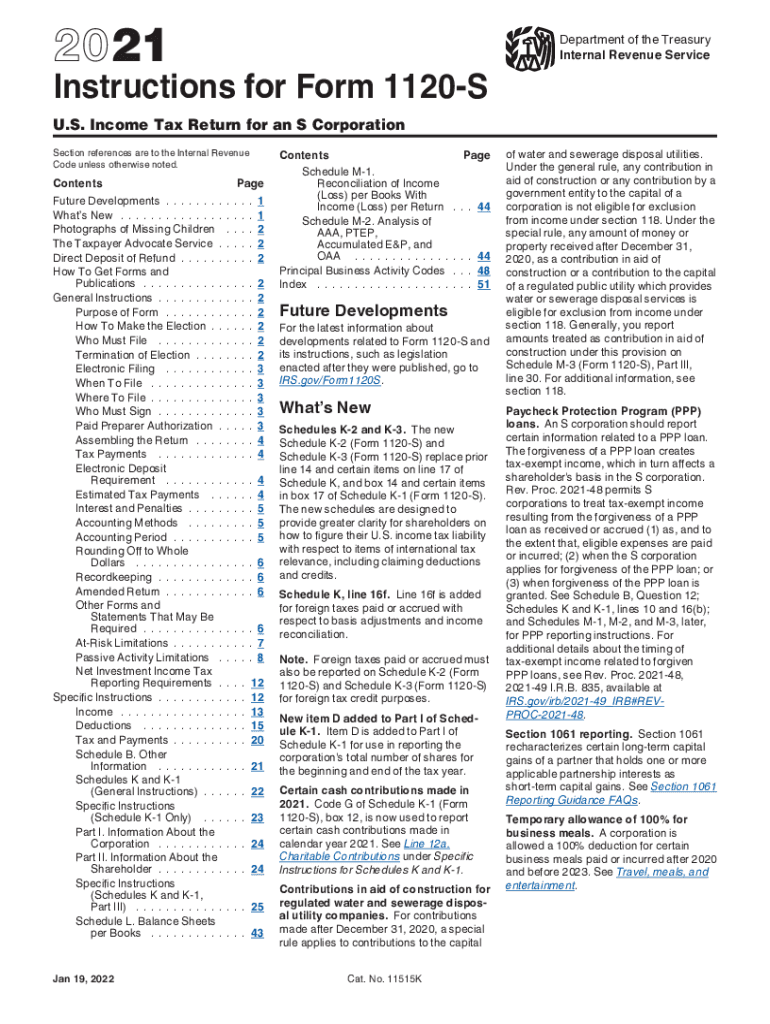

Form 1120S Instructions 2022

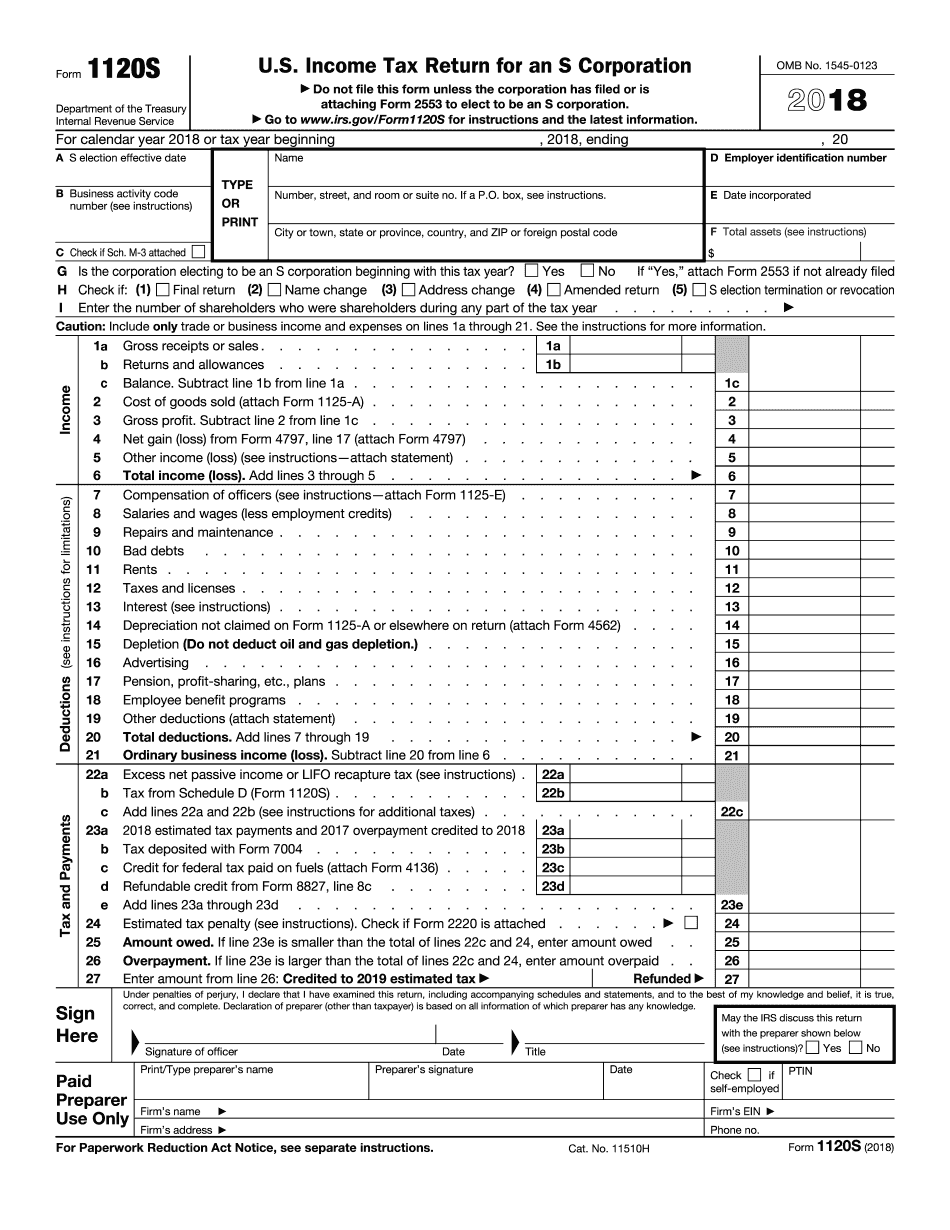

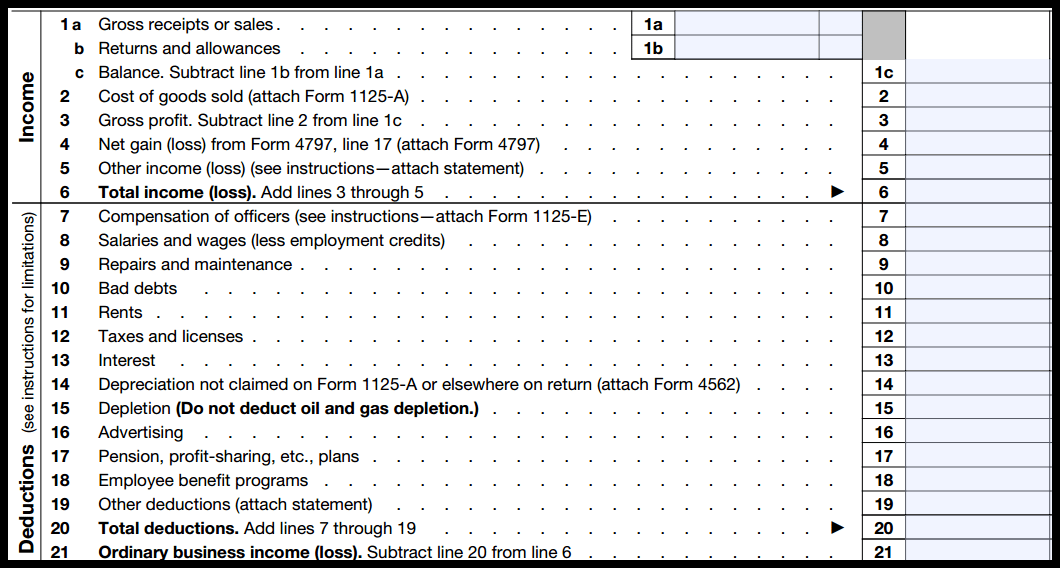

Form 1120S Instructions 2022 - The references to form numbers and line descriptions on federal corporate income tax forms were correct at the time See the march 2022 revision of the instructions for form 941 and the 2022 instructions for form 944 for more information. Web qualified sick and family leave wages in 2022 for leave taken after march 31, 2020, and before october 1, 2021, are eligible to claim a credit for qualified sick and family leave wages in 2022. Prior versions will be available on irs.gov. An insurance company must file with the department of insurance. Corporation income and replacement tax return: Web form 1120 department of the treasury internal revenue service u.s. Every corporation doing business in this state or deriving income from sources within this state, unless exempt by iowa code section 422.34, must. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation. Forms are available at dor.sc.gov/forms.

Corporation income and replacement tax return: The references to form numbers and line descriptions on federal corporate income tax forms were correct at the time Web for tax year 2022, please see the 2022 instructions. Prior versions will be available on irs.gov. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation. Forms are available at dor.sc.gov/forms. See the march 2022 revision of the instructions for form 941 and the 2022 instructions for form 944 for more information. See faq #17 for a link to the instructions. Go to www.irs.gov/form1120s for instructions and the latest information. Web form 1120 department of the treasury internal revenue service u.s.

Web for tax year 2022, please see the 2022 instructions. Web form 1120 department of the treasury internal revenue service u.s. Every corporation doing business in this state or deriving income from sources within this state, unless exempt by iowa code section 422.34, must. Go to www.irs.gov/form1120s for instructions and the latest information. Corporation income and replacement tax return: Web qualified sick and family leave wages in 2022 for leave taken after march 31, 2020, and before october 1, 2021, are eligible to claim a credit for qualified sick and family leave wages in 2022. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation. See faq #17 for a link to the instructions. The references to form numbers and line descriptions on federal corporate income tax forms were correct at the time See the march 2022 revision of the instructions for form 941 and the 2022 instructions for form 944 for more information.

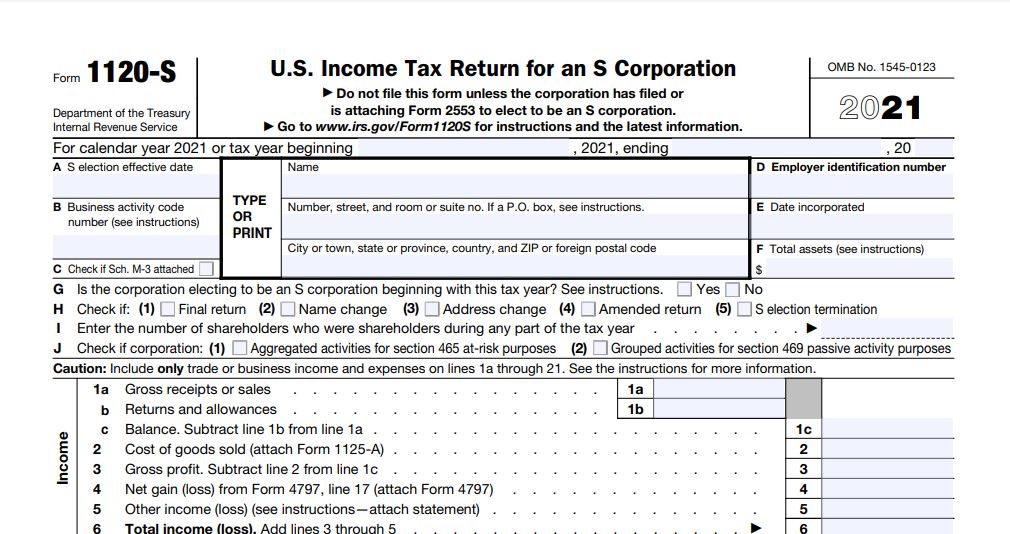

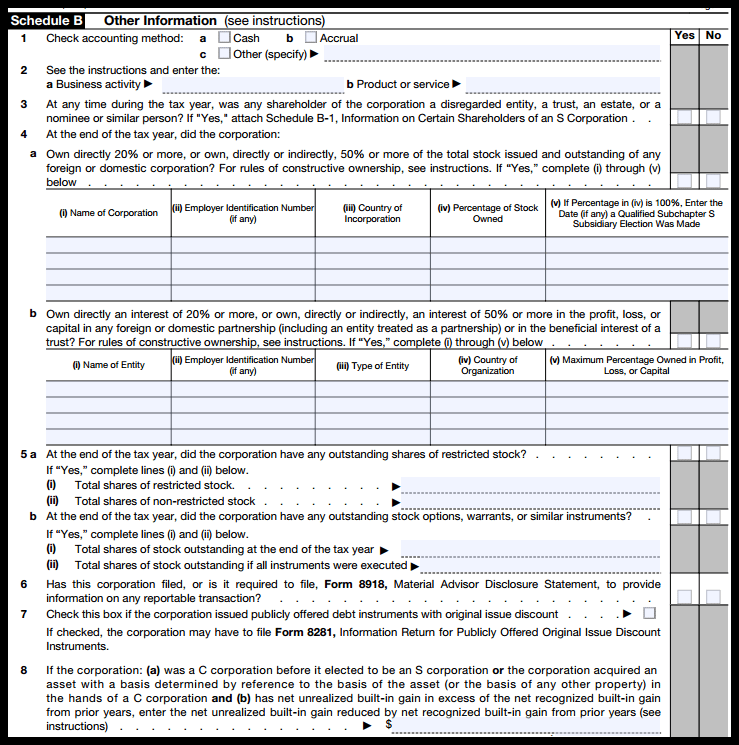

IRS 1120S 2022 Form Printable Blank PDF Online

Corporation income and replacement tax return: Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation. Forms are available at dor.sc.gov/forms. See the march 2022 revision of the instructions for form 941 and the 2022 instructions for form 944 for more.

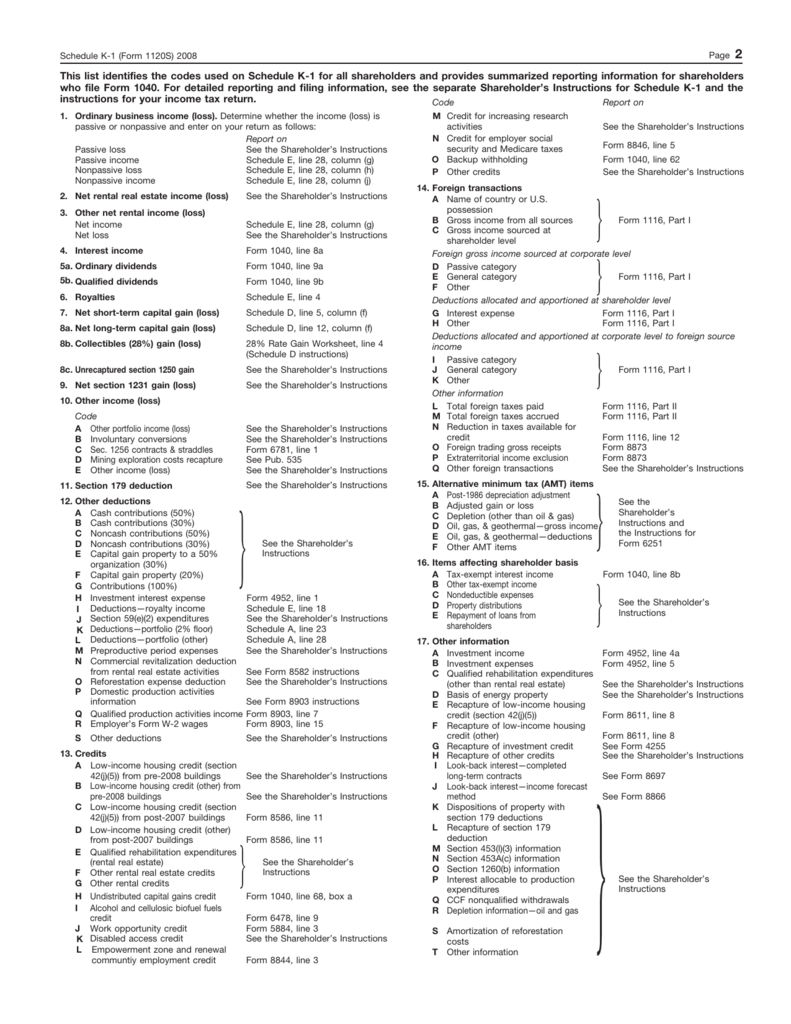

1120S K1 codes

Prior versions will be available on irs.gov. Every corporation doing business in this state or deriving income from sources within this state, unless exempt by iowa code section 422.34, must. Web qualified sick and family leave wages in 2022 for leave taken after march 31, 2020, and before october 1, 2021, are eligible to claim a credit for qualified sick.

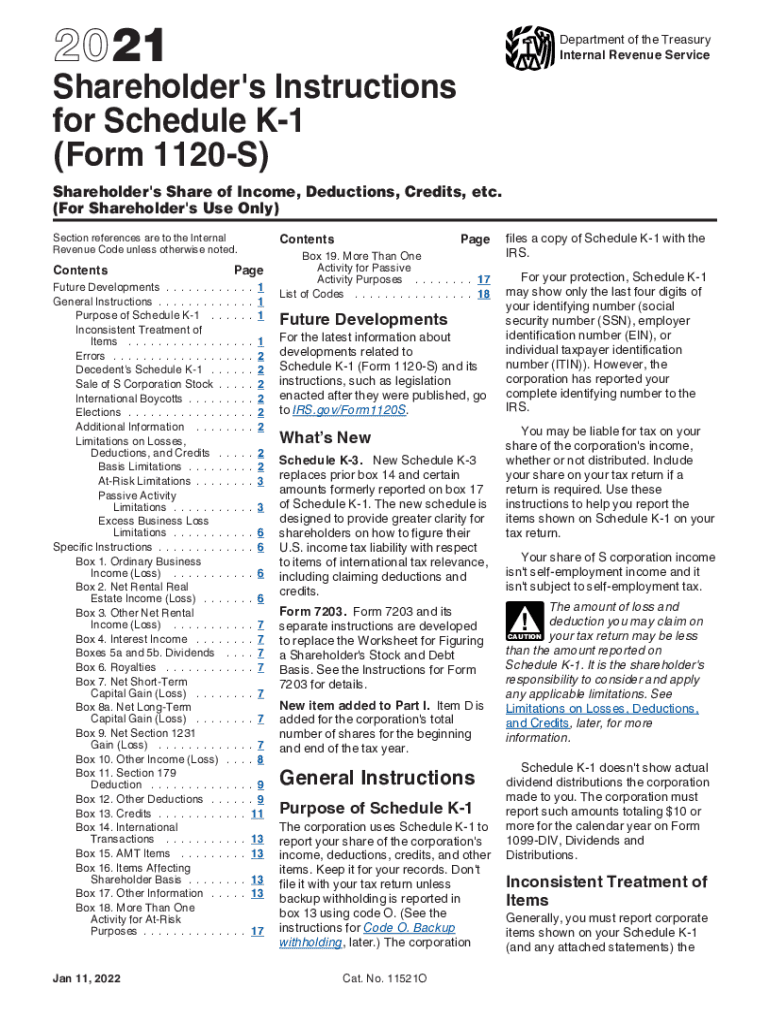

What Is K1 Form For Taxes Fill Out and Sign Printable PDF Template

Corporation income and replacement tax return: Web qualified sick and family leave wages in 2022 for leave taken after march 31, 2020, and before october 1, 2021, are eligible to claim a credit for qualified sick and family leave wages in 2022. Prior versions will be available on irs.gov. Every corporation doing business in this state or deriving income from.

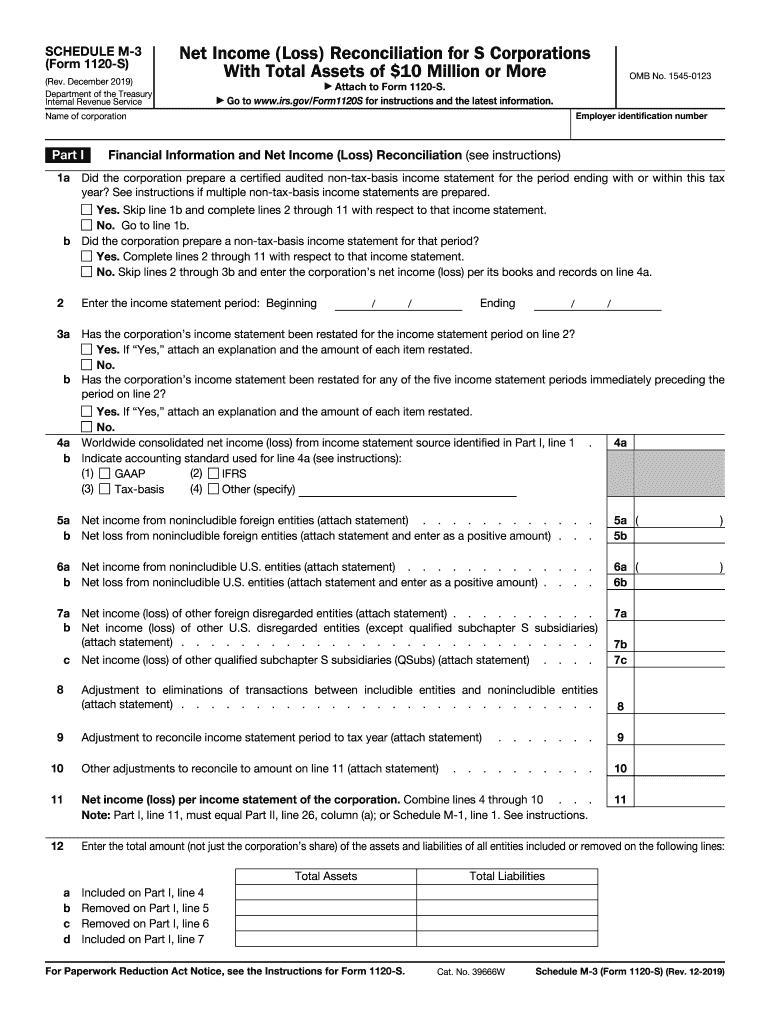

20192021 Form IRS 1120S Schedule M3 Fill Online, Printable

Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to. See faq #17 for a link to the instructions. An insurance company must file with the department of insurance. Web qualified sick and family leave wages in 2022 for leave taken after march 31, 2020, and before october 1, 2021, are eligible.

2021 Form IRS Instructions 1120S Fill Online, Printable, Fillable

Web for tax year 2022, please see the 2022 instructions. See the march 2022 revision of the instructions for form 941 and the 2022 instructions for form 944 for more information. Web form 1120 department of the treasury internal revenue service u.s. Go to www.irs.gov/form1120s for instructions and the latest information. See faq #17 for a link to the instructions.

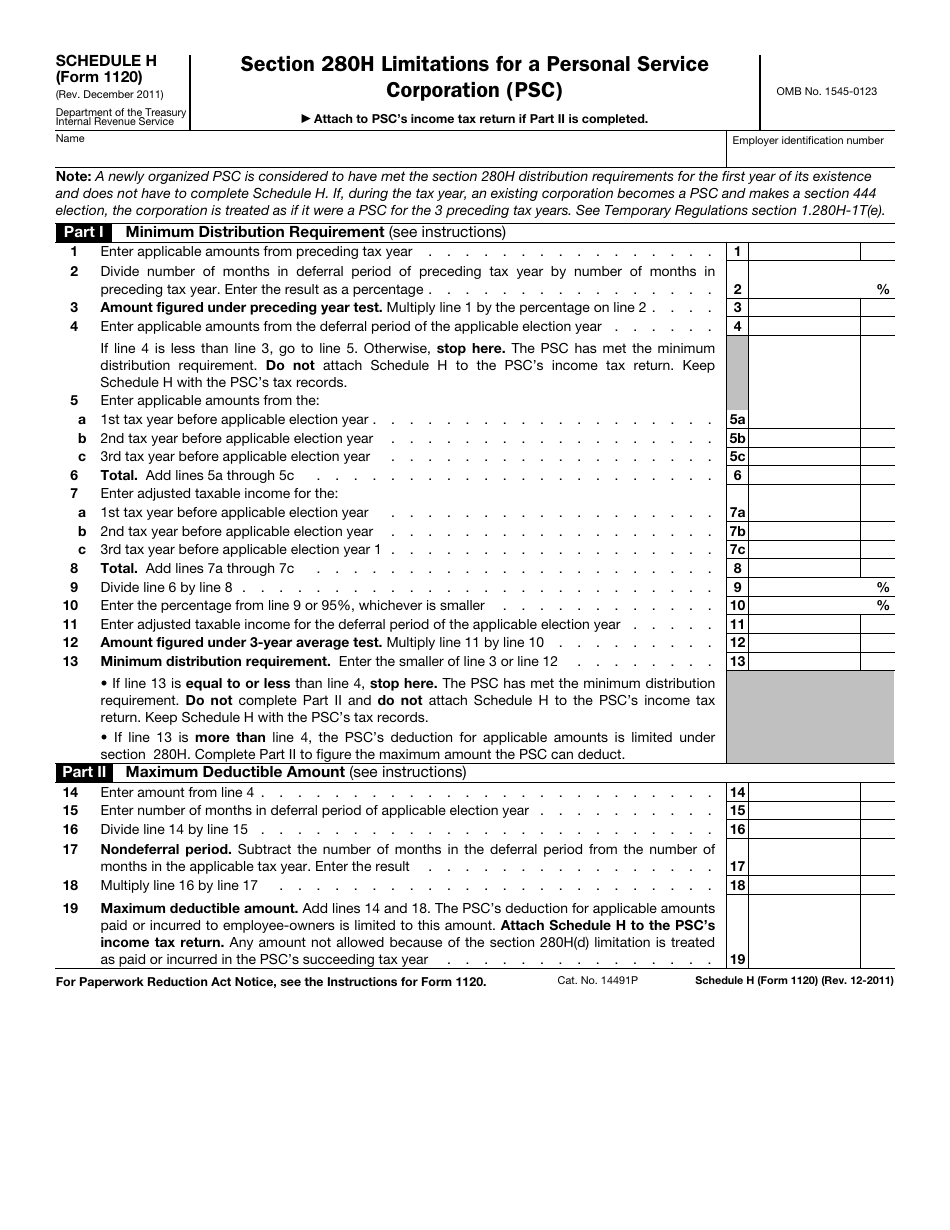

IRS Form 1120 Schedule H Download Fillable PDF or Fill Online Section

Web for tax year 2022, please see the 2022 instructions. Prior versions will be available on irs.gov. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation. Go to www.irs.gov/form1120s for instructions and the latest information. An insurance company must file.

1How to complete 2021 IRS Form 1120S and Schedule K1 For your LLC

Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to. Every corporation doing business in this state or deriving income from sources within this state, unless exempt by iowa code section 422.34, must. The references to form numbers and line descriptions on federal corporate income tax forms were correct at the time.

What is Form 1120S and How Do I File It? Ask Gusto

Every corporation doing business in this state or deriving income from sources within this state, unless exempt by iowa code section 422.34, must. Corporation income and replacement tax return: The references to form numbers and line descriptions on federal corporate income tax forms were correct at the time An insurance company must file with the department of insurance. Corporation income.

IRS Form 1120S Definition, Download, & 1120S Instructions

Every corporation doing business in this state or deriving income from sources within this state, unless exempt by iowa code section 422.34, must. See the march 2022 revision of the instructions for form 941 and the 2022 instructions for form 944 for more information. Income tax return for an s corporation do not file this form unless the corporation has.

IRS Form 1120S Definition, Download, & 1120S Instructions

Every corporation doing business in this state or deriving income from sources within this state, unless exempt by iowa code section 422.34, must. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to. Web for tax year 2022, please see the 2022 instructions. An insurance company must file with the department of.

Corporation Income And Replacement Tax Return:

Forms are available at dor.sc.gov/forms. Web for tax year 2022, please see the 2022 instructions. Go to www.irs.gov/form1120s for instructions and the latest information. Web qualified sick and family leave wages in 2022 for leave taken after march 31, 2020, and before october 1, 2021, are eligible to claim a credit for qualified sick and family leave wages in 2022.

Prior Versions Will Be Available On Irs.gov.

The references to form numbers and line descriptions on federal corporate income tax forms were correct at the time Web form 1120 department of the treasury internal revenue service u.s. See faq #17 for a link to the instructions. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation.

An Insurance Company Must File With The Department Of Insurance.

Every corporation doing business in this state or deriving income from sources within this state, unless exempt by iowa code section 422.34, must. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to. See the march 2022 revision of the instructions for form 941 and the 2022 instructions for form 944 for more information.