Form 5695 Example

Form 5695 Example - Web department of the treasury internal revenue service residential energy credits go to www.irs.gov/form5695 for instructions and the latest information. Web department of the treasury internal revenue service go to www.irs.gov/form5695 for instructions and the latest information. What is the irs form 5695? The form 5695 instructions include a worksheet on page 4 to help you make the necessary calculations. It’s divided into two parts based on the two different tax incentive programs, but you only need to complete whichever portion(s) are relevant to your home improvement project. Web going green / what is the irs form 5695? Web form 5695 filing instructions. However, it does not need to be your primary residence. Web form 5695 is used to calculate the nonrefundable credit for residential energy efficient property. Web get answers to frequently asked questions about entering information from form 5695, residential energy credits, in the individual module of intuit proconnect.

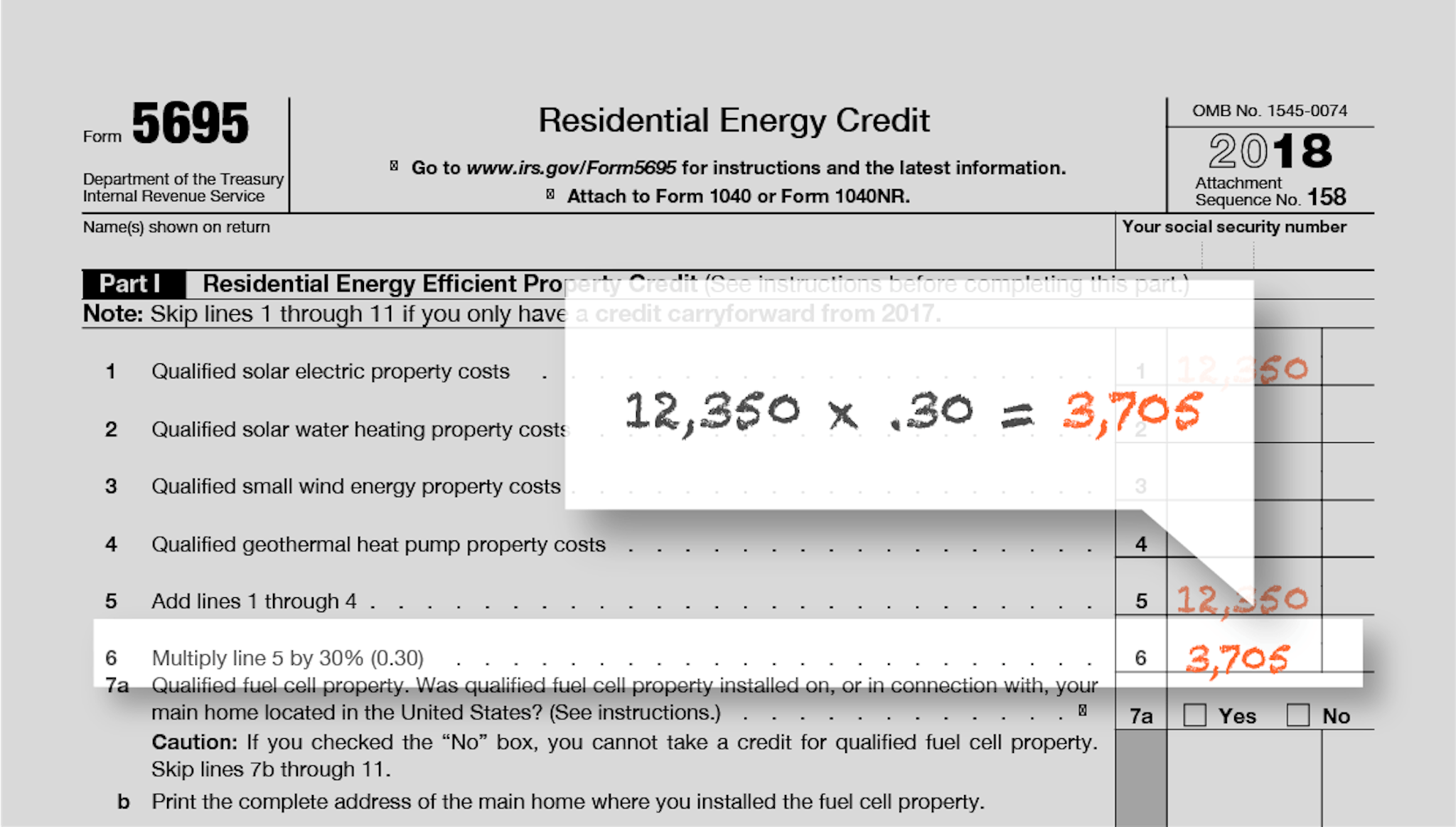

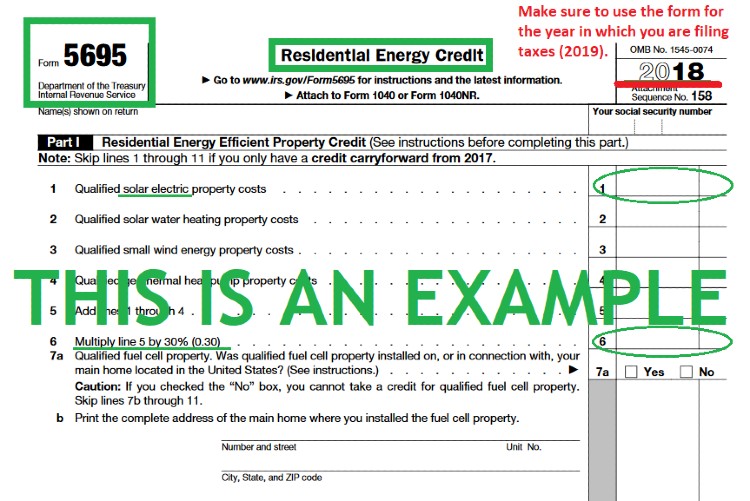

Web with form 5695 completed, you’ll have the amount of your tax credit for the current tax year (line 15), which you can then include on line 5 of schedule 3 for your form 1040. Web form 5695 filing instructions. Web also, use form 5695 to take any residential energy efficient property credit carryforward from 2016 or to carry the unused portion of the credit to 2018. Click next or continue, and the second screen will ask about insulation, air conditioning and the furnace. We’ve provided sample images of the tax forms to help you follow along. We commonly think of tax form 5695 as the residential clean energy credit form. Web purpose of form use form 5695 to figure and take your residential energy credits. Who can take the credit you may be able to take the credit if you made energy saving improvements to your home located in the united states in The energy efficient home improvement credit. You need to submit it alongside form 1040.

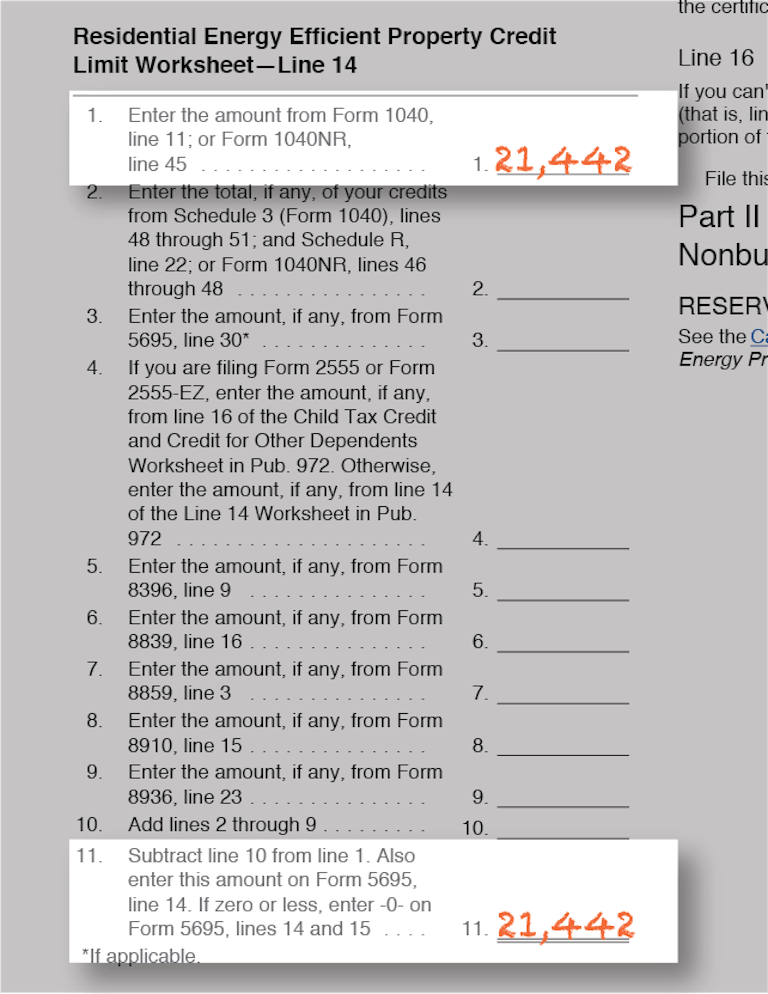

In our example, we’re claiming $2,500 of our full solar itc amount, with the remaining $388 carrying over and allowing us to enter it on line 12 of form 5695 next year. Web form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water heating, small wind turbines, and fuel cells. For tax years 2006 through 2017 it was also used to calculate the nonbusiness energy property credit, which has expired. We’ll use the national average gross cost. Web form 5695 filing instructions. Web use form 5695 to figure and take your residential energy credits. Web with form 5695 completed, you’ll have the amount of your tax credit for the current tax year (line 15), which you can then include on line 5 of schedule 3 for your form 1040. 158 name(s) shown on return your social security number part i residential clean energy credit Web department of the treasury internal revenue service go to www.irs.gov/form5695 for instructions and the latest information. See the worksheets under line 18 and line 19f, later.

How to File IRS Form 5695 To Claim Your Renewable Energy Credits

It’s divided into two parts based on the two different tax incentive programs, but you only need to complete whichever portion(s) are relevant to your home improvement project. Web purpose of form use form 5695 to figure and take your residential energy credits. Also use form 5695 to take any residential energy efficient property credit carryforward from 2020 or to.

How To Claim The Solar Tax Credit Alba Solar Energy

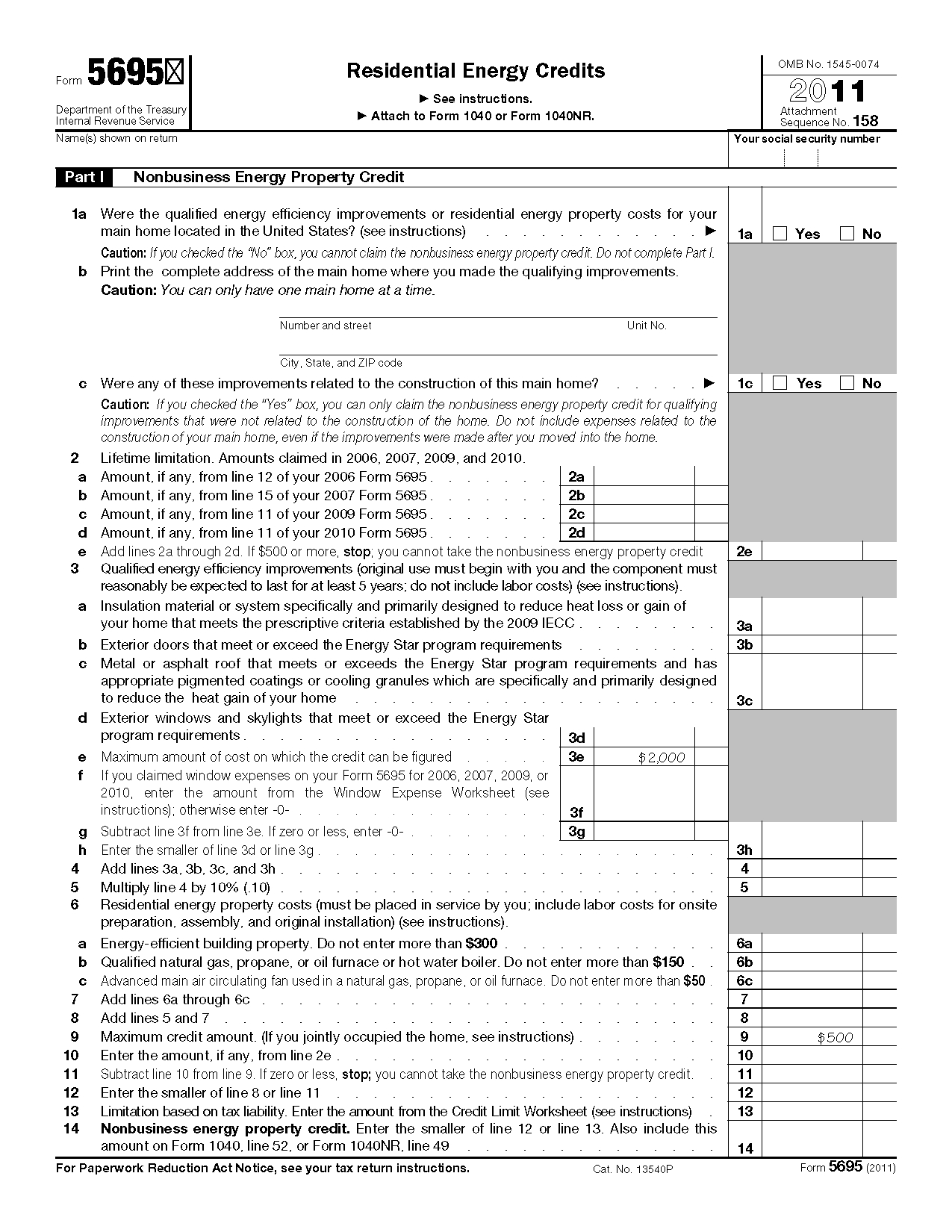

The residential clean energy credit, and. Web purpose of form use form 5695 to figure and take your residential energy credits. The residential clean energy credit, and the energy efficient home improvement credit. Web if you are claiming the nonbusiness energy property credit on both a 2018 and a 2019 form 5695, complete your 2018 form 5695 first as there.

How to File IRS Form 5695 To Claim Your Renewable Energy Credits

Also use form 5695 to take any residential energy efficient property credit carryforward from 2020 or to carry the unused Two parts cover the two primary tax credits for residential green upgrades. The form 5695 instructions include a worksheet on page 4 to help you make the necessary calculations. However, it does not need to be your primary residence. For.

Form 5695 Instructions & Information on IRS Form 5695

The form 5695 instructions include a worksheet on page 4 to help you make the necessary calculations. Also use form 5695 to take any residential energy efficient property credit carryforward from 2021 or to carry the unused portion of the residential clean energy credit to 2023. Web if you are claiming the nonbusiness energy property credit on both a 2018.

Ev Federal Tax Credit Form

Web form 5695 is what you need to fill out to calculate your residential energy tax credits. The form 5695 instructions include a worksheet on page 4 to help you make the necessary calculations. You need to submit it alongside form 1040. However, it does not need to be your primary residence. Click next or continue, and the second screen.

Filing For The Solar Tax Credit Wells Solar

We’ll use the national average gross cost. See the worksheets under line 18 and line 19f, later. Web going green / what is the irs form 5695? The residential energy credits are: Web form 5695 is what you need to fill out to calculate your residential energy tax credits.

Form 5695 Residential Energy Credits —

Web purpose of form use form 5695 to figure and take your residential energy credits. We commonly think of tax form 5695 as the residential clean energy credit form. The residential energy credits are: Web purpose of form use form 5695 to figure and take your residential energy credits. You must own the residence in order to claim this credit,.

How to file for the solar tax credit IRS Form 5695 instructions (2023)

We’ve provided sample images of the tax forms to help you follow along. The form 5695 instructions include a worksheet on page 4 to help you make the necessary calculations. Web form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water heating, small wind turbines, and fuel cells. Also.

How to File IRS Form 5695 To Claim Your Renewable Energy Credits

Web what is irs form 5695? The residential energy credits are: Web form 5695 is what you need to fill out to calculate your residential energy tax credits. See the worksheets under line 18 and line 19f, later. For tax years 2006 through 2017 it was also used to calculate the nonbusiness energy property credit, which has expired.

Form 5695 YouTube

Web form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water heating, small wind turbines, and fuel cells. Meaning of 5695 form as a finance term. Web form 5695 filing instructions. Web form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps,.

Two Parts Cover The Two Primary Tax Credits For Residential Green Upgrades.

The residential energy credits are: However, it does not need to be your primary residence. The energy efficient home improvement credit. Click next or continue, and the second screen will ask about insulation, air conditioning and the furnace.

Also Use Form 5695 To Take Any Residential Energy Efficient Property Credit Carryforward From 2020 Or To Carry The Unused

Web the residential energy credits are: Web if you are claiming the nonbusiness energy property credit on both a 2018 and a 2019 form 5695, complete your 2018 form 5695 first as there is a lifetime limitation on the credit itself and on window expenses. For tax years 2006 through 2017 it was also used to calculate the nonbusiness energy property credit, which has expired. Web examples include solar electric, solar water heating, small wind energy and geothermal heat pump property costs.

Web Information About Form 5695, Residential Energy Credits, Including Recent Updates, Related Forms And Instructions On How To File.

Also use form 5695 to take any residential energy efficient property credit carryforward from 2021 or to carry the unused portion of the residential clean energy credit to 2023. Meaning of 5695 form as a finance term. We’ll use $25,000 gross cost. Web purpose of form use form 5695 to figure and take your residential energy credits.

The Form 5695 Instructions Include A Worksheet On Page 4 To Help You Make The Necessary Calculations.

You need to submit it alongside form 1040. Refer to form 5695 instructions for additional information and limitations. The residential clean energy credit, and. Web form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water heating, small wind turbines, and fuel cells.