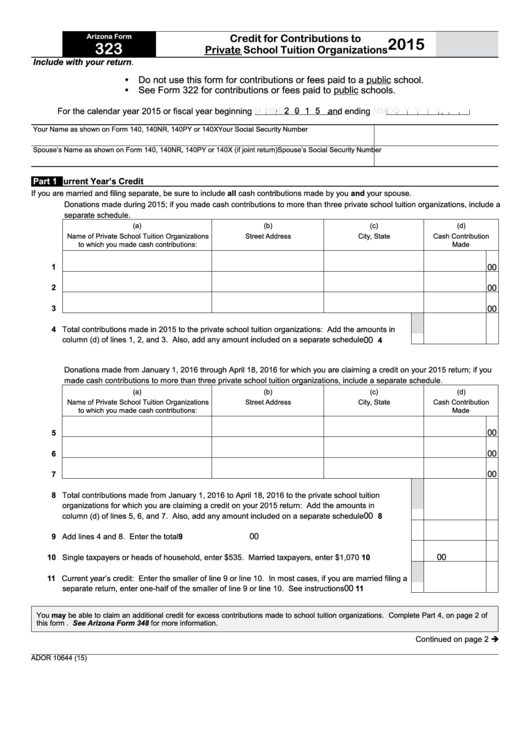

Arizona Tax Form 323

Arizona Tax Form 323 - Do not use this form for cash contributions or fees paid to a. Arizona has a state income tax that ranges between 2.59% and 4.5% , which is administered by the arizona department of revenue. Do not use this form for cash contributions or fees paid to a. Web arizona form credit for contributions to 323private school tuition organizations2020 include with your return. Web first claim the maximum current year’s credit allowed on arizona form 323, credit for contributions to private school tuition organizations. Web arizona form 323 credit for contributions to private school tuition organizations 2022 include with your return. Credit eligible cash contributions made to a private sto from january 1, 2022, to april 18, 2022, may be used as a tax. Web individual income tax forms the arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022 electronic filing. Web arizona form 323 for calendar year filers: Web credit for contributions to private school tuition organizations (original individual income tax credit) this tax credit is claimed on form 323.

Web arizona form credit for contributions to 323private school tuition organizations2020 include with your return. Arizona has a state income tax that ranges between 2.59% and 4.5% , which is administered by the arizona department of revenue. Are eligible and elect to pay tax based on the optional tax tables pursuant to section 43. Web first claim the maximum current year’s credit allowed on arizona form 323, credit for contributions to private school tuition organizations. Web a nonrefundable individual tax credit for cash contributions to a school tuition organization that exceed the original private school tuition organization. Do not use this form for cash contributions or fees paid to a. Credit eligible cash contributions made to a private sto from january 1, 2021, to april 15, 2021, may be used as a tax. Do not use this form for cash contributions or fees paid to a. Web 323 credit for contributions toprivate school tuition organizations 2021 include with your return. The amount of credit you must.

Application for bingo license packet. The amount of credit you must. The department may provide a simplified return form for individual taxpayers who: Web when filing, you can claim your credit for donations made to the original tax credit by using arizona form 323, donations made to the switcher (overflow/plus) tax credit can be. Web arizona form credit for contributions to 323private school tuition organizations2020 include with your return. Do not use this form for cash contributions or fees paid to a. Web 26 rows bingo forms. Arizona has a state income tax that ranges between 2.59% and 4.5% , which is administered by the arizona department of revenue. Web the maximum for the 2023 tax year is $1,307 filing single, and $2,609 filing married jointly. Are eligible and elect to pay tax based on the optional tax tables pursuant to section 43.

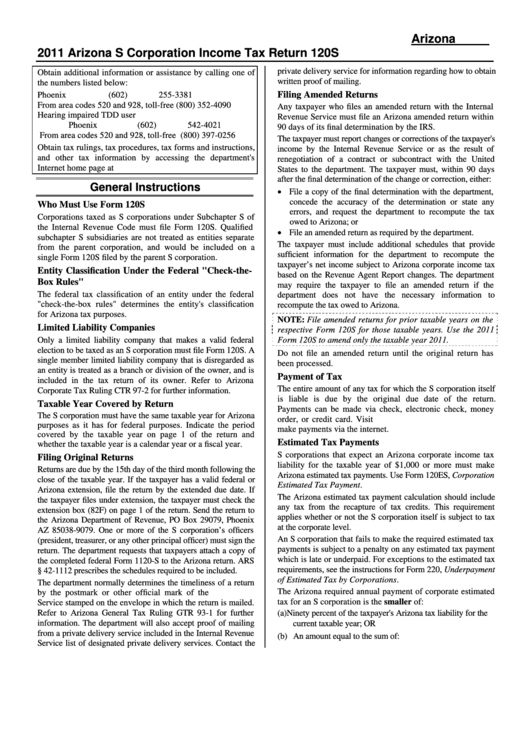

Instructions For Arizona Form 120s Arizona S Corporation Tax

Web the maximum for the 2023 tax year is $1,307 filing single, and $2,609 filing married jointly. Web arizona form credit for contributions to 323private school tuition organizations2020 include with your return. Credit eligible cash contributions made to a private sto from january 1, 2021, to april 15, 2021, may be used as a tax. Do not use this form.

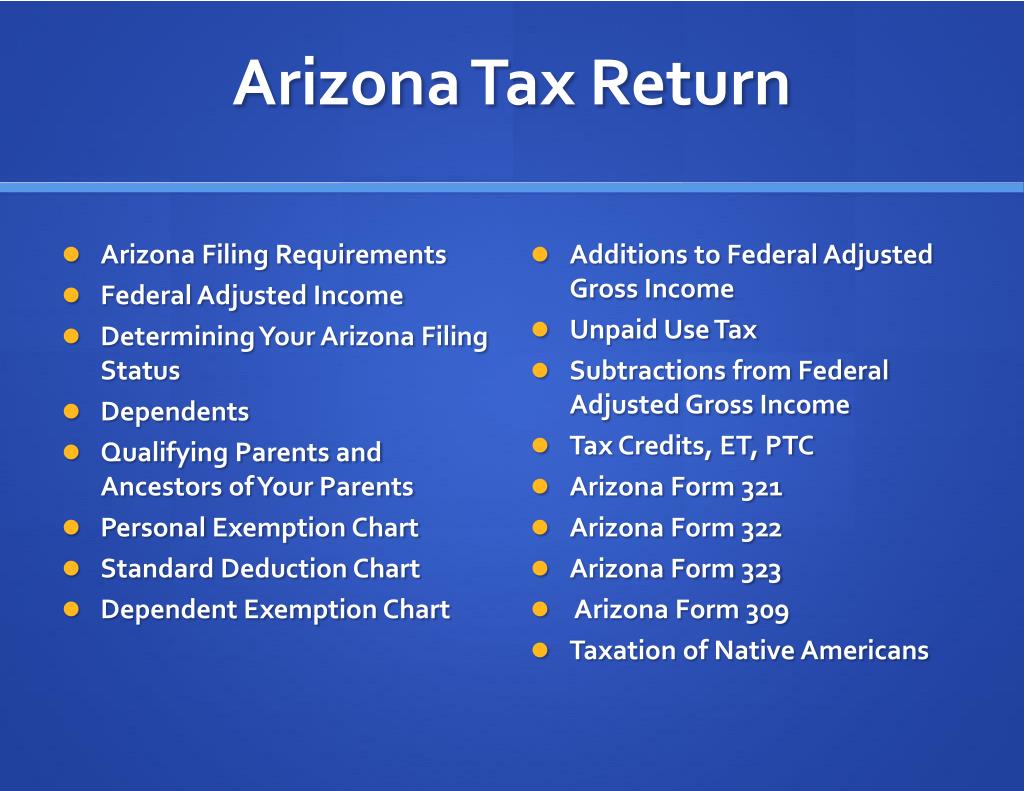

PPT Arizona State Tax Return 2012 PowerPoint Presentation, free

Application for bingo license packet. The department may provide a simplified return form for individual taxpayers who: Web a nonrefundable individual tax credit for cash contributions to a school tuition organization that exceed the original private school tuition organization. Web 323 credit for contributions toprivate school tuition organizations 2021 include with your return. Web arizona form 323 for calendar year.

Form 323 Download Printable PDF or Fill Online Residential Economic

Web the forms needed to claim the credit are az form 301 (used for any arizona state tax credit), az form 323 (to claim original donation credits) and az form 348 (to claim plus. If married taxpayers file separate returns, each spouse may claim only 1/2 of the credit that. Web first claim the maximum current year’s credit allowed on.

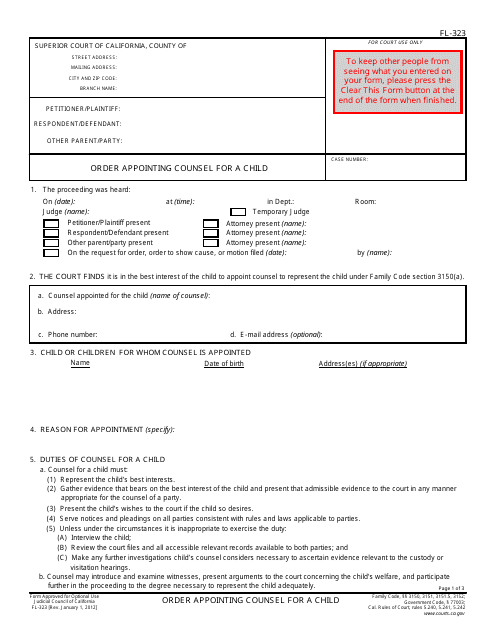

Form FL323 Download Fillable PDF or Fill Online Order Appointing

Arizona has a state income tax that ranges between 2.59% and 4.5% , which is administered by the arizona department of revenue. The amount of credit you must. Web arizona form credit for contributions to 323private school tuition organizations2020 include with your return. Web arizona form 323 for calendar year filers: Web 26 rows bingo forms.

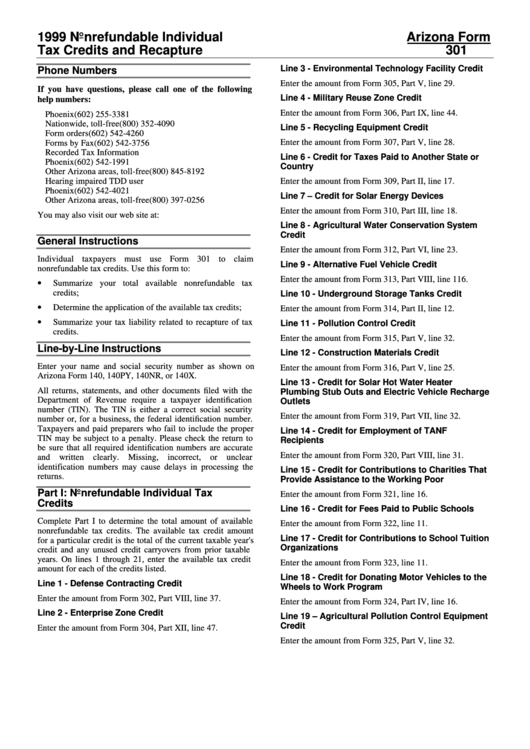

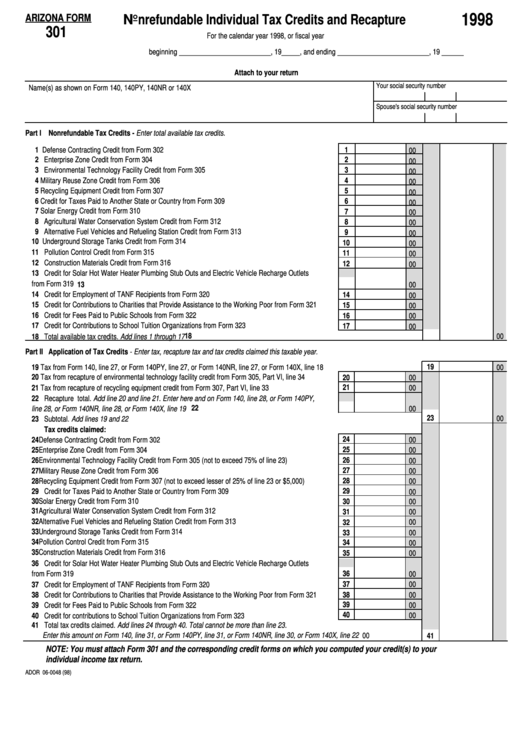

Arizona Form 301 Nonrefundable Individual Tax Credits And Recapture

The amount of credit you must. Do not use this form for cash contributions or fees paid to a public school. Web arizona form credit for contributions to 323private school tuition organizations2020 include with your return. Web first claim the maximum current year’s credit allowed on arizona form 323, credit for contributions to private school tuition organizations. Web when filing,.

Fillable Arizona Form 301 Nonrefundable Individual Tax Credits And

Web the forms needed to claim the credit are az form 301 (used for any arizona state tax credit), az form 323 (to claim original donation credits) and az form 348 (to claim plus. Web 323 credit for contributions toprivate school tuition organizations 2021 include with your return. Web arizona tax form 323 is created by turbotax when you indicate.

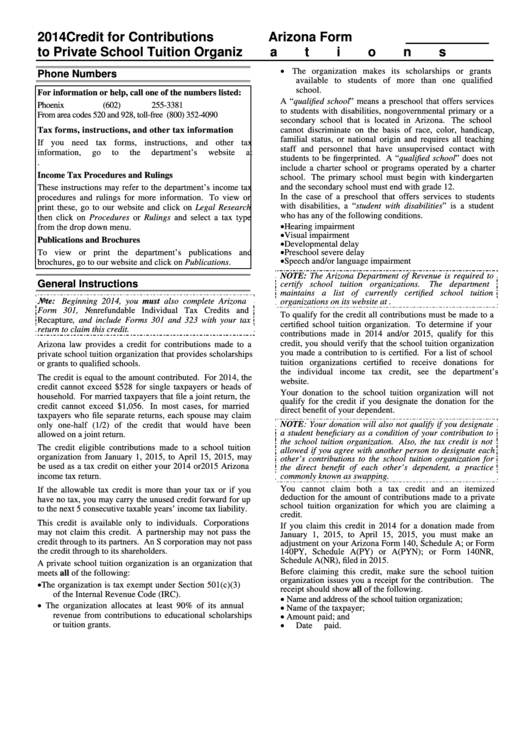

Instructions For Form 323 Arizona Credit For Contributions To Private

Web individual income tax forms the arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022 electronic filing. Credit eligible cash contributions made to a private sto from january 1, 2021, to april 15, 2021, may be used as a tax. Web 2019 credit for contributions arizona form to private school tuition.

Fillable Arizona Form 323 Credit For Contributions To Private School

Web 323 credit for contributions toprivate school tuition organizations 2021 include with your return. The department may provide a simplified return form for individual taxpayers who: The amount of credit you must. Web the maximum for the 2023 tax year is $1,307 filing single, and $2,609 filing married jointly. Arizona has a state income tax that ranges between 2.59% and.

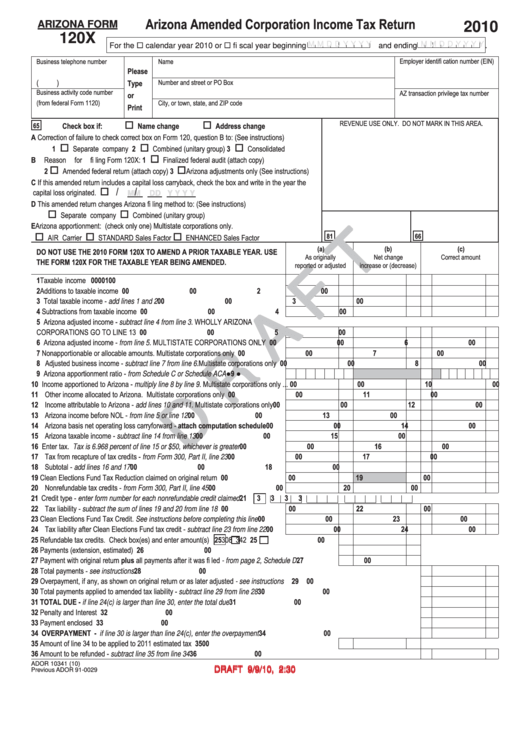

Arizona Form 120x Draft Arizona Amended Corporation Tax Return

Arizona has a state income tax that ranges between 2.59% and 4.5% , which is administered by the arizona department of revenue. Are eligible and elect to pay tax based on the optional tax tables pursuant to section 43. Web 2019 credit for contributions arizona form to private school tuition organizations 323 for information or help, call one of the.

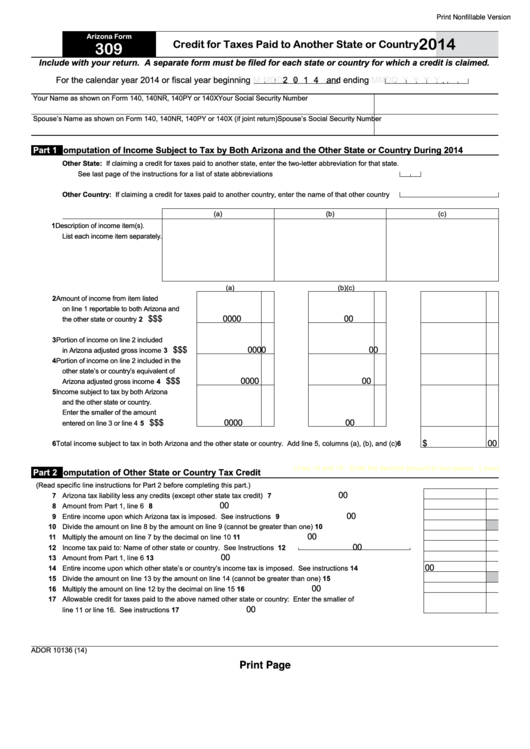

Fillable Arizona Form 309 Credit For Taxes Paid To Another State Or

Web individual income tax forms the arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022 electronic filing. Web the maximum for the 2023 tax year is $1,307 filing single, and $2,609 filing married jointly. Web 2019 credit for contributions arizona form to private school tuition organizations 323 for information or help,.

Web A Nonrefundable Individual Tax Credit For Cash Contributions To A School Tuition Organization That Exceed The Original Private School Tuition Organization.

Application for bingo license packet. Do not use this form for cash contributions or fees paid to a public school. Credit eligible cash contributions made to a private sto from january 1, 2021, to april 15, 2021, may be used as a tax. Do not use this form for cash contributions or fees paid to a.

Web Arizona Form 323 Either The Current Or Preceding Taxable Year And Is Considered To Have Been Made On The Last Day Of That Taxable Year.

Web individual income tax forms the arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022 electronic filing. Web when filing, you can claim your credit for donations made to the original tax credit by using arizona form 323, donations made to the switcher (overflow/plus) tax credit can be. Web arizona form 323 credit for contributions to private school tuition organizations 2022 include with your return. Web arizona form credit for contributions to 323private school tuition organizations2020 include with your return.

Web First Claim The Maximum Current Year’s Credit Allowed On Arizona Form 323, Credit For Contributions To Private School Tuition Organizations.

Web the maximum for the 2023 tax year is $1,307 filing single, and $2,609 filing married jointly. The amount of credit you must. Web the forms needed to claim the credit are az form 301 (used for any arizona state tax credit), az form 323 (to claim original donation credits) and az form 348 (to claim plus. Web 2019 credit for contributions arizona form to private school tuition organizations 323 for information or help, call one of the numbers listed:

Web Arizona Form 323 For Calendar Year Filers:

Web arizona form 323 for calendar year filers: Web arizona tax form 323 is created by turbotax when you indicate that you have made cash contributions to a private school tuition organization that provides scholarships or grants. Web credit for contributions to private school tuition organizations (original individual income tax credit) this tax credit is claimed on form 323. The department may provide a simplified return form for individual taxpayers who: