Form 1098 Due Date 2022

Form 1098 Due Date 2022 - To file electronically, you must have software that generates a file according to the specifications in pub. Several properties securing the mortgage. These due dates for information. Web refund of the overpaid interest. If it is filed on paper, then the. Here are a few dates. Ad 1098/1099 pro files 10% of all 1098/1099 filings in the united states! If filing the form electronically, the due date. Address and description of the property. Web the due date for paper filing form 1099 is january 31st, 2022.

Web form 1098 is an irs form used by taxpayers to report the amount of interest and related expenses paid on a mortgage during the tax year when the amount totals. Instructions, including due dates, and to request. Also referred to as mortgage interest tax form, it reports the mortgage interest payments. Address and description of the property. If filing the form electronically, the due date. These due dates for information. Web don’t miss any 2022 tax deadlines! If you file electronically, the due date is march 31, 2022. Web interest received on december 20, of the current year, that accrues by december 31, of the current year, but is not due until january 31, of the following year, is reportable on the. Web the due date for paper filing form 1099 is january 31st, 2022.

Web the due date for paper filing form 1099 is january 31st, 2022. Recipient copy 30 days from the date of the sale or contribution. If filing the form electronically, the due date. Ad 1098/1099 pro files 10% of all 1098/1099 filings in the united states! Instructions, including due dates, and to request. Learn more about how to simplify your businesses 1098/1099 reporting. These due dates for information. Here are a few dates. Web deadline for tax form 1098: Several properties securing the mortgage.

2848 Form 2021 IRS Forms Zrivo

Web due date for certain statements sent to recipients. Address and description of the property. If it is filed on paper, then the. Learn more about how to simplify your businesses 1098/1099 reporting. Several properties securing the mortgage.

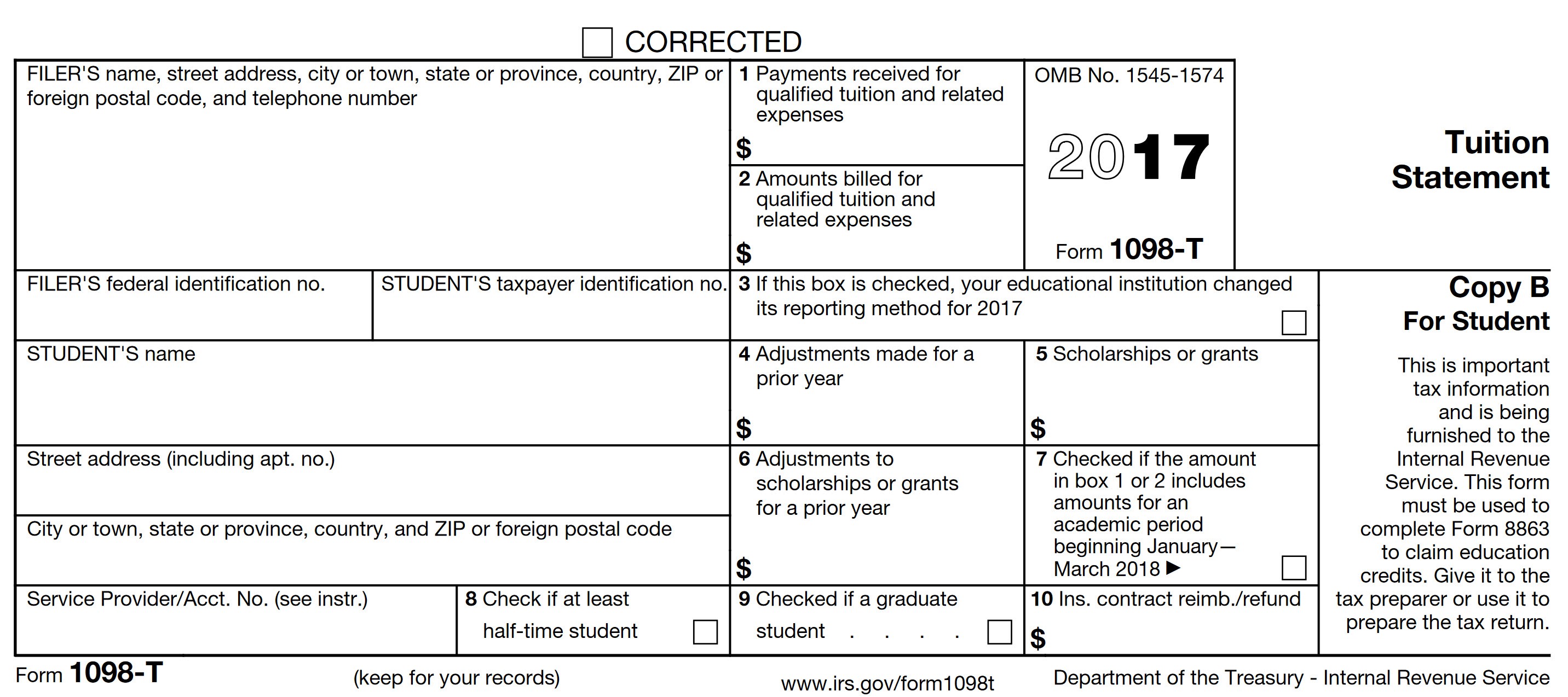

Form 1098T Community Tax

If it is filed on paper, then the. If you file electronically, the due date is march 31, 2022. Ad 1098/1099 pro files 10% of all 1098/1099 filings in the united states! Paper file to government by: These due dates for information.

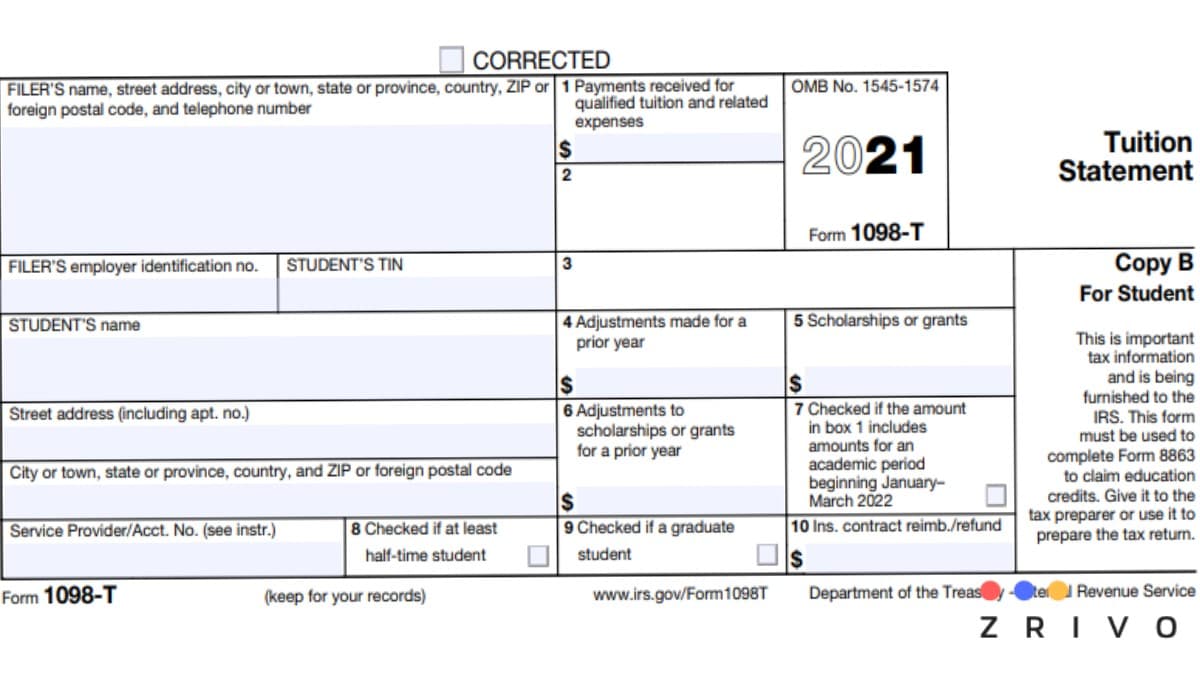

1098 T Form 2021

To file electronically, you must have software that generates a file according to the specifications in pub. January 31, 2023 is the due date to distribute copies of form 1098 to a recipient. Web your mortgage interest statement (form 1098) is available within digital banking during the month of january and we'll notify you when it's ready. Web the due.

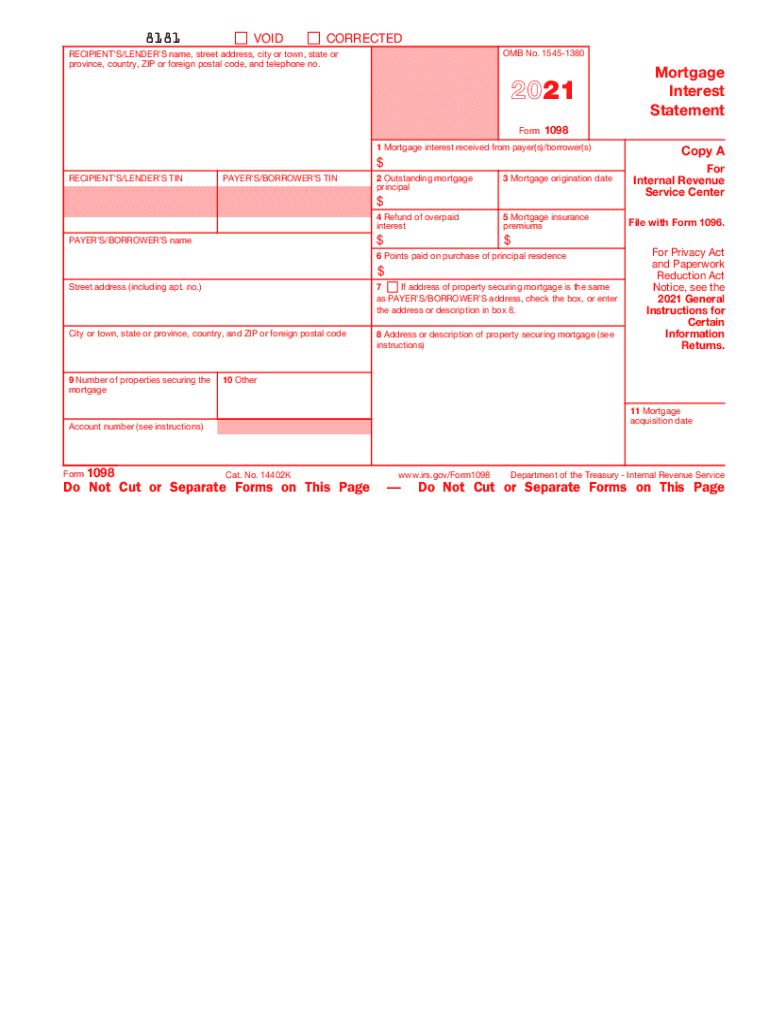

2021 Form 1098. Mortgage Interest Statement Fill and Sign Printable

Here are a few dates. Web refund of the overpaid interest. Web when is the deadline to file form 1098 for the 2022 tax year? Learn more about how to simplify your businesses 1098/1099 reporting. The irs’ copy, other than for 1099.

Form 1098 Mortgage Interest Statement and How to File

If you file electronically, the due date is march 31, 2022. For taxpayers filing electronically, the due date to file form 1098. Learn more about how to simplify your businesses 1098/1099 reporting. Web due date for certain statements sent to recipients. Instructions, including due dates, and to request.

Documents to Bring To Tax Preparer Tax Documents Checklist

If filing the form electronically, the due date. Web form 1098 is an irs form used by taxpayers to report the amount of interest and related expenses paid on a mortgage during the tax year when the amount totals. Web deadline for tax form 1098: Recipient copy 30 days from the date of the sale or contribution. Web due date.

2020 Form IRS 1098E Fill Online, Printable, Fillable, Blank pdfFiller

Web deadline for tax form 1098: Web your mortgage interest statement (form 1098) is available within digital banking during the month of january and we'll notify you when it's ready. Recipient copy 30 days from the date of the sale or contribution. These due dates for information. Several properties securing the mortgage.

Form 1098T Information Student Portal

If you file electronically, the due date is march 31, 2022. Web form 1098 is an irs form used by taxpayers to report the amount of interest and related expenses paid on a mortgage during the tax year when the amount totals. Web the due date for paper filing form 1099 is january 31st, 2022. January 31, 2023 is the.

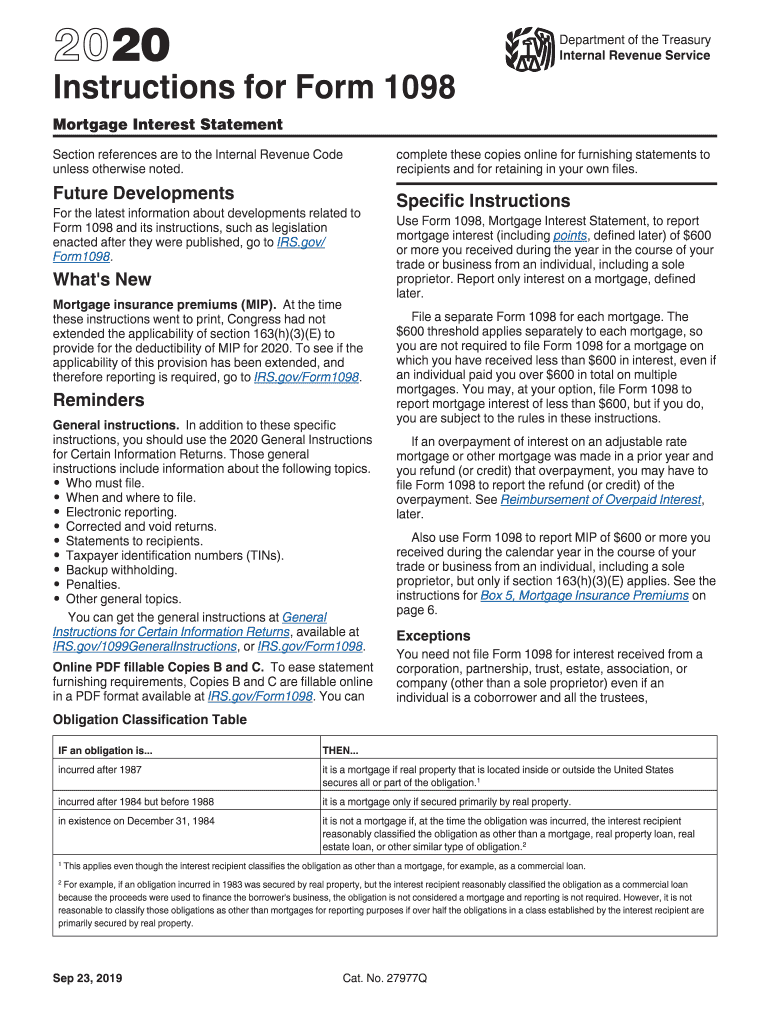

2020 Form IRS 1098 Instructions Fill Online, Printable, Fillable, Blank

Web the due date for paper filing form 1099 is january 31st, 2022. January 31, 2023 is the due date to distribute copies of form 1098 to a recipient. Instructions, including due dates, and to request. Web refund of the overpaid interest. Recipient copy 30 days from the date of the sale or contribution.

1098C Software to Print and Efile Form 1098C

If you file electronically, the due date is march 31, 2022. Web refund of the overpaid interest. Web form 1098 is an irs form used by taxpayers to report the amount of interest and related expenses paid on a mortgage during the tax year when the amount totals. January 31, 2023 is the due date to distribute copies of form.

Web Your Mortgage Interest Statement (Form 1098) Is Available Within Digital Banking During The Month Of January And We'll Notify You When It's Ready.

Also referred to as mortgage interest tax form, it reports the mortgage interest payments. Address and description of the property. Web don’t miss any 2022 tax deadlines! If filing the form electronically, the due date.

Web Form 1098 Is An Irs Form Used By Taxpayers To Report The Amount Of Interest And Related Expenses Paid On A Mortgage During The Tax Year When The Amount Totals.

Here are a few dates. Web it has to be sent to the recipient by 31 st january. Ad 1098/1099 pro files 10% of all 1098/1099 filings in the united states! January 31, 2023 is the due date to distribute copies of form 1098 to a recipient.

Learn More About How To Simplify Your Businesses 1098/1099 Reporting.

Recipient copy 30 days from the date of the sale or contribution. Paper file to government by: Web when is the deadline to file form 1098 for the 2022 tax year? Web due date for certain statements sent to recipients.

Web Deadline For Tax Form 1098:

Several properties securing the mortgage. The irs’ copy, other than for 1099. If it is filed on paper, then the. Web interest received on december 20, of the current year, that accrues by december 31, of the current year, but is not due until january 31, of the following year, is reportable on the.

/Form1098-5c57730f46e0fb00013a2bee.jpg)