affiliated with irs. Web the corporation will expense officer compensation on line 12 of form 1120. Do not include compensation deductible elsewhere on the return, such as amounts.

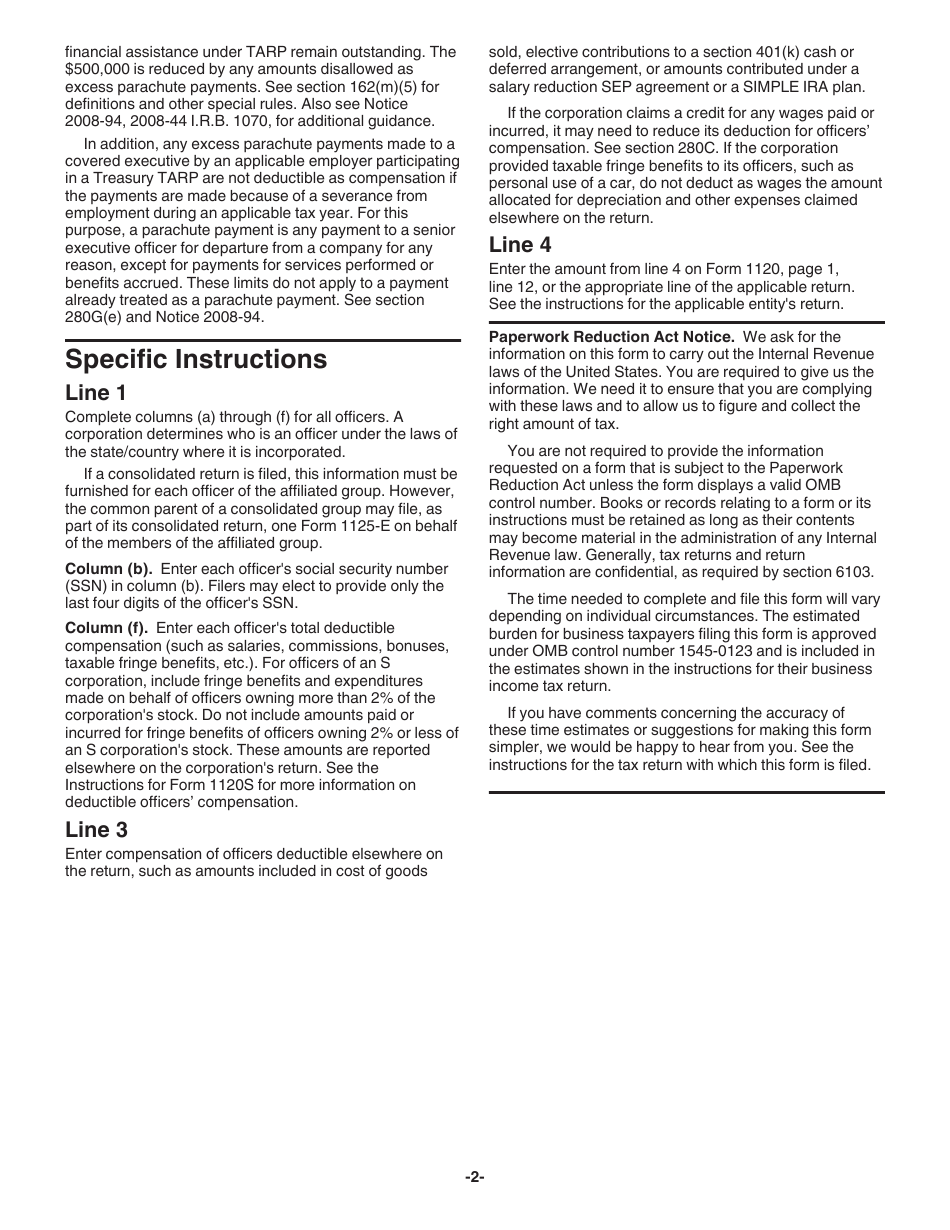

Download Instructions for IRS Form 1125E Compensation of Officers PDF

Show details this website is not affiliated with irs. How it works upload the 1125 e. Web the corporation will expense officer compensation on line 12 of form 1120. Web how to create an signature for the ir's form 1125 e 2018 2019 on ios devices 1125 ece like an iphone or ipad, easily create electronic signatures for signing an.

Show Details This Website Is Not Affiliated With Irs.

It is for separate entity business returns. Total receipts (line 1a, plus lines 4 through. Do not include compensation deductible elsewhere on the return, such as amounts. How it works upload the 1125 e.

You Can Download Or Print Current Or.

Web how to create an signature for the ir's form 1125 e 2018 2019 on ios devices 1125 ece like an iphone or ipad, easily create electronic signatures for signing an form 1125 e in pdf. Web the corporation will expense officer compensation on line 12 of form 1120. I have one officer that was. Total receipts (line 1a, plus lines 4 through 10) on form 1120 must be $500,000.