Business Debt Schedule Form

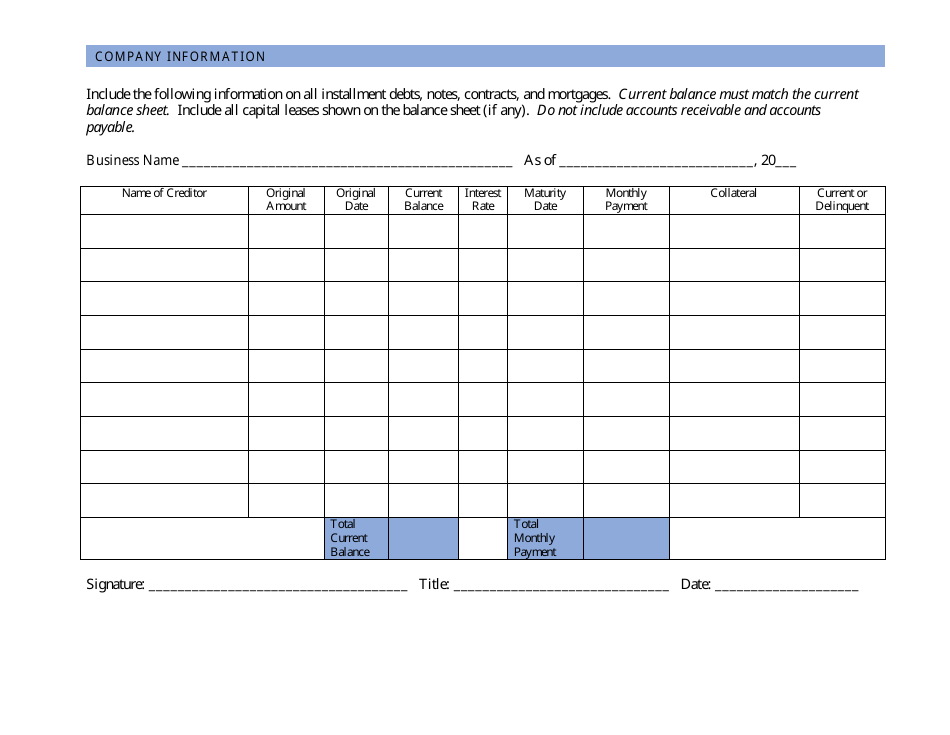

Business Debt Schedule Form - Download the debt schedule template. Creditor name creditor type loan, line or credit card note date open date (mm/yyyy) current balance outstanding. Web business debt schedule creditor name/address original date original amount term or maturity date present balance interest rate monthly. Using the debt schedule template Web a business debt schedule is a table that lists your monthly debt payments in order of maturity. This form is provided for your convenience in responding to filing requirements in item 2 on the application, sba form 5. You can deduct it on schedule c (form 1040), profit or loss from business (sole proprietorship) or. Web what is a business debt schedule? The information contained in this schedule is a su pplement to your balance sheet and should balance to the liabilities presented on that form. Item 2 on the application, sba form 5.

It helps you track cash flow and make informed, strategic decisions about paying off debt and potentially taking on new small business loans. Item 2 on the application, sba form 5. The information contained in this schedule is a su pplement to your balance sheet and should balance to the liabilities presented on that form. A debt schedule for a business is a table that lists your debts according to the order of maturity. Web downloadable business debt schedule form. Web what is a business debt schedule? Web a business debt schedule, much like it sounds, is a list of all the debts your business currently owes. Web business debt schedule creditor name/address original date original amount term or maturity date present balance interest rate monthly. Complete the table below by identifying all business debt (excluding any personal debt). Please use a separate form for each independent business entity.

Web a business debt schedule is a table that lists your monthly debt payments in order of maturity. However, to save time, our easy to use debt schedule includes: The information contained in this schedule is a su pplement to your balance sheet and should balance to the liabilities presented on that form. This form is provided for your convenience in responding to filing requirements on sba form 5, the disaster business loan application. It helps you track cash flow and make informed, strategic decisions about paying off debt and potentially taking on new small business loans. Your schedule of business debt can include details about the following: Complete the table below by identifying all business debt (excluding any personal debt). Using the debt schedule template Web a business debt schedule, much like it sounds, is a list of all the debts your business currently owes. Web what is a business debt schedule?

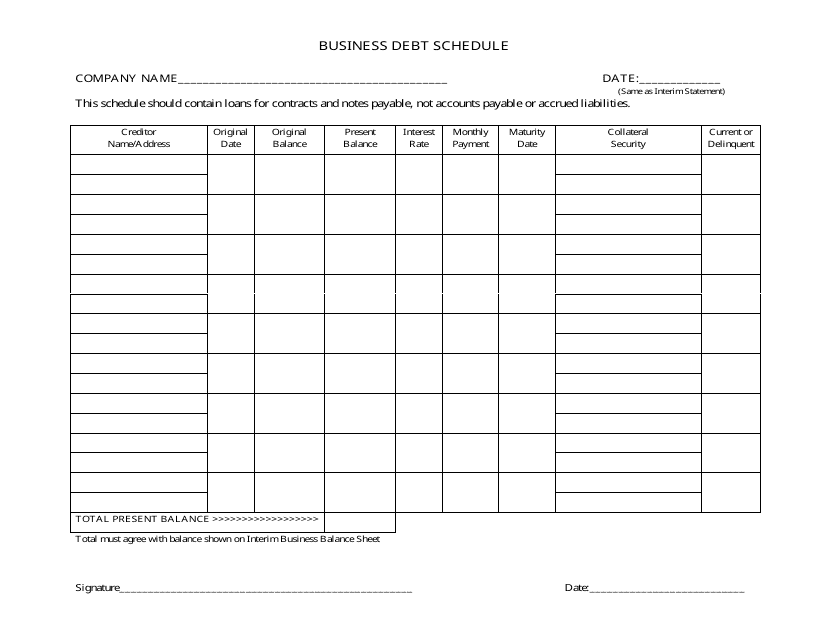

Business Debt Schedule Template Download Printable PDF Templateroller

Web business debt schedule creditor name/address original date original amount term or maturity date present balance interest rate monthly. Your schedule of business debt can include details about the following: Web a business debt schedule, much like it sounds, is a list of all the debts your business currently owes. Download the debt schedule template. You may use your own.

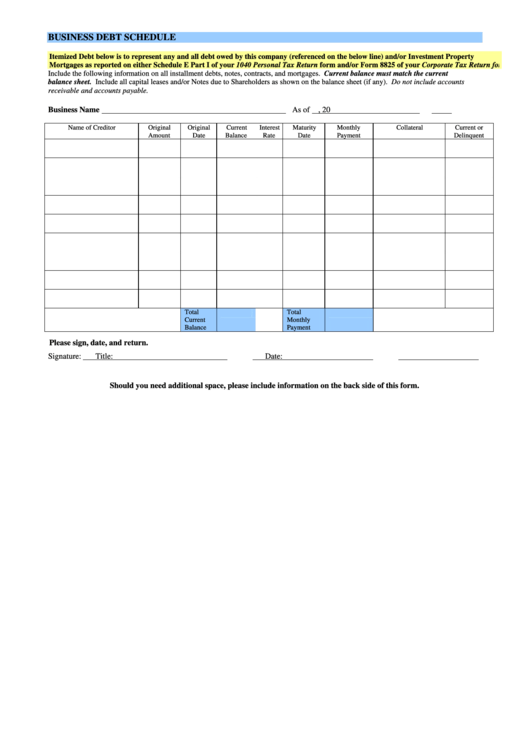

Business Debt Schedule Template Excel Darrin Kenney's Templates

At the end of the day, a business debt schedule connects 3 essential. Web schedule of liabilities. Item 2 on the application, sba form 5. This form is provided for your convenience in responding to filing requirements on sba form 5, the disaster business loan application. Web what is a business debt schedule?

Fillable Business Debt Schedule Template printable pdf download

Web schedule of liabilities. Your schedule of business debt can include details about the following: You can deduct it on schedule c (form 1040), profit or loss from business (sole proprietorship) or. At the end of the day, a business debt schedule connects 3 essential. You may use your own form if you prefer.

Debt Schedule Template Fill Online, Printable, Fillable, Blank

Web a business debt schedule is a table that lists your monthly debt payments in order of maturity. Web business debt schedule small business lending business name: You may use your own form if you prefer. Using the debt schedule template Web what is a business debt schedule?

Business Debt Schedule Template Download Fillable PDF Templateroller

Web schedule of liabilities. It helps you track cash flow and make informed, strategic decisions about paying off debt and potentially taking on new small business loans. Please use a separate form for each independent business entity. Loans leases contracts notes payable Web business debt schedule creditor name/address original date original amount term or maturity date present balance interest rate.

Business Debt Schedule Template Download Fillable PDF Templateroller

At the end of the day, a business debt schedule connects 3 essential. Web business debt schedule creditor name/address original date original amount term or maturity date present balance interest rate monthly. Please use a separate form for each independent business entity. Creditor name creditor type loan, line or credit card note date open date (mm/yyyy) current balance outstanding. Web.

Business Debt Schedule Form Ethel Hernandez's Templates

You can deduct it on schedule c (form 1040), profit or loss from business (sole proprietorship) or. Please use a separate form for each independent business entity. A debt schedule for a business is a table that lists your debts according to the order of maturity. Web what is a business debt schedule? You may use your own form if.

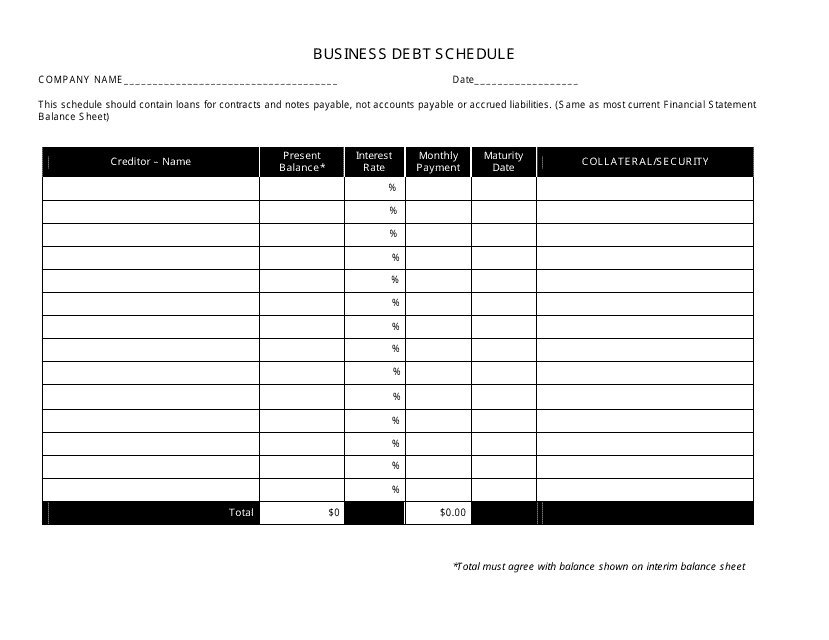

Free Debt Schedule Template Printable Templates

(total must agree with balance shown on interim balance sheet.) the schedule should include loans for contracts/notes payable and lines of credit, not accounts payable or accrued liabilities. A debt schedule for a business is a table that lists your debts according to the order of maturity. Please use a separate form for each independent business entity. Web a debt.

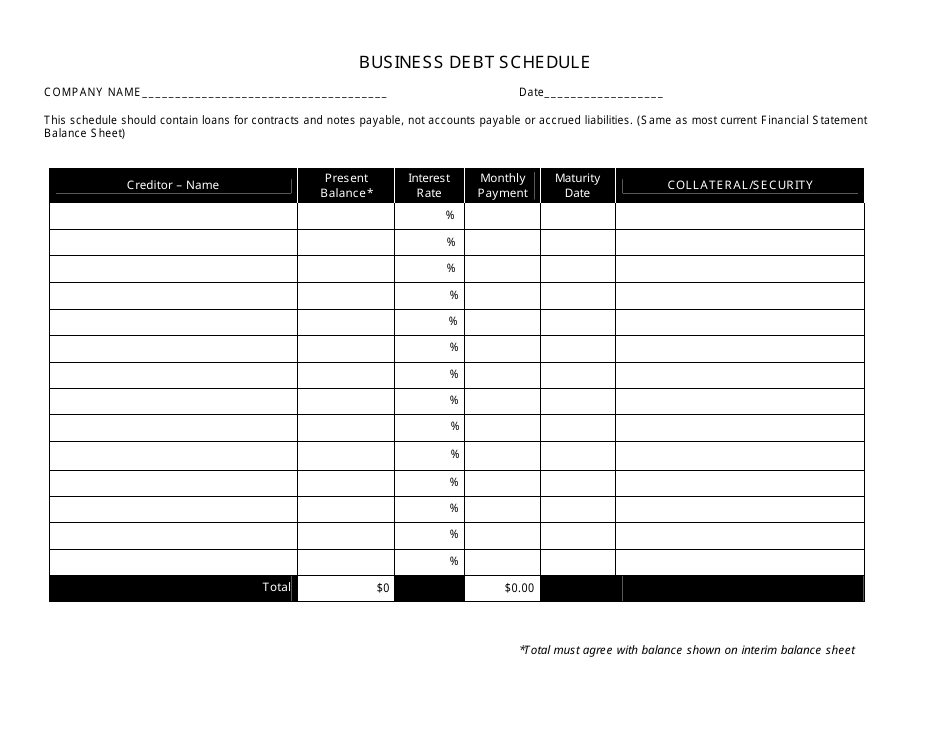

Business Debt Schedule Form Ethel Hernandez's Templates

However, to save time, our easy to use debt schedule includes: It helps you track cash flow and make informed, strategic decisions about paying off debt and potentially taking on new small business loans. You can deduct it on schedule c (form 1040), profit or loss from business (sole proprietorship) or. At the end of the day, a business debt.

Business Debt Schedule Template Excel Darrin Kenney's Templates

Web business debt schedule small business lending business name: Web business debt schedule creditor name/address original date original amount term or maturity date present balance interest rate monthly. Complete the table below by identifying all business debt (excluding any personal debt). It helps you track cash flow and make informed, strategic decisions about paying off debt and potentially taking on.

Web Downloadable Business Debt Schedule Form.

Please use a separate form for each independent business entity. Web a business debt schedule, much like it sounds, is a list of all the debts your business currently owes. Web schedule of liabilities. This form is provided for your convenience in responding to filing requirements on sba form 5, the disaster business loan application.

Web What Is A Business Debt Schedule?

Web this form is provided for your convenience in responding to filing requirements in. However, to save time, our easy to use debt schedule includes: Using the debt schedule template Item 2 on the application, sba form 5.

Web A Debt Is Closely Related To Your Trade Or Business If Your Primary Motive For Incurring The Debt Is Business Related.

Your schedule of business debt can include details about the following: It helps you track cash flow and make informed, strategic decisions about paying off debt and potentially taking on new small business loans. Web business debt schedule small business lending business name: Loans leases contracts notes payable

At The End Of The Day, A Business Debt Schedule Connects 3 Essential.

A debt schedule for a business is a table that lists your debts according to the order of maturity. (total must agree with balance shown on interim balance sheet.) the schedule should include loans for contracts/notes payable and lines of credit, not accounts payable or accrued liabilities. Creditor name creditor type loan, line or credit card note date open date (mm/yyyy) current balance outstanding. You may use your own form if you prefer.