Form 8582 Unallowed Loss

Form 8582 Unallowed Loss - Start date dec 9, 2014; Web per the form 8582 instructions: Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. Ad access irs tax forms. Web when creating the current year return, taxslayer pro will inform you if unallowed losses are found in the prior year return: Complete, edit or print tax forms instantly. Main forum / tax discussion. A passive activity loss occurs when total losses. Ad register and subscribe now to work on your irs 8582 & more fillable forms. If a rental real estate activity isn’t a passive activity for the current year, any prior year unallowed loss is treated as a loss from a former passive.

Web up to 10% cash back the passive activity loss rules generally prevent taxpayers with adjusted gross income (agi) above $100,000 from deducting some or all losses from real estate. Get ready for tax season deadlines by completing any required tax forms today. Web when creating the current year return, taxslayer pro will inform you if unallowed losses are found in the prior year return: Web from 8582, passive activity loss limitations, is filed by individuals, estates, and trusts who have passive activity deductions (including prior year unallowed losses). Web form 8582 must generally be filed by taxpayers who have an overall gain (including any prior year unallowed losses) from business or rental passive activities. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed. A passive activity loss occurs when total losses. If a rental real estate activity isn’t a passive activity for the current year, any prior year unallowed loss is treated as a loss from a former passive. Ad register and subscribe now to work on your irs 8582 & more fillable forms. Web per the form 8582 instructions:

Web form 8582 figures the amount of any passive activity loss for the current tax year for all activities and the amount of the passive activity loss allowed on your. Get ready for tax season deadlines by completing any required tax forms today. Start date dec 9, 2014; Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. Web when creating the current year return, taxslayer pro will inform you if unallowed losses are found in the prior year return: Ad register and subscribe now to work on your irs 8582 & more fillable forms. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed. Complete, edit or print tax forms instantly. Web from 8582, passive activity loss limitations, is filed by individuals, estates, and trusts who have passive activity deductions (including prior year unallowed losses). Web department of the treasury internal revenue service (99) passive activity loss limitations see separate instructions.

Form 8582 Passive Activity Loss Limitations (2014) Free Download

Web form 8582 figures the amount of any passive activity loss for the current tax year for all activities and the amount of the passive activity loss allowed on your. Web from 8582, passive activity loss limitations, is filed by individuals, estates, and trusts who have passive activity deductions (including prior year unallowed losses). Complete, edit or print tax forms.

Form 8582 Passive Activity Loss Limitations (2014) Free Download

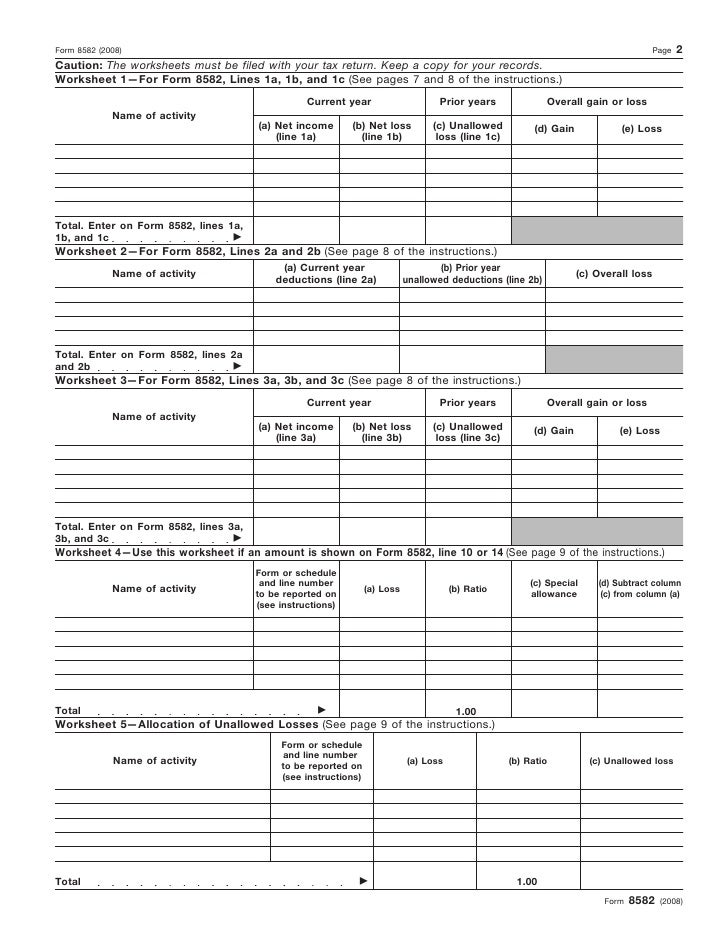

Web form 8582 figures the amount of any passive activity loss for the current tax year for all activities and the amount of the passive activity loss allowed on your. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. Web form 8582 (2006) worksheet 1—for form 8582,.

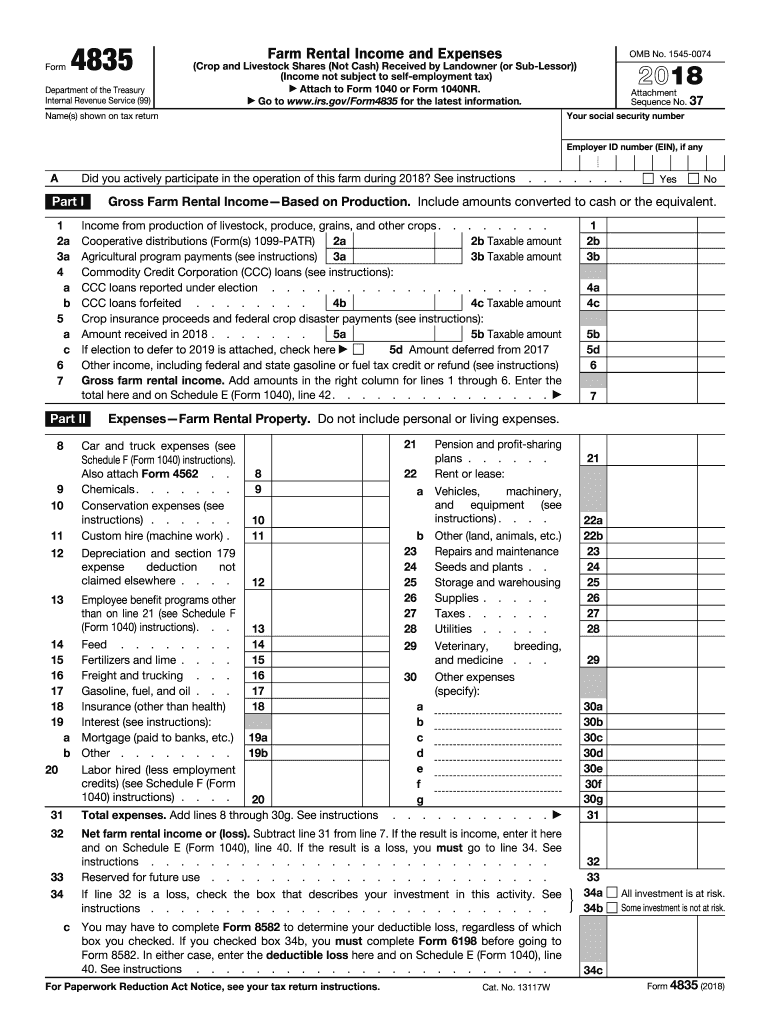

Us Government Tax Form 4835 Fill Out and Sign Printable PDF Template

Web when creating the current year return, taxslayer pro will inform you if unallowed losses are found in the prior year return: Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed. Web form 8582 (2006) worksheet 1—for.

Form 8582 Passive Activity Loss Limitations (2014) Free Download

Web form 8582 figures the amount of any passive activity loss for the current tax year for all activities and the amount of the passive activity loss allowed on your. Web when creating the current year return, taxslayer pro will inform you if unallowed losses are found in the prior year return: Web from 8582, passive activity loss limitations, is.

Form 8582CR Passive Activity Credit Limitations (2012) Free Download

If a rental real estate activity isn’t a passive activity for the current year, any prior year unallowed loss is treated as a loss from a former passive. Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. Joined dec 9, 2014 messages 9.

Fill Free fillable form 8582 passive activity loss limitations pdf

Web up to 10% cash back the passive activity loss rules generally prevent taxpayers with adjusted gross income (agi) above $100,000 from deducting some or all losses from real estate. If a rental real estate activity isn’t a passive activity for the current year, any prior year unallowed loss is treated as a loss from a former passive. Web department.

Instructions for Form 8582CR (12/2019) Internal Revenue Service

Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. A passive activity loss occurs when total losses. Web from 8582, passive activity loss limitations, is filed by individuals, estates, and trusts who have passive activity deductions (including prior year unallowed losses). Main forum.

Form 8582Passive Activity Loss Limitations

Web from 8582, passive activity loss limitations, is filed by individuals, estates, and trusts who have passive activity deductions (including prior year unallowed losses). Main forum / tax discussion. Ad access irs tax forms. Web when creating the current year return, taxslayer pro will inform you if unallowed losses are found in the prior year return: Start date dec 9,.

Form 8582 Passive Activity Loss Miller Financial Services

If this is your first visit, be sure to check out the faq by clicking the link. Web department of the treasury internal revenue service (99) passive activity loss limitations see separate instructions. Ad access irs tax forms. Web when creating the current year return, taxslayer pro will inform you if unallowed losses are found in the prior year return:.

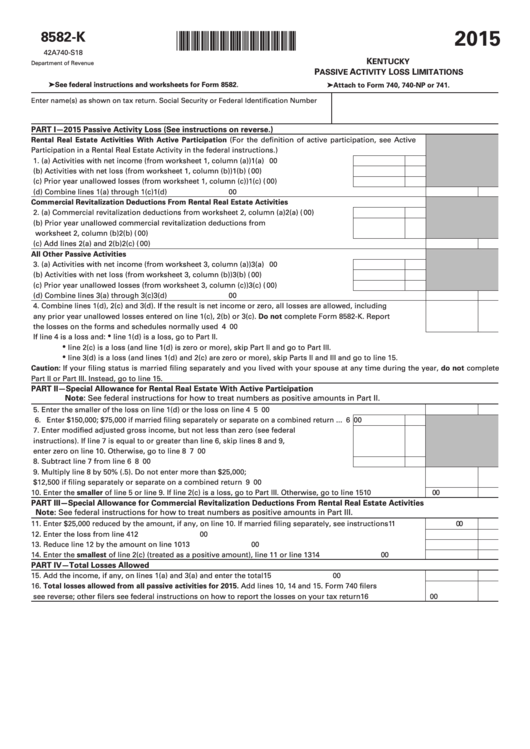

Fillable Form 8582K Kentucky Passive Activity Loss Limitations

Get ready for tax season deadlines by completing any required tax forms today. If a rental real estate activity isn’t a passive activity for the current year, any prior year unallowed loss is treated as a loss from a former passive. Main forum / tax discussion. Web form 8582 (2006) worksheet 1—for form 8582, lines 1a, 1b, and 1c (see.

Web Per The Form 8582 Instructions:

Ad register and subscribe now to work on your irs 8582 & more fillable forms. Joined dec 9, 2014 messages 9 reaction score 0. Main forum / tax discussion. Web form 8582 figures the amount of any passive activity loss for the current tax year for all activities and the amount of the passive activity loss allowed on your.

Start Date Dec 9, 2014;

Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Web from 8582, passive activity loss limitations, is filed by individuals, estates, and trusts who have passive activity deductions (including prior year unallowed losses). Web up to 10% cash back the passive activity loss rules generally prevent taxpayers with adjusted gross income (agi) above $100,000 from deducting some or all losses from real estate.

Web Form 8582 Must Generally Be Filed By Taxpayers Who Have An Overall Gain (Including Any Prior Year Unallowed Losses) From Business Or Rental Passive Activities.

Web form 8582 (2006) worksheet 1—for form 8582, lines 1a, 1b, and 1c (see pages 7 and 8 of the instructions.) current year prior years overall gain or loss (c) unallowed loss (line 1c). Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. Web department of the treasury internal revenue service (99) passive activity loss limitations see separate instructions. If this is your first visit, be sure to check out the faq by clicking the link.

If A Rental Real Estate Activity Isn’t A Passive Activity For The Current Year, Any Prior Year Unallowed Loss Is Treated As A Loss From A Former Passive.

Web when creating the current year return, taxslayer pro will inform you if unallowed losses are found in the prior year return: A passive activity loss occurs when total losses. Web form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current tax year and to report the application of prior year unallowed. Get ready for tax season deadlines by completing any required tax forms today.