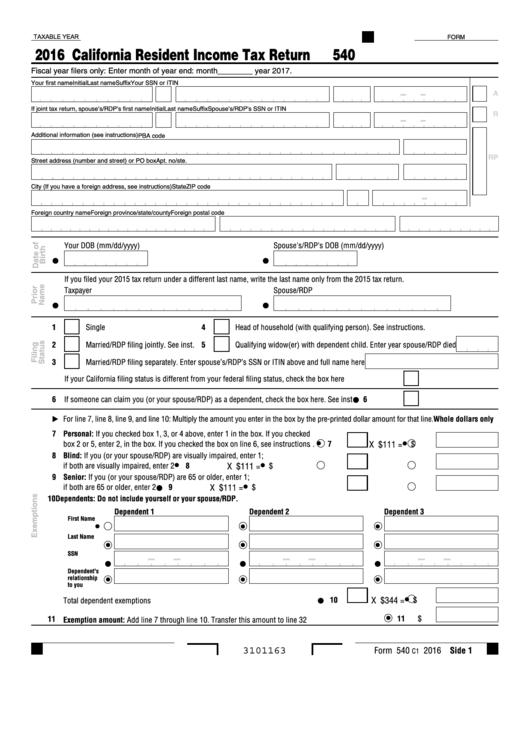

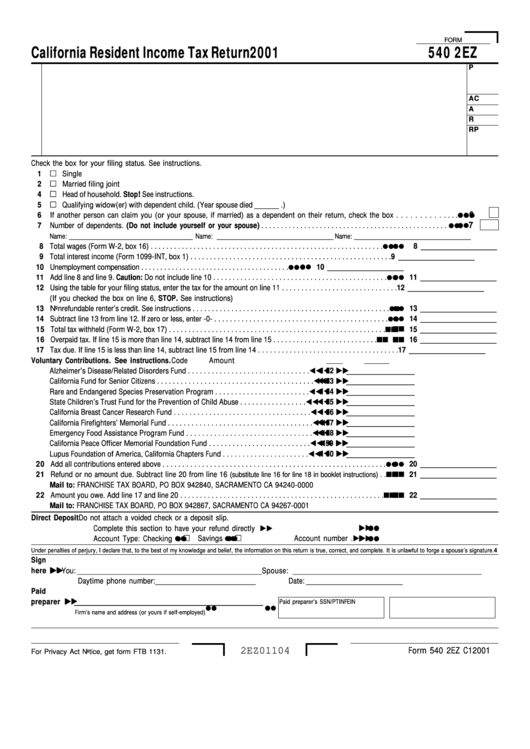

Ca Form 540Ez

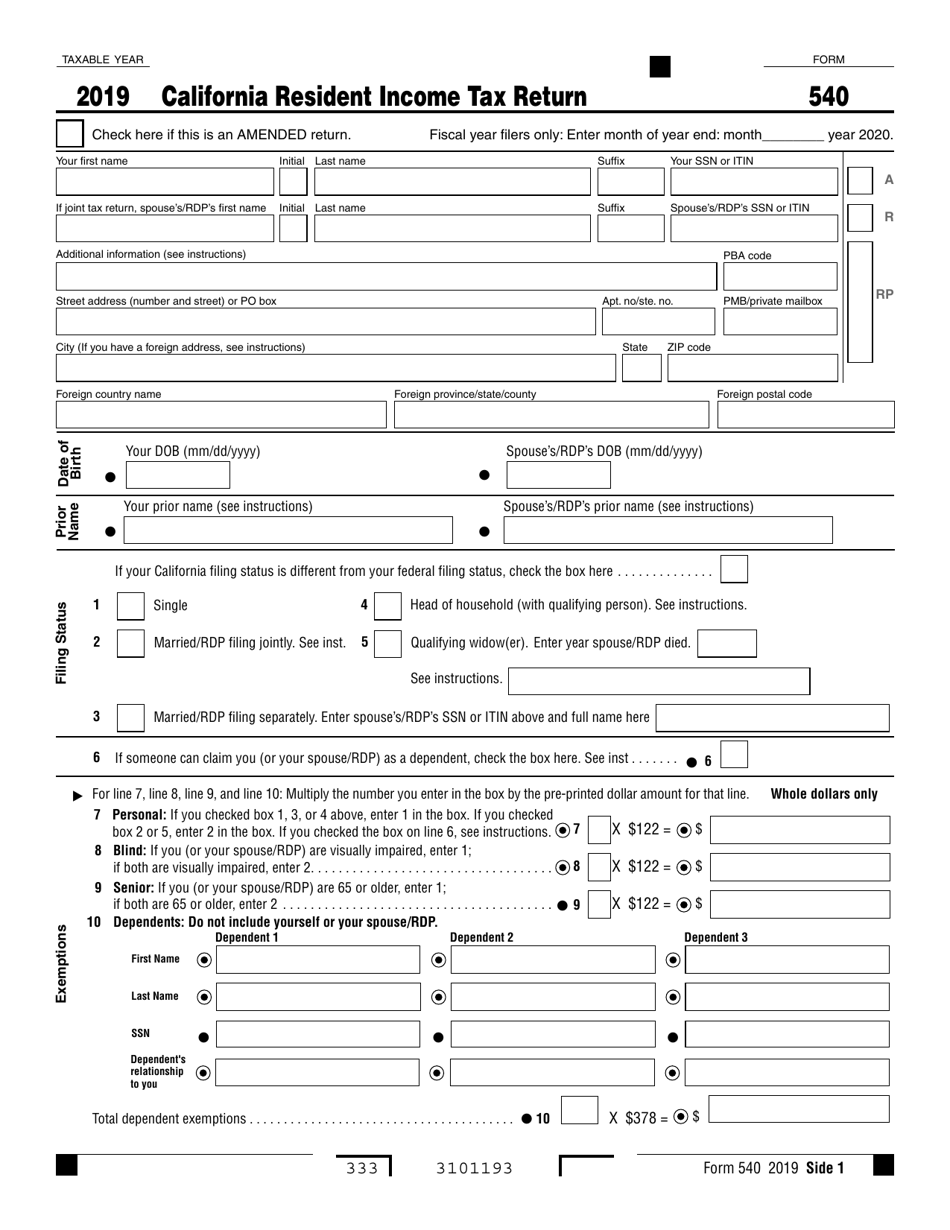

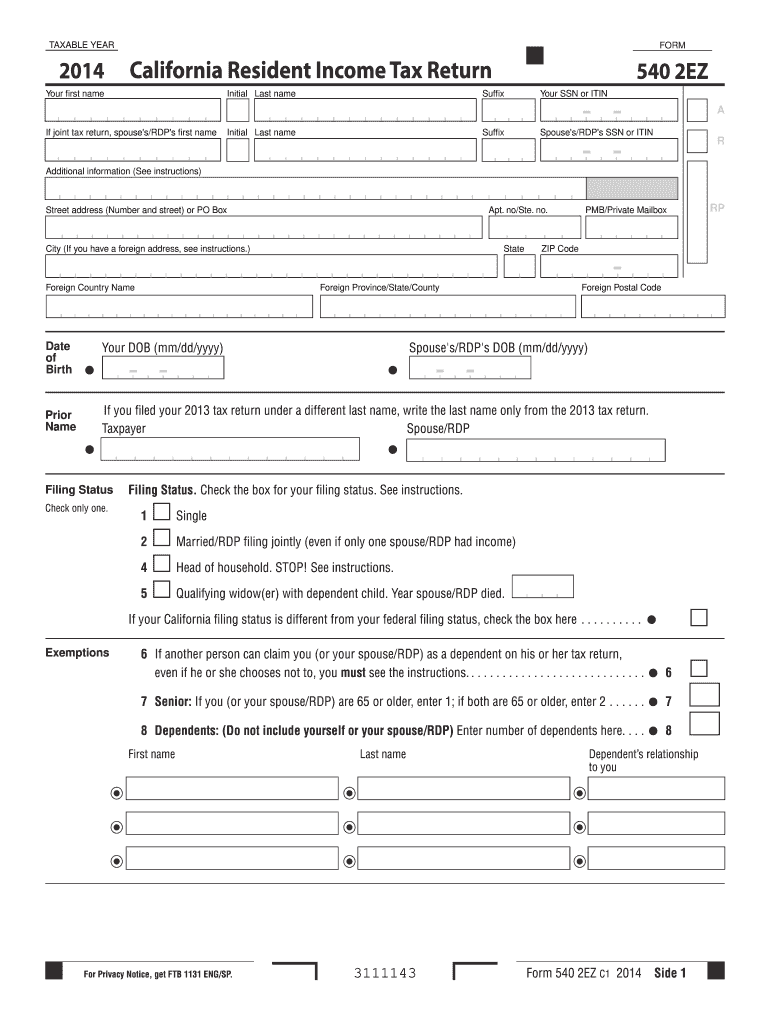

Ca Form 540Ez - Please use the link below to. You use your federal information (forms 1040, 1040a or 1040ez) to fill out your 540 form in turbot ax. Do not use these tables for form 540 or form 540nr. Do not use these tables for form 540 or form 540nr. Add line 29, line 31, line 33, and line 34. Web form 5402ez is a simplified tax form for individuals who do not have complex taxes. Web 540 2ez california resident income tax return. Web handy tips for filling out form 540 2ez online. Web form 540 is used by california residents to file their state income tax every april. Printing and scanning is no longer the best way to manage documents.

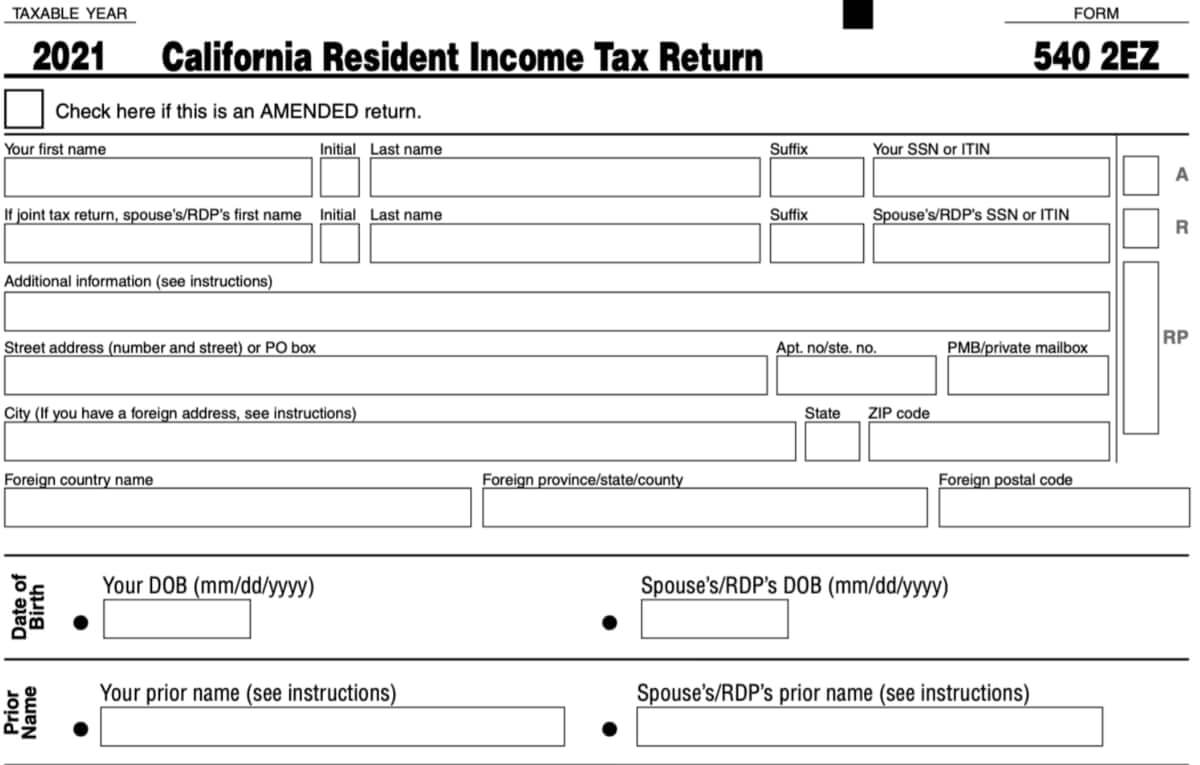

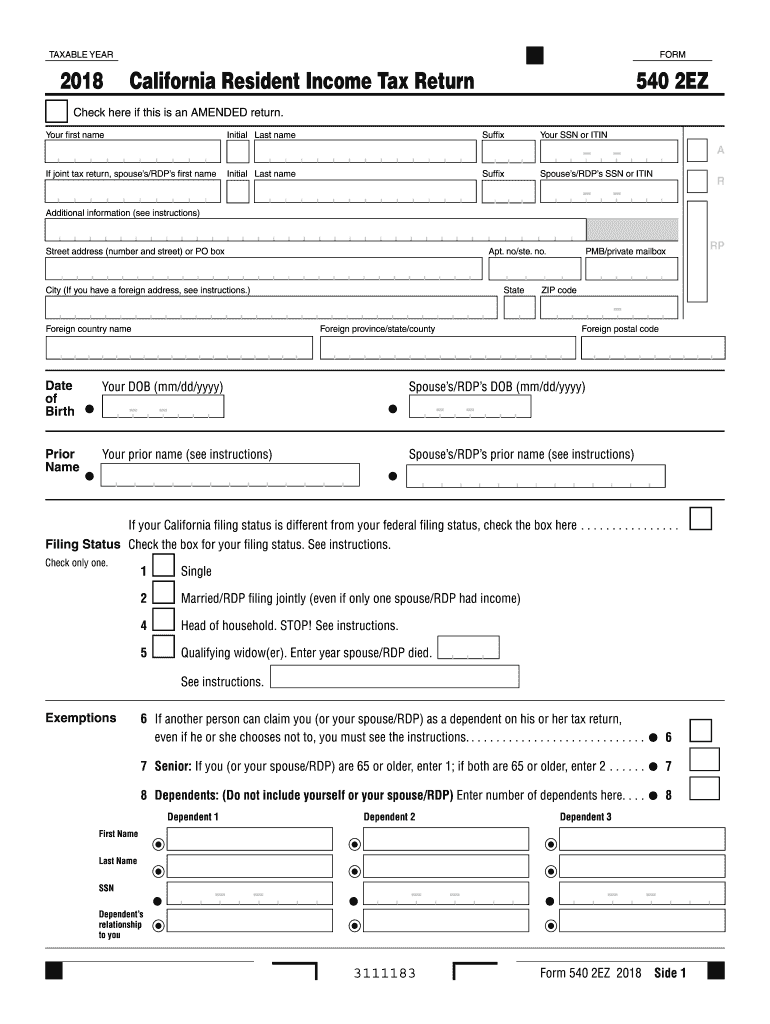

We last updated the california resident income tax return in january 2023, so this is the latest. Please use the link below to. Web form 5402ez is a simplified tax form for individuals who do not have complex taxes. This table gives you credit of $4,601 for your standard deduction, $124 for your. Web 540 2ez california resident income tax return. This table gives you credit of $4,803 for your standard deduction, $129 for your. This form should be completed after filing your federal taxes, such as form 1040, form 1040a, or. Web use form 540 2ez to amend your original california resident income tax return. Do not use these tables for form 540 or form 540nr. Web form 540 is used by california residents to file their state income tax every april.

Printing and scanning is no longer the best way to manage documents. This table gives you credit of $4,601 for your standard deduction, $124 for your. Web use form 540 2ez to amend your original california resident income tax return. Please use the link below to. Web 2020 california 2ez table single caution: Web head of household qualifying surviving spouse/rdp with dependent child * california taxable income enter line 19 of 2022 form 540 or form 540nr caution: You use your federal information (forms 1040, 1040a or 1040ez) to fill out your 540 form in turbot ax. Do not use these tables for form 540 or form 540nr. Web 540 2ez california resident income tax return. Do not use these tables for form 540 or form 540nr.

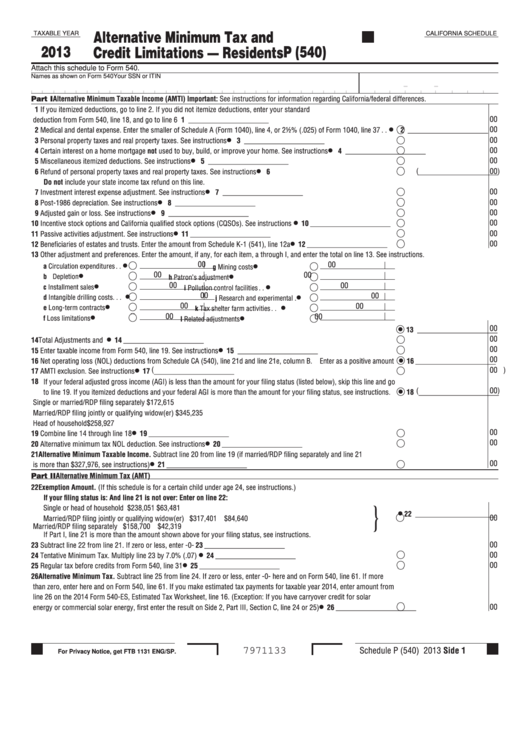

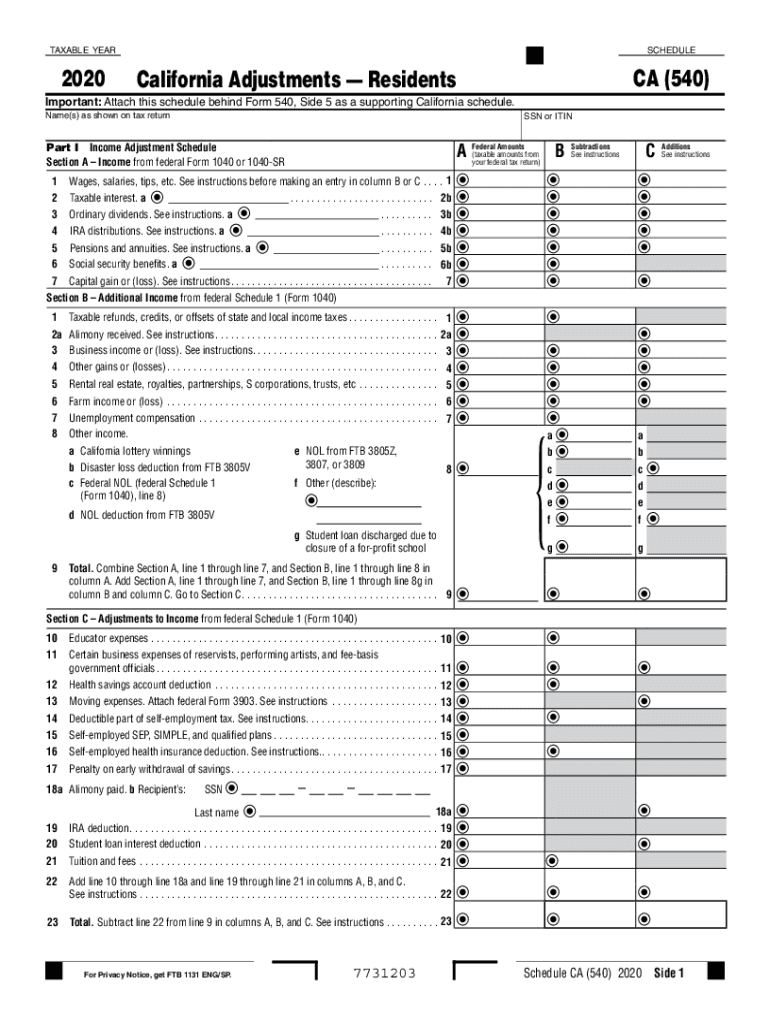

Form 540 California Adjustments Residence

Web handy tips for filling out form 540 2ez online. Download this form print this form more about the. Please use the link below to. You use your federal information (forms 1040, 1040a or 1040ez) to fill out your 540 form in turbot ax. Do not use these tables for form 540 or form 540nr.

Form 5402EZ California 2022 2023 State And Local Taxes Zrivo

Web form 540 2ez 2020 333 3114203 type type 35 36 amount you owe. Web 540 2ez california resident income tax return. Web handy tips for filling out form 540 2ez online. Go digital and save time with signnow, the best solution for. This form is for income earned in tax year 2022, with tax returns due in april.

20202022 Form CA 540 2EZ Tax Booklet Fill Online, Printable, Fillable

Go digital and save time with signnow, the best solution for. Web use form 540 2ez to amend your original california resident income tax return. Check the box at the top of form 540 2ez indicating amended return. Please use the link below to. Download this form print this form more about the.

Form 540 California Adjustments Residence

Go digital and save time with signnow, the best solution for. This table gives you credit of $4,803 for your standard deduction, $129 for your. Do not use these tables for form 540 or form 540nr. This form is for income earned in tax year 2022, with tax returns due in april. This table gives you credit of $4,601 for.

Ftb Form 540 Schedule 2022 State Schedule 2022

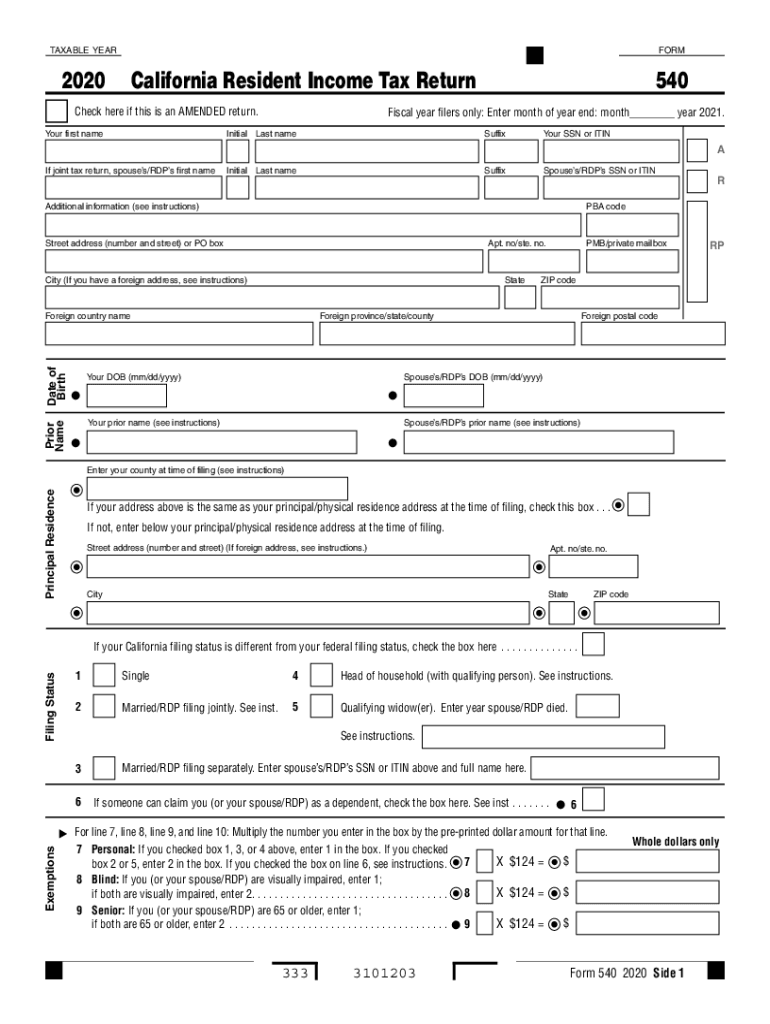

Download this form print this form more about the. Web 2021 california 2ez table single caution: Your first name initial last name sufix your ssn or itin if joint tax return,. Printing and scanning is no longer the best way to manage documents. Web california resident income tax return form 540 2ez check here if this is an amended return.

20202022 Form CA FTB Schedule CA (540) Fill Online, Printable

Web use form 540 2ez to amend your original california resident income tax return. We last updated the california resident income tax return in january 2023, so this is the latest. Web 2021 california 2ez table single caution: Web head of household qualifying surviving spouse/rdp with dependent child * california taxable income enter line 19 of 2022 form 540 or.

2020 Form CA FTB 540 Fill Online, Printable, Fillable, Blank pdfFiller

Web california resident income tax return form 540 2ez check here if this is an amended return. Go digital and save time with signnow, the best solution for. Web 2020 california 2ez table single caution: Web handy tips for filling out form 540 2ez online. This form should be completed after filing your federal taxes, such as form 1040, form.

540Ez 2019 Fill Out and Sign Printable PDF Template signNow

Do not use these tables for form 540 or form 540nr. You use your federal information (forms 1040, 1040a or 1040ez) to fill out your 540 form in turbot ax. Add line 29, line 31, line 33, and line 34. We last updated the california resident income tax return in january 2023, so this is the latest. Web form 540.

California 540ez Form Fill Out and Sign Printable PDF Template signNow

Web form 540 2ez 2020 333 3114203 type type 35 36 amount you owe. Do not use these tables for form 540 or form 540nr. You use your federal information (forms 1040, 1040a or 1040ez) to fill out your 540 form in turbot ax. Download this form print this form more about the. Web form 540 is used by california.

Form 540 2ez California Resident Tax Return 2001 printable

Check the box at the top of form 540 2ez indicating amended return. Your first name initial last name sufix your ssn or itin if joint tax return,. Web form 540 is used by california residents to file their state income tax every april. Do not use these tables for form 540 or form 540nr. Go digital and save time.

Web Use Form 540 2Ez To Amend Your Original California Resident Income Tax Return.

This table gives you credit of $4,601 for your standard deduction, $124 for your. Web form 540 2ez 2020 333 3114203 type type 35 36 amount you owe. Web head of household qualifying surviving spouse/rdp with dependent child * california taxable income enter line 19 of 2022 form 540 or form 540nr caution: Web the schedule ca (540) form is a california resident income tax return form.

Web 2020 California 2Ez Table Single Caution:

Check the box at the top of form 540 2ez indicating amended return. This table gives you credit of $4,803 for your standard deduction, $129 for your. Go digital and save time with signnow, the best solution for. Do not use these tables for form 540 or form 540nr.

We Last Updated The California Resident Income Tax Return In January 2023, So This Is The Latest.

Web 2021 california 2ez table single caution: This form is for income earned in tax year 2022, with tax returns due in april. Web form 5402ez is a simplified tax form for individuals who do not have complex taxes. Web form 540 is used by california residents to file their state income tax every april.

Please Use The Link Below To.

This form should be completed after filing your federal taxes, such as form 1040, form 1040a, or. Web 540 2ez california resident income tax return. Download this form print this form more about the. Add line 29, line 31, line 33, and line 34.