Ca Form 571 L

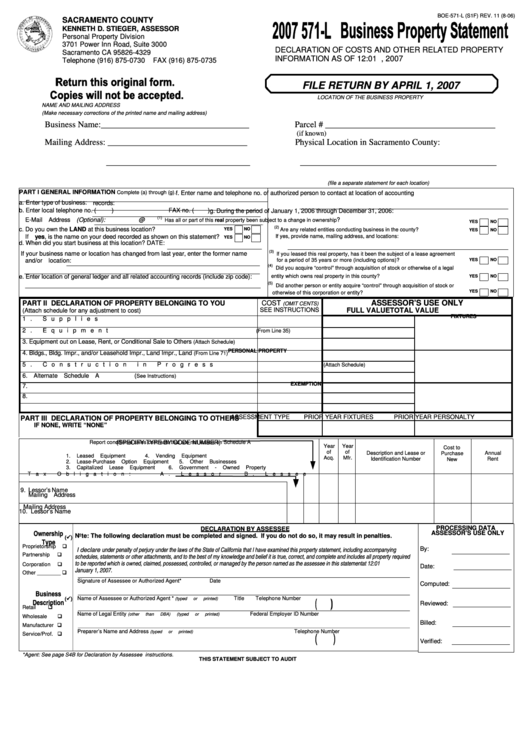

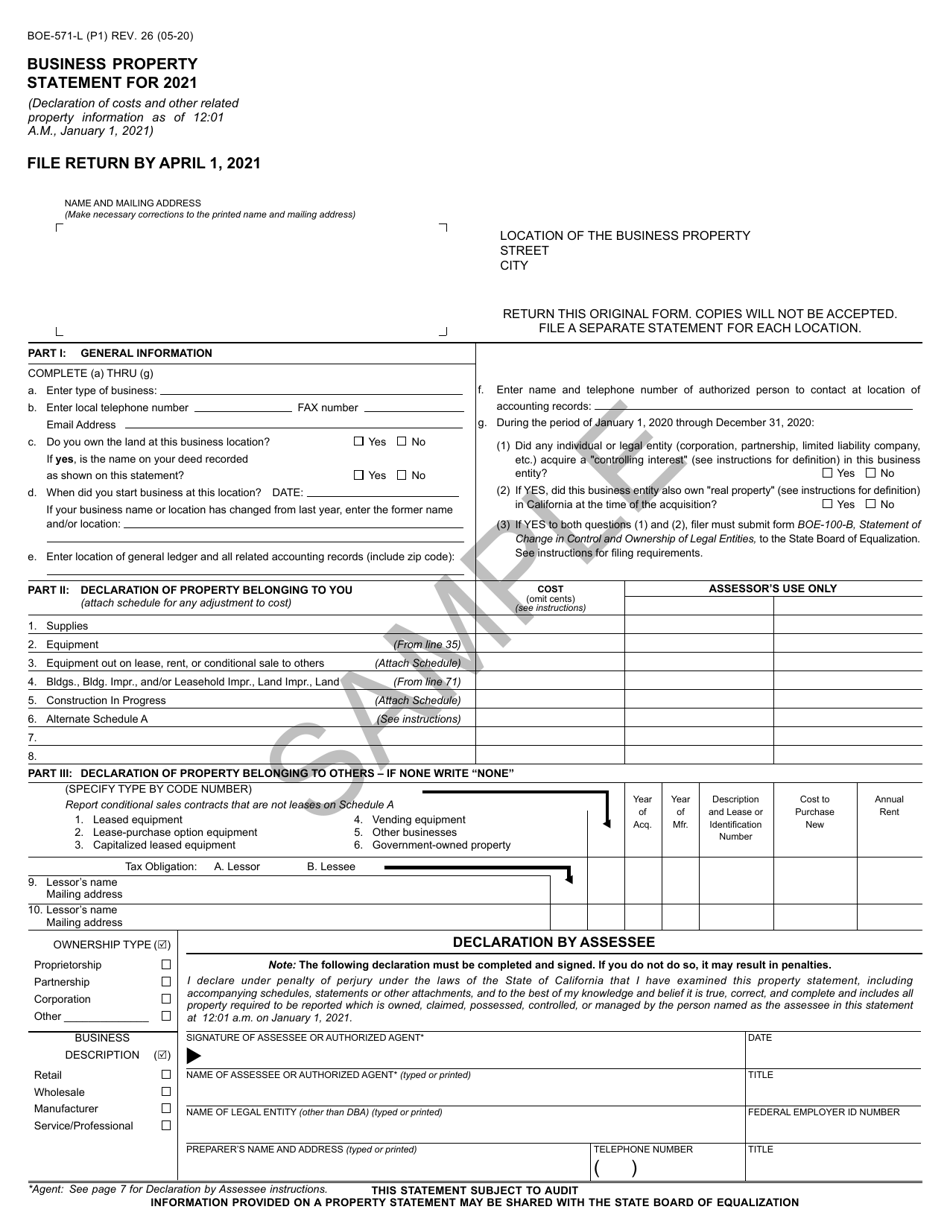

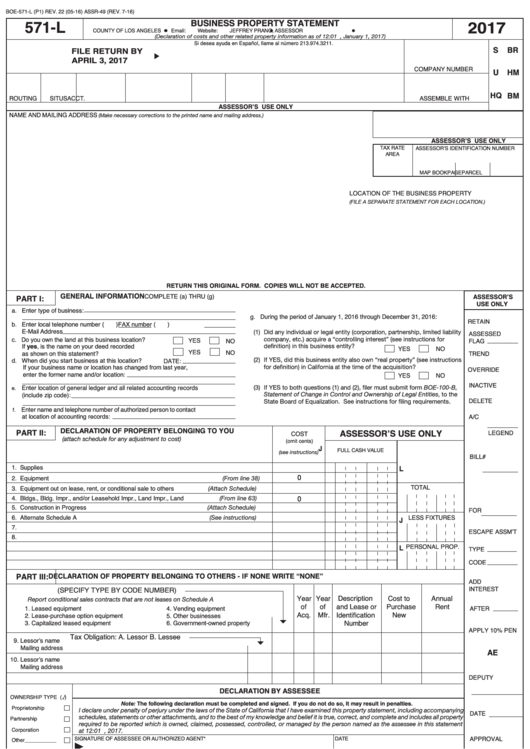

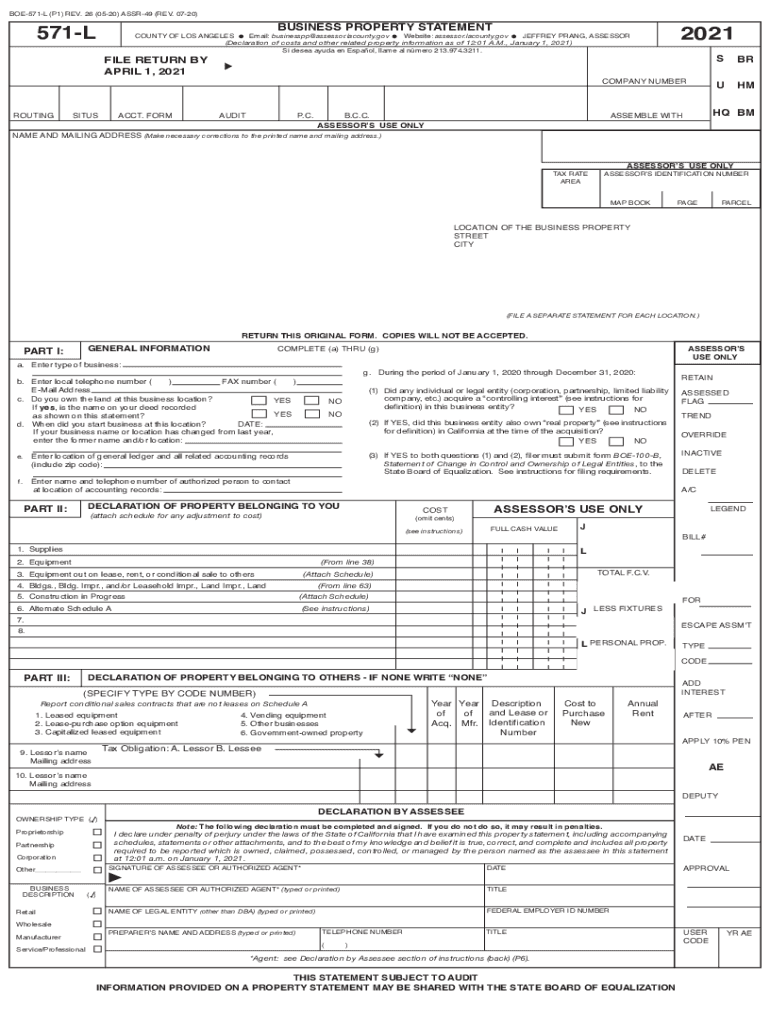

Ca Form 571 L - What is the “lien date” for property tax purposes? Businesses are required by law to file an annual business property statement (bps) if their aggregate cost of business personal. Web what is a form 571l business property statement (bps)? You are required to report the total cost of all your business property unless it is not assessable. Who must file a bps? 2023 busi ness proper ty statement. Alternate schedule a for bank, insurance company, or financial corporation fixtures:. (declaration of costs and other related property information as of 12:01 january 1,a.m.,. Business personal property 1155 market st., 5th floor, san francisco, ca 94103 tel: Businesses are required by law to file a business property statement if the aggregate cost of business personal property is $100,000 or more or if the assessor.

What is the “lien date” for property tax purposes? Business property statement, long form: Business personal property 1155 market st., 5th floor, san francisco, ca 94103 tel: Businesses are required by law to file an annual business property statement (bps) if their aggregate cost of business personal. Alternate schedule a for bank, insurance company, or financial corporation fixtures:. Web filing form 571l business property statement. Web what is a form 571l business property statement (bps)? (declaration of costs and other related property information as of 12:01 january 1,a.m.,. Please call our office at. Who must file a bps?

You are required to report the total cost of all your business property unless it is not assessable. Businesses are required by law to file a business property statement if the aggregate cost of business personal property is $100,000 or more or if the assessor. Who must file a bps? Web what is a form 571l business property statement (bps)? Alternate schedule a for bank, insurance company, or financial corporation fixtures:. Web filing form 571l business property statement. (declaration of costs and other related property information as of 12:01 january 1,a.m.,. What is the “lien date” for property tax purposes? Business personal property 1155 market st., 5th floor, san francisco, ca 94103 tel: What is business personal property?

Form Boe571L Business Property Statement 2007 printable pdf download

What is the “lien date” for property tax purposes? Businesses are required by law to file an annual business property statement (bps) if their aggregate cost of business personal. Businesses are required by law to file a business property statement if the aggregate cost of business personal property is $100,000 or more or if the assessor. Who must file a.

Ol Fill out & sign online DocHub

Alternate schedule a for bank, insurance company, or financial corporation fixtures:. Business personal property 1155 market st., 5th floor, san francisco, ca 94103 tel: Business property statement, long form: What is the “lien date” for property tax purposes? Businesses are required by law to file an annual business property statement (bps) if their aggregate cost of business personal.

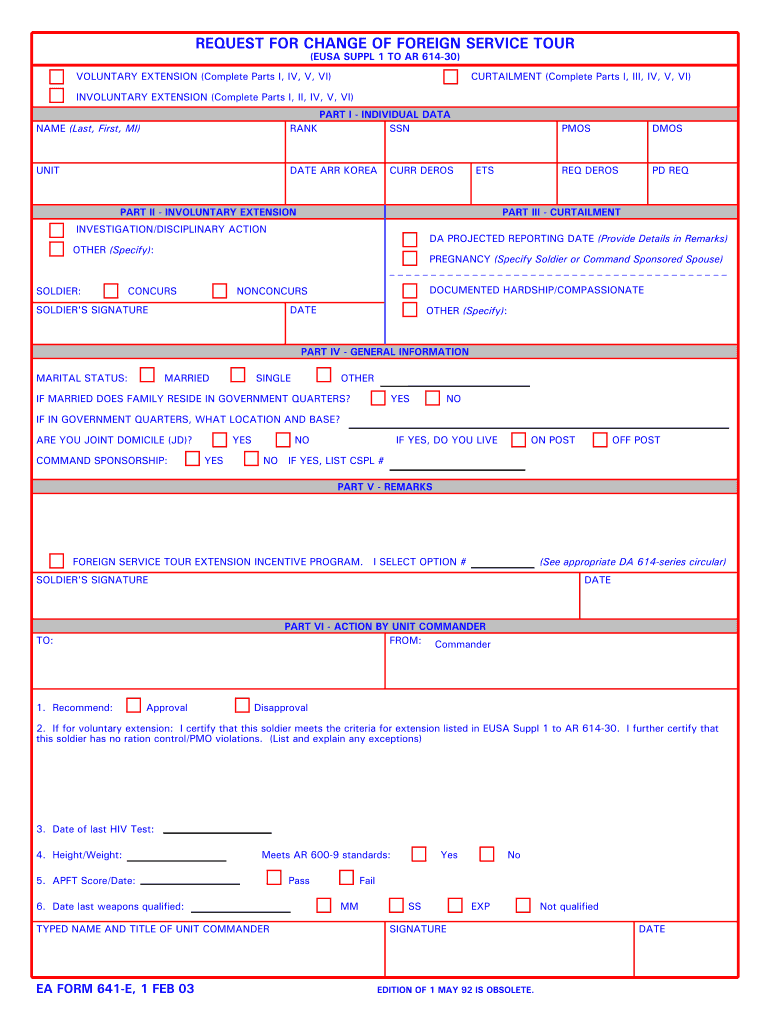

Ea Form 571 E 20202022 Fill and Sign Printable Template Online US

Please call our office at. What is the “lien date” for property tax purposes? Businesses are required by law to file a business property statement if the aggregate cost of business personal property is $100,000 or more or if the assessor. You are required to report the total cost of all your business property unless it is not assessable. 2023.

CA BOE571L (P1) 2015 Fill and Sign Printable Template Online US

Business personal property 1155 market st., 5th floor, san francisco, ca 94103 tel: What is the “lien date” for property tax purposes? Alternate schedule a for bank, insurance company, or financial corporation fixtures:. Web fill online, printable, fillable, blank form 2020: Web filing form 571l business property statement.

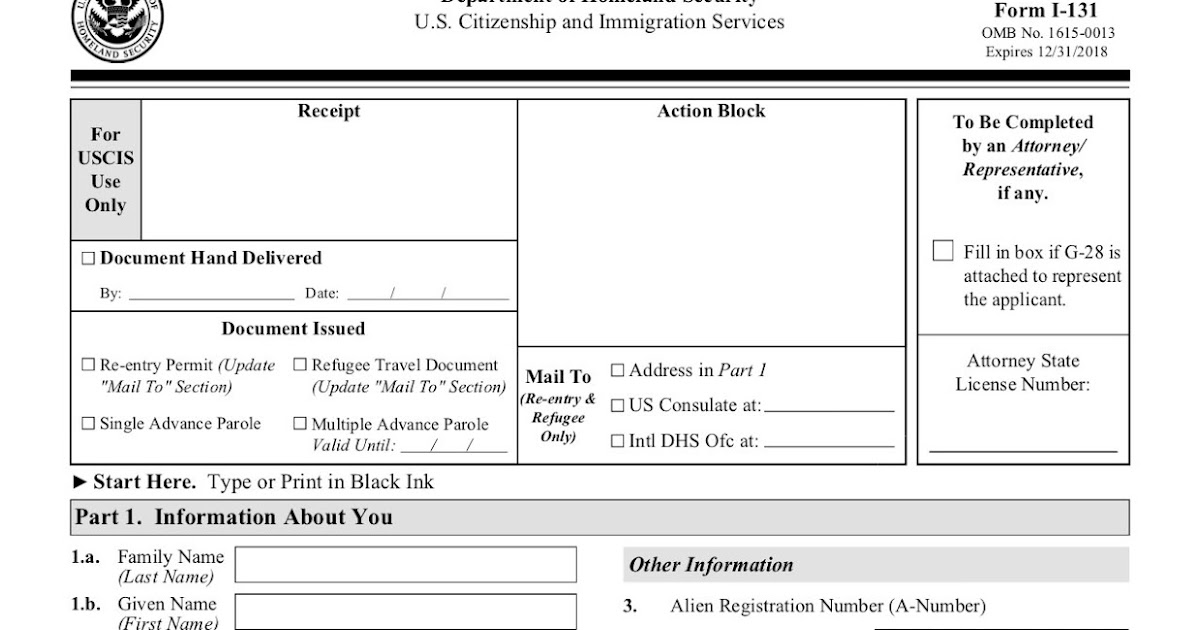

HOW TO APPLY FOR A U.S. REFUGEE TRAVEL DOCUMENT (FORM I571)? (UNITED

Businesses are required by law to file an annual business property statement (bps) if their aggregate cost of business personal. What is the “lien date” for property tax purposes? What is business personal property? (declaration of costs and other related property information as of 12:01 january 1,a.m.,. 2023 busi ness proper ty statement.

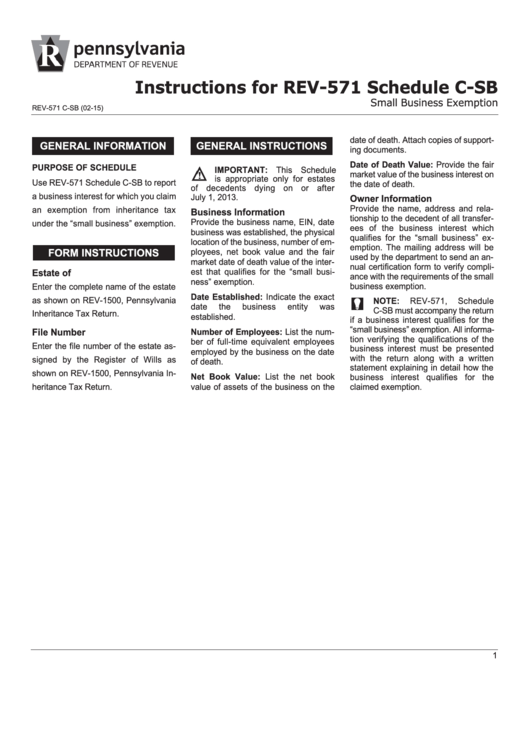

Instructions For Rev571 Schedule CSb printable pdf download

2023 busi ness proper ty statement. Business property statement, long form: You are required to report the total cost of all your business property unless it is not assessable. Alternate schedule a for bank, insurance company, or financial corporation fixtures:. Please call our office at.

Form BOE571L Download Printable PDF or Fill Online Business Property

Business personal property 1155 market st., 5th floor, san francisco, ca 94103 tel: Businesses are required by law to file an annual business property statement (bps) if their aggregate cost of business personal. Web what is a form 571l business property statement (bps)? 2023 busi ness proper ty statement. (declaration of costs and other related property information as of 12:01.

Form Boe571L Business Property Statement 2017 printable pdf download

Please call our office at. You are required to report the total cost of all your business property unless it is not assessable. Business property statement, long form: Web filing form 571l business property statement. Web fill online, printable, fillable, blank form 2020:

CA BOE571L (P1) 20212022 Fill and Sign Printable Template Online

Please call our office at. Businesses are required by law to file a business property statement if the aggregate cost of business personal property is $100,000 or more or if the assessor. Who must file a bps? Alternate schedule a for bank, insurance company, or financial corporation fixtures:. Businesses are required by law to file an annual business property statement.

CA BOE571L (P1) 2012 Fill and Sign Printable Template Online US

Web filing form 571l business property statement. Web what is a form 571l business property statement (bps)? Businesses are required by law to file an annual business property statement (bps) if their aggregate cost of business personal. Please call our office at. Web fill online, printable, fillable, blank form 2020:

You Are Required To Report The Total Cost Of All Your Business Property Unless It Is Not Assessable.

Who must file a bps? Web fill online, printable, fillable, blank form 2020: What is business personal property? Web filing form 571l business property statement.

Businesses Are Required By Law To File An Annual Business Property Statement (Bps) If Their Aggregate Cost Of Business Personal.

Business property statement, long form: Business personal property 1155 market st., 5th floor, san francisco, ca 94103 tel: Businesses are required by law to file a business property statement if the aggregate cost of business personal property is $100,000 or more or if the assessor. (declaration of costs and other related property information as of 12:01 january 1,a.m.,.

Please Call Our Office At.

What is the “lien date” for property tax purposes? Alternate schedule a for bank, insurance company, or financial corporation fixtures:. Web what is a form 571l business property statement (bps)? 2023 busi ness proper ty statement.