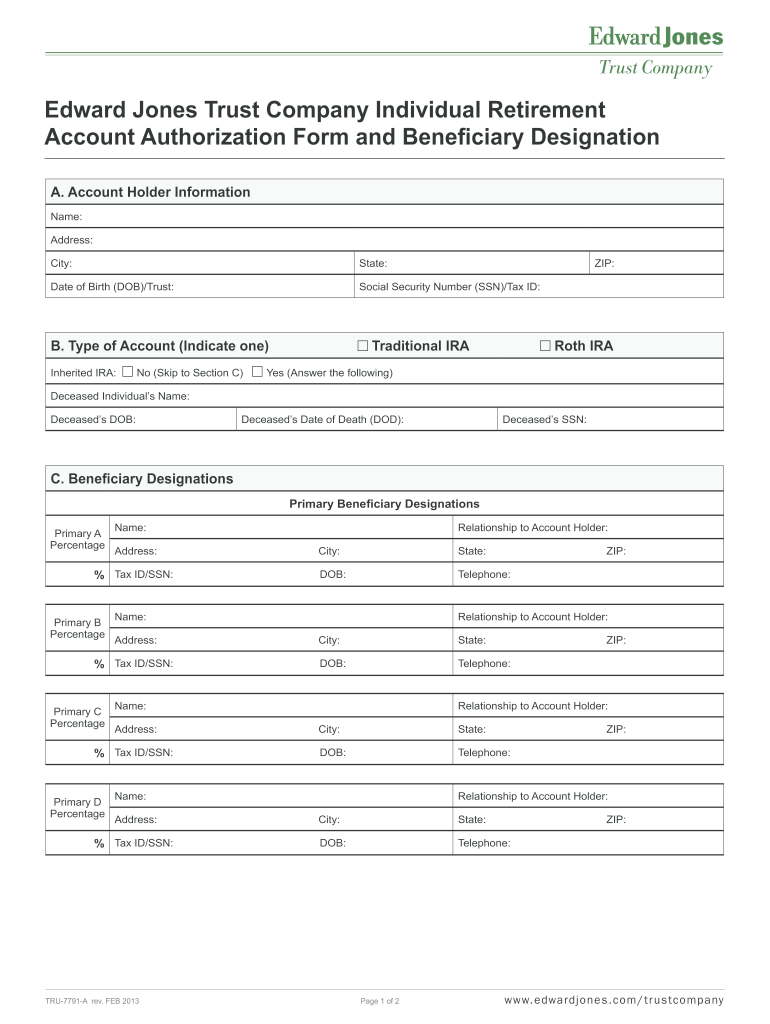

Edward Jones Beneficiary Form

Edward Jones Beneficiary Form - Jane's spouse recently passed away. The following case illustrates what can go wrong if beneficiary designations are not updated. Web if you can name a beneficiary on a specific account, have you already? Web depending on your state, the cost could range from $10 to $25 per death certificate. Custom beneficiary designations can specify beneficiary types including individuals, entities, trusts and separate share trusts. Brokerage accounts don't automatically include beneficiary designations, but you can complete a transfer on death agreement to identify the person to whom the assets. Save or instantly send your ready documents. Understanding the how and why of beneficiary designations is an essential part of your financial strategy. Get everything done in minutes. Web edward jones change of beneficiary form.

Web depending on your state, the cost could range from $10 to $25 per death certificate. Brokerage accounts don't automatically include beneficiary designations, but you can complete a transfer on death agreement to identify the person to whom the assets. Custom beneficiary designations can specify beneficiary types including individuals, entities, trusts and separate share trusts. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web if you can name a beneficiary on a specific account, have you already? Web edward jones offers a personal approach to investing with 18,000 financial advisors ready to support your retirement, education savings and insurance needs. Retirement accounts , life insurance policies and annuities typically allow you to assign beneficiaries. A compelling case for keeping them updated. Web complete edward jones beneficiary designation form online with us legal forms. Web edward jones change of beneficiary form.

Retirement accounts , life insurance policies and annuities typically allow you to assign beneficiaries. Jane's spouse recently passed away. Web edward jones change of beneficiary form. Web primary benefciaries upon the account owner’s death, the eligible assets in the account shall be transferred to the person(s) designated by the account owner as primary benefciaries on the benefciary form according to the allocation specifed. Find a financial advisor today. Custom beneficiary designations can specify beneficiary types including individuals, entities, trusts and separate share trusts. The following case illustrates what can go wrong if beneficiary designations are not updated. Get everything done in minutes. Web edward jones offers a personal approach to investing with 18,000 financial advisors ready to support your retirement, education savings and insurance needs. Web if you can name a beneficiary on a specific account, have you already?

Edward Jones BrokerChalk

A compelling case for keeping them updated. Get everything done in minutes. Save or instantly send your ready documents. The following case illustrates what can go wrong if beneficiary designations are not updated. Brokerage accounts don't automatically include beneficiary designations, but you can complete a transfer on death agreement to identify the person to whom the assets.

Edward Jones Adds Financial Advisor Keith Eckhardt California Newswire

Web if you can name a beneficiary on a specific account, have you already? Find a financial advisor today. Web depending on your state, the cost could range from $10 to $25 per death certificate. Web edward jones change of beneficiary form. Web complete edward jones beneficiary designation form online with us legal forms.

How Edward Jones Keeps Its Employees Happy to Come to Work Fortune

Jane's spouse recently passed away. The following case illustrates what can go wrong if beneficiary designations are not updated. Get everything done in minutes. Find a financial advisor today. A compelling case for keeping them updated.

Weekly Market Update with Edward Jones Investments Patchogue Chamber

Easily fill out pdf blank, edit, and sign them. 1) provide your financial advisor with a completed spousal consent form, and 2) complete your tod agreement beneficiary designation form. Custom beneficiary designations can specify beneficiary types including individuals, entities, trusts and separate share trusts. Web edward jones change of beneficiary form. Web if you can name a beneficiary on a.

Edward Jones financial advisors rate the firm highest in overall

Web edward jones offers a personal approach to investing with 18,000 financial advisors ready to support your retirement, education savings and insurance needs. Save or instantly send your ready documents. Jane's spouse recently passed away. A compelling case for keeping them updated. Brokerage accounts don't automatically include beneficiary designations, but you can complete a transfer on death agreement to identify.

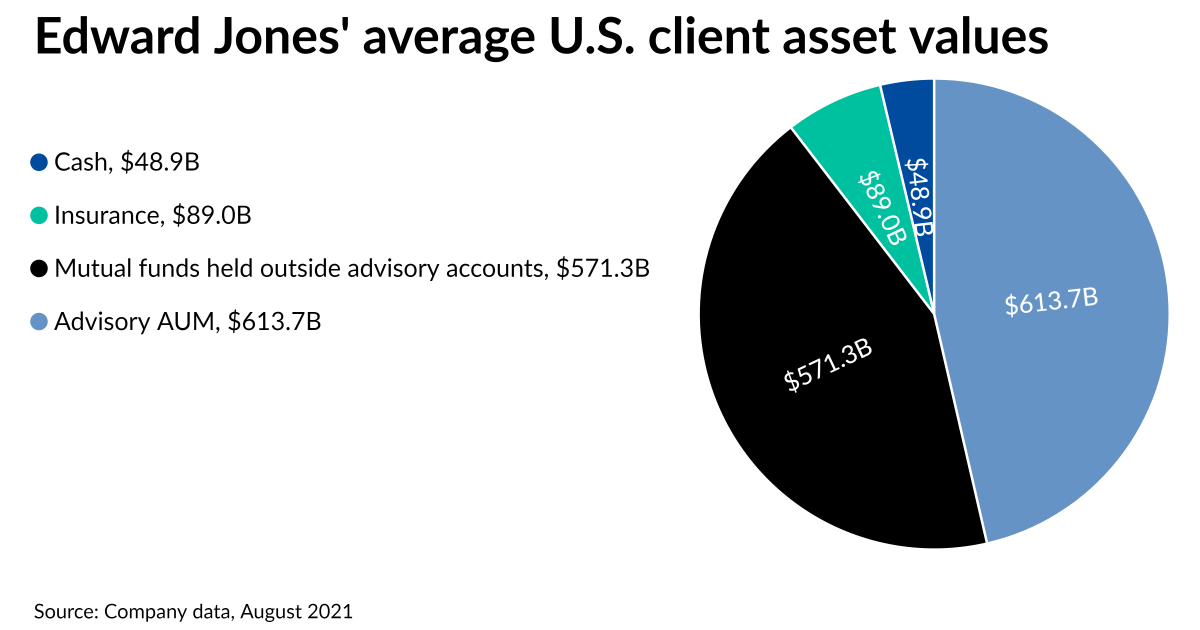

Edward Jones Q2 earnings rise on higher asset values Financial Planning

Understanding the how and why of beneficiary designations is an essential part of your financial strategy. Web edward jones offers a personal approach to investing with 18,000 financial advisors ready to support your retirement, education savings and insurance needs. Jane's spouse recently passed away. Easily fill out pdf blank, edit, and sign them. 1) provide your financial advisor with a.

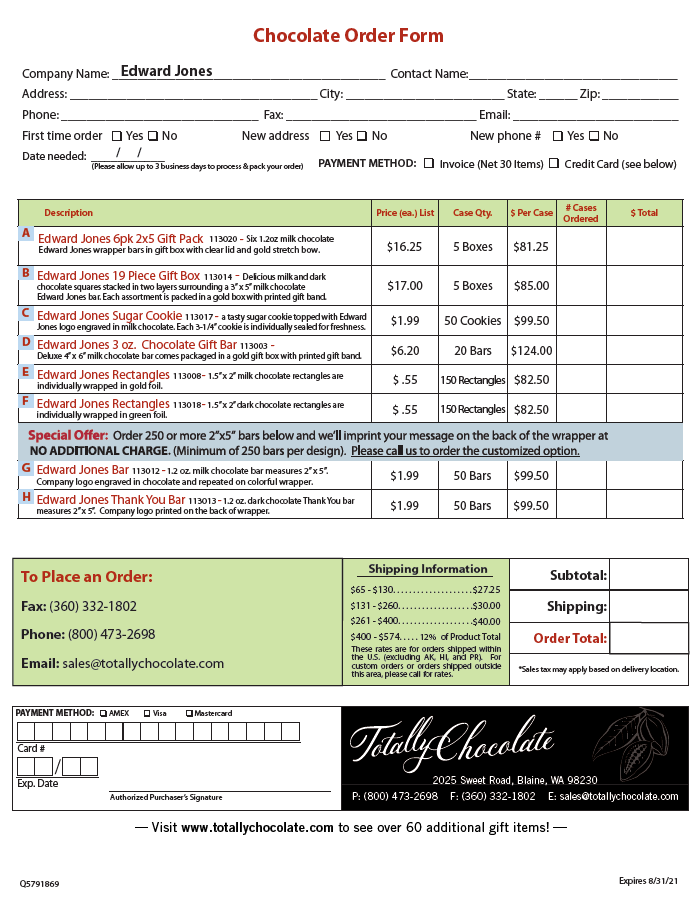

Edward Jones Order Form Totally Chocolate

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. 1) provide your financial advisor with a completed spousal consent form, and 2) complete your tod agreement beneficiary designation form. Easily fill out pdf blank, edit, and sign them. Web complete edward jones beneficiary designation form online with us legal forms..

Custom beneficiary designations Edward Jones

Save or instantly send your ready documents. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Custom beneficiary designations can specify beneficiary types including individuals, entities, trusts and separate share trusts. Web if you can name a beneficiary on a specific account, have you already? Retirement accounts , life insurance.

Edward Jones new matchmaking tool takes cue from Tinder InvestmentNews

Web if you can name a beneficiary on a specific account, have you already? Save or instantly send your ready documents. Get everything done in minutes. Web edward jones offers a personal approach to investing with 18,000 financial advisors ready to support your retirement, education savings and insurance needs. Check out how easy it is to complete and esign documents.

Edward Jones Transfer On Death Agreement Form Fill Out and Sign

Web complete edward jones beneficiary designation form online with us legal forms. Brokerage accounts don't automatically include beneficiary designations, but you can complete a transfer on death agreement to identify the person to whom the assets. Find a financial advisor today. Jane's spouse recently passed away. Save or instantly send your ready documents.

Custom Beneficiary Designations Can Specify Beneficiary Types Including Individuals, Entities, Trusts And Separate Share Trusts.

Web if you can name a beneficiary on a specific account, have you already? Web edward jones change of beneficiary form. Web complete edward jones beneficiary designation form online with us legal forms. Easily fill out pdf blank, edit, and sign them.

Get Everything Done In Minutes.

Web edward jones offers a personal approach to investing with 18,000 financial advisors ready to support your retirement, education savings and insurance needs. Retirement accounts , life insurance policies and annuities typically allow you to assign beneficiaries. Web primary benefciaries upon the account owner’s death, the eligible assets in the account shall be transferred to the person(s) designated by the account owner as primary benefciaries on the benefciary form according to the allocation specifed. Understanding the how and why of beneficiary designations is an essential part of your financial strategy.

The Following Case Illustrates What Can Go Wrong If Beneficiary Designations Are Not Updated.

Brokerage accounts don't automatically include beneficiary designations, but you can complete a transfer on death agreement to identify the person to whom the assets. Jane's spouse recently passed away. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Find a financial advisor today.

A Compelling Case For Keeping Them Updated.

Web depending on your state, the cost could range from $10 to $25 per death certificate. 1) provide your financial advisor with a completed spousal consent form, and 2) complete your tod agreement beneficiary designation form. Save or instantly send your ready documents.