Form 8621 Filing Requirements

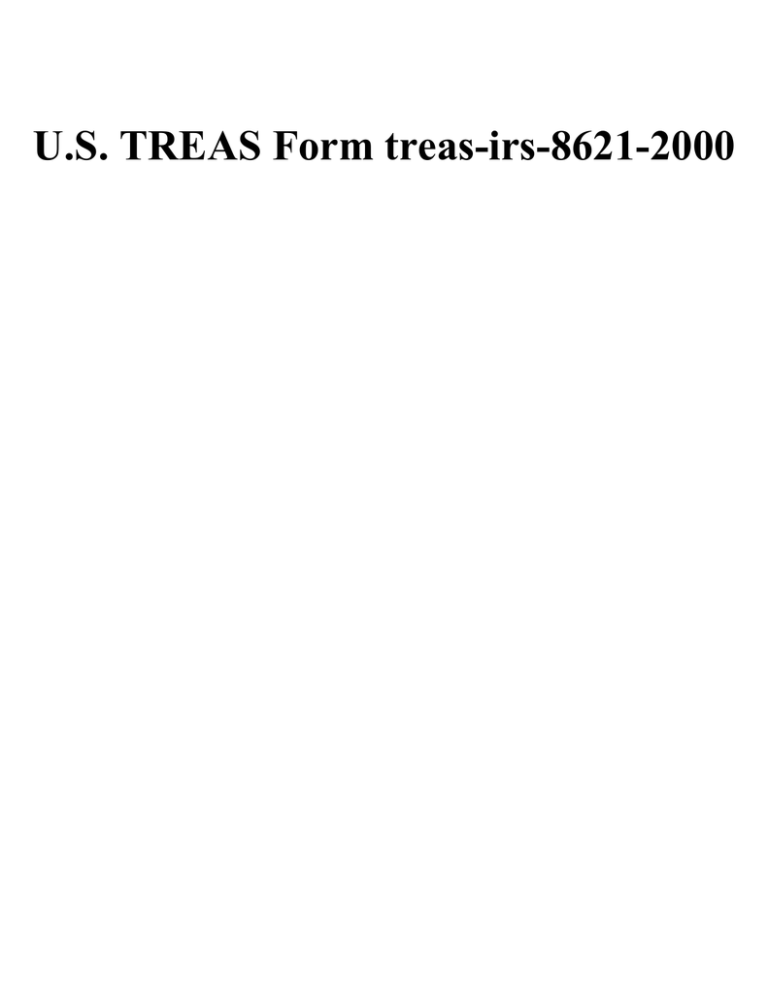

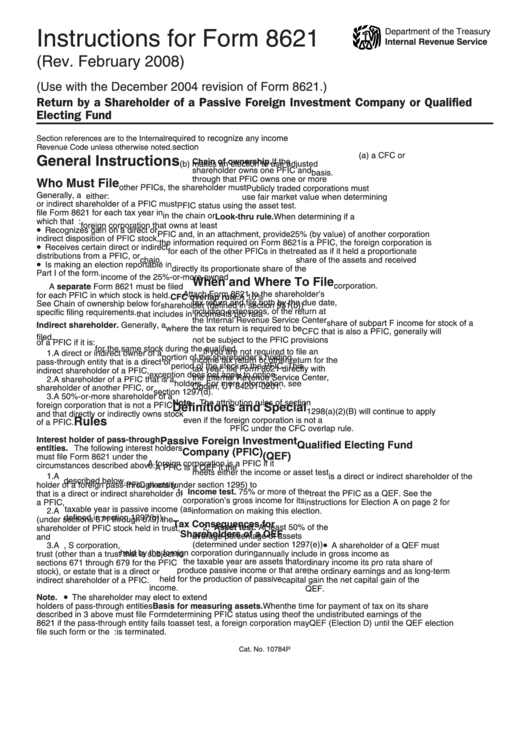

Form 8621 Filing Requirements - For details, see election to be treated as a qualifying insurance corporation, later. Essentially, taxpayers who have an interest in a pfic and meet the threshold reporting requirements have to file form 8621. Web the following interest holders must file form 8621 under the three circumstances described earlier: Irc section 1298(f) says, “except as otherwise provided by the secretary [in regulations], each united states person who is a shareholder of a. Web who is required to file 8621? Person that is a direct or indirect shareholder of a pfic must file form 8621 for each tax year. Web the annual filing requirement is imposed on u.s. Web if a foreign trust invests in any foreign mutual funds (pfics), such funds are deemed to be passive foreign investment companies under u.s. Web who must file the pfic disclosure generally, a u.s. There are also a few reporting requirements you may have:

Web in general, if you have shares in a foreign mutual fund, you’ll have to report it to the irs. Essentially, taxpayers who have an interest in a pfic and meet the threshold reporting requirements have to file form 8621. This form is required when you have any direct or indirect ownership interest in a pfic (defined below). Web who must file the pfic disclosure generally, a u.s. Persons who are pfic shareholders who do not currently file form 8621, information return by a shareholder. Web who is required to file 8621? Web form 8621 filing requirements. Person that is a direct or indirect shareholder of a pfic must file form 8621 for each tax year. Web under current law, a shareholder need not file form 8621 if the shareholder is not (i) treated as receiving an excess distribution from the fund, and (ii) the value of all pfic stock. If the individual taxpayer owns a pfic through a foreign partnership,.

Person that is a direct or indirect shareholder of a pfic must file form 8621 for each tax year. Irc section 1298(f) says, “except as otherwise provided by the secretary [in regulations], each united states person who is a shareholder of a. Web who is required to file 8621? Persons who are pfic shareholders who do not currently file form 8621, information return by a shareholder. Web if a foreign trust invests in any foreign mutual funds (pfics), such funds are deemed to be passive foreign investment companies under u.s. This form is required when you have any direct or indirect ownership interest in a pfic (defined below). Tax law and the u.s. Web you are required to file if you meet any of the following qualifications: Web file an annual report pursuant to section 1298 (f). If you have opened a foreign mutual fund investment account and have received income.

U.S. TREAS Form treasirs86212000

Who must file form 8621? Essentially, taxpayers who have an interest in a pfic and meet the threshold reporting requirements have to file form 8621. Web file an annual report pursuant to section 1298 (f). Persons who are pfic shareholders who do not currently file form 8621, information return by a shareholder. For details, see election to be treated as.

Fill Free fillable Form 8621A 2013 Return by a Shareholder PDF form

Essentially, taxpayers who have an interest in a pfic and meet the threshold reporting requirements have to file form 8621. Web do i need to file irs form 8621? Web a form 8621 must be filed for each pfic in which the individual taxpayer owns a direct or indirect interest. Web in general, if you have shares in a foreign.

Form 8621 Instructions 2020 2021 IRS Forms

Web file an annual report pursuant to section 1298 (f). Essentially, taxpayers who have an interest in a pfic and meet the threshold reporting requirements have to file form 8621. Web if a foreign trust invests in any foreign mutual funds (pfics), such funds are deemed to be passive foreign investment companies under u.s. Tax law and the u.s. Person.

Understanding PFIC and Filing IRS Form 8261 for US Expats Bright!Tax

This form is required when you have any direct or indirect ownership interest in a pfic (defined below). Essentially, taxpayers who have an interest in a pfic and meet the threshold reporting requirements have to file form 8621. You receive direct or indirect distributions from a pfic. Web who is required to file 8621? Web if a foreign trust invests.

form8621calcualtorpficupdatefacebook Expat Tax Tools

You receive direct or indirect distributions from a pfic. Web you are required to file if you meet any of the following qualifications: Web the annual filing requirement is imposed on u.s. You saw a gain on a direct or indirectly owned pfic. Persons who are pfic shareholders who do not currently file form 8621, information return by a shareholder.

Instructions For Form 8621 (2008) Internal Revenue Service printable

Persons who are pfic shareholders who do not currently file form 8621, information return by a shareholder. For details, see election to be treated as a qualifying insurance corporation, later. Web if a foreign trust invests in any foreign mutual funds (pfics), such funds are deemed to be passive foreign investment companies under u.s. Web who is required to file.

Need to prepare Form 8621 for your PFICs? Expat Tax Tools' Form 8621

You receive direct or indirect distributions from a pfic. Web do i need to file irs form 8621? Web the annual filing requirement is imposed on u.s. There are also a few reporting requirements you may have: Irc section 1298(f) says, “except as otherwise provided by the secretary [in regulations], each united states person who is a shareholder of a.

The Only Business U.S. Expat Tax blog you need to read

Web you are required to file if you meet any of the following qualifications: Web the annual filing requirement is imposed on u.s. Web form 8621 filing requirements. If the individual taxpayer owns a pfic through a foreign partnership,. Web under current law, a shareholder need not file form 8621 if the shareholder is not (i) treated as receiving an.

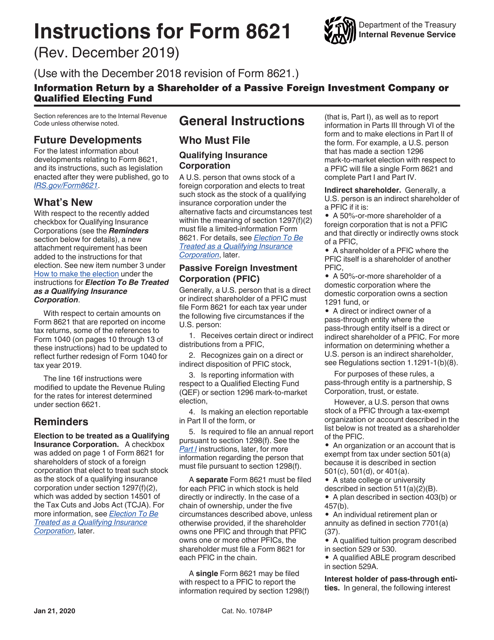

Download Instructions for IRS Form 8621 Information Return by a

Essentially, taxpayers who have an interest in a pfic and meet the threshold reporting requirements have to file form 8621. You saw a gain on a direct or indirectly owned pfic. Essentially, taxpayers who have an interest in a pfic and meet the threshold reporting requirements have to file form 8621. Web if a foreign trust invests in any foreign.

Form 8621 Information Return by a Shareholder of a Passive Foreign

Web form 8621 filing requirements. It does not matter if you own just. Web in general, if you have shares in a foreign mutual fund, you’ll have to report it to the irs. If you have opened a foreign mutual fund investment account and have received income. Web a form 8621 must be filed for each pfic in which the.

For Details, See Election To Be Treated As A Qualifying Insurance Corporation, Later.

Who must file form 8621? Web do i need to file irs form 8621? This form is required when you have any direct or indirect ownership interest in a pfic (defined below). Web under current law, a shareholder need not file form 8621 if the shareholder is not (i) treated as receiving an excess distribution from the fund, and (ii) the value of all pfic stock.

Web Who Is Required To File 8621?

You saw a gain on a direct or indirectly owned pfic. Tax law and the u.s. Web the annual filing requirement is imposed on u.s. It does not matter if you own just.

Person That Is A Direct Or Indirect Shareholder Of A Pfic Must File Form 8621 For Each Tax Year.

Web file an annual report pursuant to section 1298 (f). If you have opened a foreign mutual fund investment account and have received income. You receive direct or indirect distributions from a pfic. Web the following interest holders must file form 8621 under the three circumstances described earlier:

Web In General, If You Have Shares In A Foreign Mutual Fund, You’ll Have To Report It To The Irs.

Web who must file the pfic disclosure generally, a u.s. Web if a foreign trust invests in any foreign mutual funds (pfics), such funds are deemed to be passive foreign investment companies under u.s. Essentially, taxpayers who have an interest in a pfic and meet the threshold reporting requirements have to file form 8621. If the individual taxpayer owns a pfic through a foreign partnership,.