Home Equity Loan Form

Home Equity Loan Form - To qualify for a home equity loan from discover, most applicants must be able to demonstrate: Typically, you can borrow up to a specified percentage of your equity. To increase your equity, you need to either boost the. Beware of red flags, like lenders who change the terms of the loan at the. A credit score of 620 or better, and a responsible credit history; If you need to improve your credit score before applying for a loan, there are some things you can do. Equity is the value of your home minus the. Home equity loans have a fixed interest rate. Web a minimum credit score of 620 is usually required to qualify for a home equity loan, although a score of 680 or higher is preferred. Web a home equity line of credit, aka heloc, and a home equity loan are ways to finance large expenses by borrowing against the equity in your house.

Web all lenders review an applicant’s financial health and creditworthiness before approving a home equity loan. Home equity loans have a fixed interest rate. It’s one of a few options homeowners can use to access some of the equity they’ve built in their homes without selling. Web a heloc is a line of credit borrowed against the available equity of your home. Web a home equity loan allows you to borrow against the equity in your home. With both, the rate you can secure will. Please sign the attached credit authorization form and include with the application. 1 that rate will usually be lower than the borrower could get on other. Web home equity loan request form. Web a home equity loan is a loan you take out against the equity you already have in your home.

In fact, as of the first quarter of 2023, the. Home equity loans often offer at a lower rate than other debt. If you need to improve your credit score before applying for a loan, there are some things you can do. High interest rates, financing fees, and other closing costs and credit costs can also make it very expensive to borrow money, even if you use your home as collateral. For loan requests greater than $150,000: Through bank of america, you can generally borrow up to 85% of the value of your home minus the amount you still owe. Please note, there is no application fee. You will only be required to pay the appraisal fee at the time of inspection. Web how to get a loan (5 steps) apply for a loan online common loan terms faqs video sample how to write by type (10) personal loan extension family i owe you (iou) payment plan personal guaranty promissory note release of debt release of guaranty small business how to get a loan (5 steps) It’s one of a few options homeowners can use to access some of the equity they’ve built in their homes without selling.

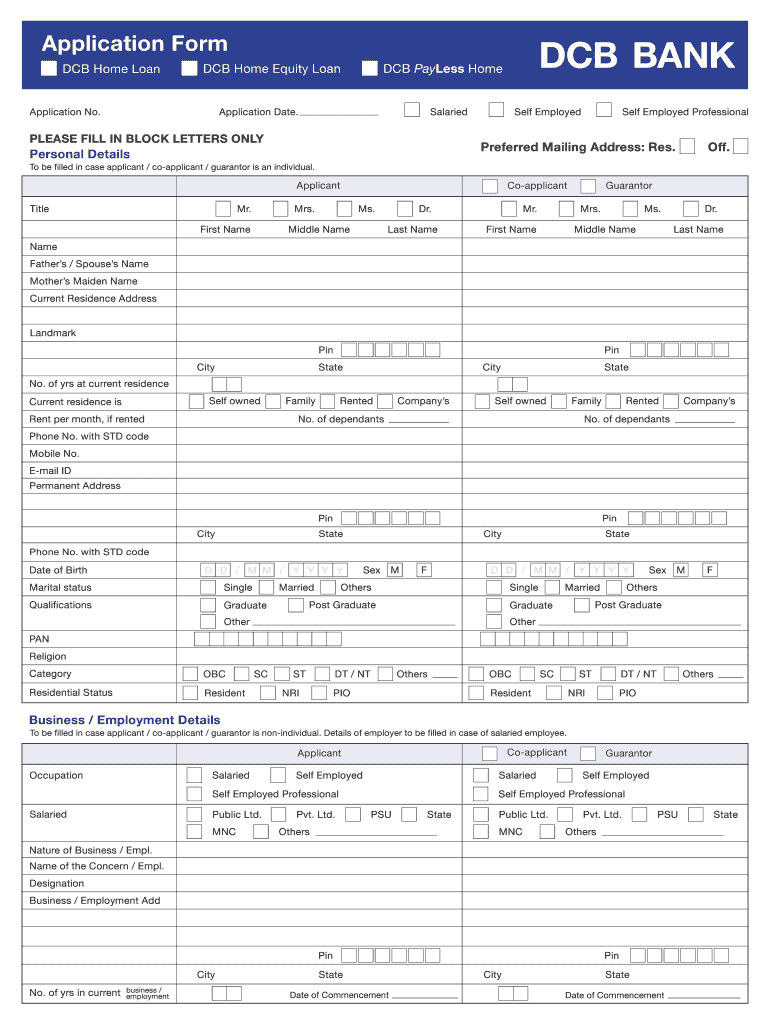

Equity finance loan form application

This is also a good time to review the offers and benefits associated with our loans. They’re generally offered at lower interest rates than other forms of consumer loans because they are secured by your home, just like your primary mortgage. A home equity line of credit (heloc) typically allows you to draw against an approved limit and comes with.

Home Equity Loan Form And Cash On A Table. Stock Image Image of table

Properties increased, and that led to an uptick in home equity on a national level. (a) form of disclosures —. You can’t deduct home mortgage interest unless the following conditions are met. Web home equity loan request form. To qualify for a home equity loan from discover, most applicants must be able to demonstrate:

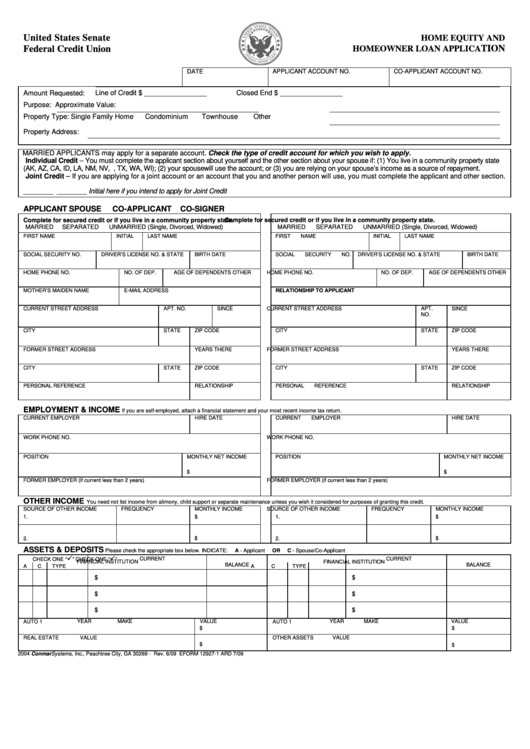

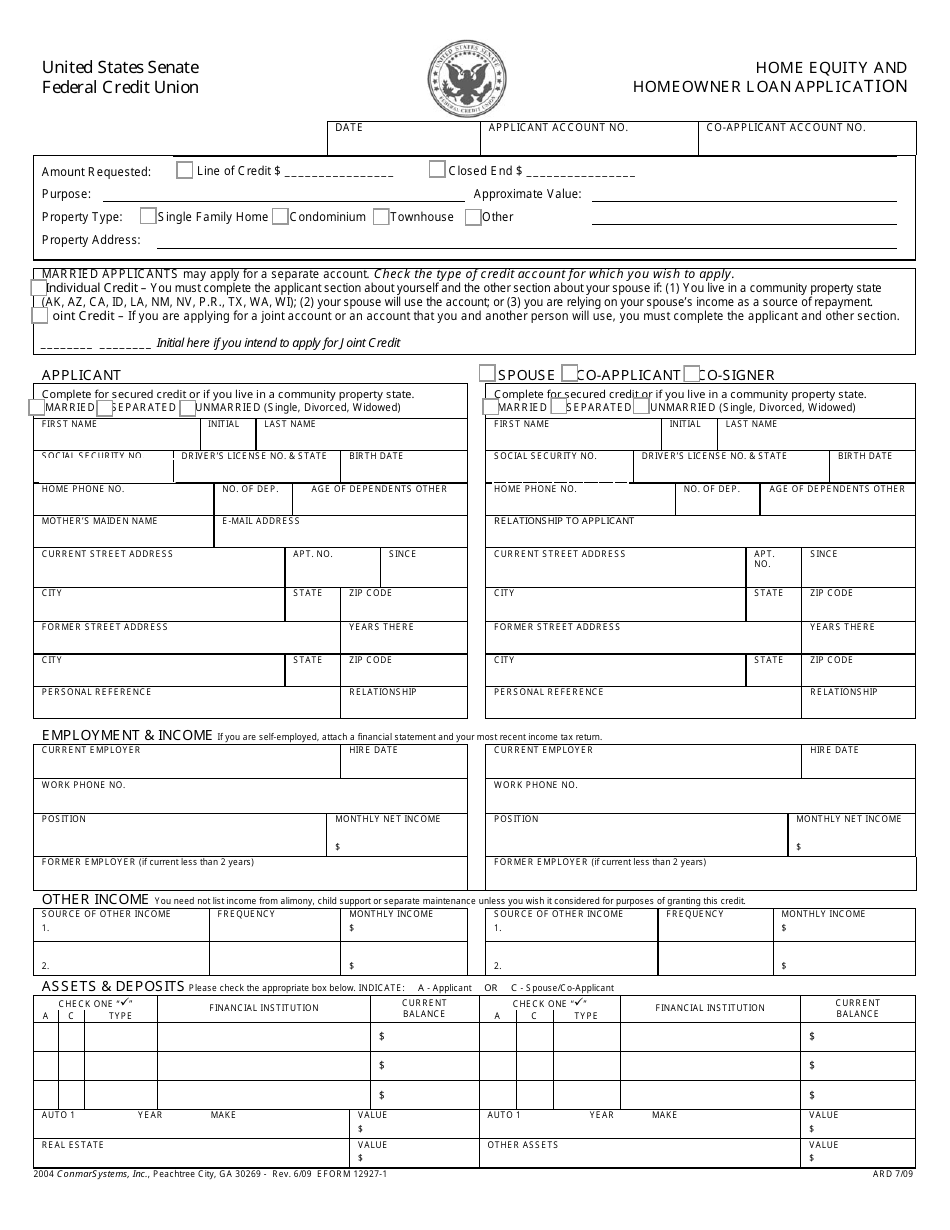

Fillable Home Equity And Homeowner Loan Application printable pdf download

Step 3 gather your information here's what you'll need to apply for a home equity loan or heloc: Equity is the value of your home minus the. However, a lender may approve you for a loan with a lower score if certain requirements are met. Through bank of america, you can generally borrow up to 85% of the value of.

Refinancing vs. Home Equity Loans Tribecca

Web a home equity loan's term can last anywhere from 5 to 30 years. Web a home equity loan—also known as an equity loan, home equity installment loan, or second mortgage —is a type of consumer debt. Browse the online library of over 85,000 legal forms and find the ones that match your unique needs. All items indicated above and.

Form 129271 Download Fillable PDF or Fill Online Home Equity and

Web step 2 choose a loan type compare the different types of home equity loans, including helocs, and select the one that's right for you. In fact, as of the first quarter of 2023, the. Web how to get a loan (5 steps) apply for a loan online common loan terms faqs video sample how to write by type (10).

5 Tips For Choosing A Home Equity Loan In 2021 Best Finance Blog

In fact, as of the first quarter of 2023, the. Properties increased, and that led to an uptick in home equity on a national level. Typically, you can borrow up to a specified percentage of your equity. A credit score of 620 or better, and a responsible credit history; They differ from home equity loans and home equity lines of.

HELOC Pros and Cons You Need To Know FortuneBuilders

Home equity loans have a fixed interest rate. A credit score of 620 or better, and a responsible credit history; Home equity loans allow homeowners to borrow against. Home equity loans allow you to borrow against the portion of your home that you own outright, at a fixed interest rate. Web home equity loan request form.

Equity Bank Loan Schedule Pdf Fill Online, Printable, Fillable, Blank

Your home's equity is the difference between the appraised value of your home and your current mortgage balance. Browse the online library of over 85,000 legal forms and find the ones that match your unique needs. High interest rates, financing fees, and other closing costs and credit costs can also make it very expensive to borrow money, even if you.

Equity Loan Application Form Fill Out and Sign Printable PDF Template

In fact, as of the first quarter of 2023, the. Web you should have at least 20% equity in your home to qualify for a home equity loan, though some lenders will be more flexible on that ratio. Official interpretation of 40 (a) form of disclosures show. Web catch the top stories of the day on anc’s ‘top story’ (28.

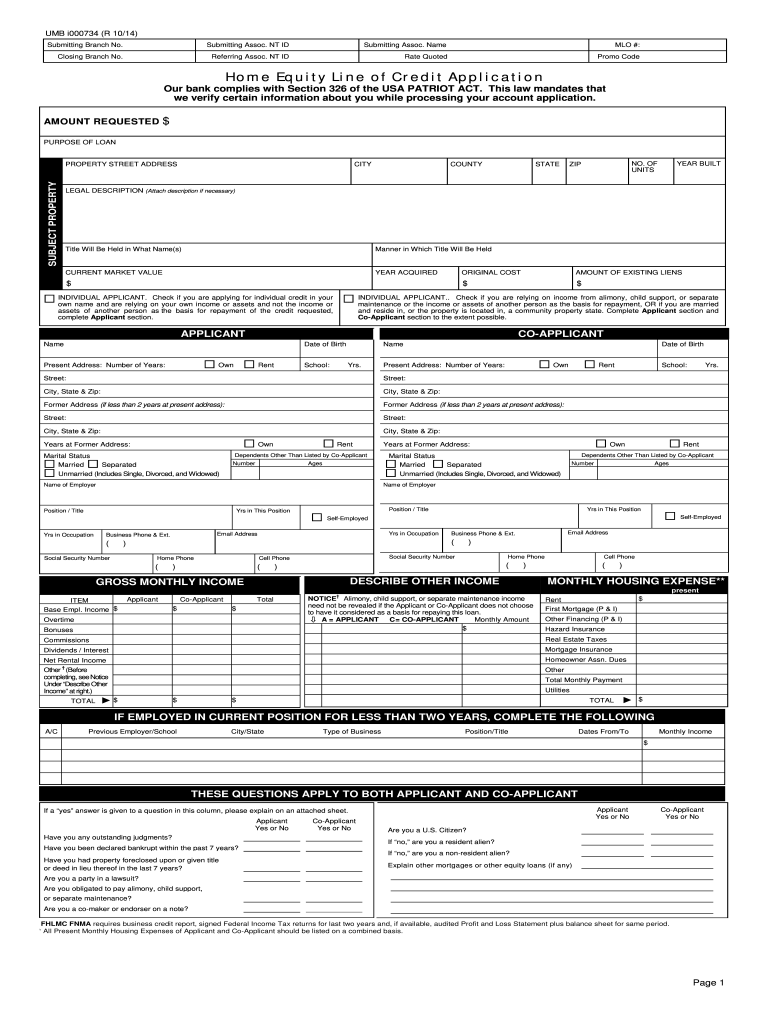

Secure Form Home Equity Loan Application CU*Answers Store

Web home equity loans are a useful way to tap into the equity of your home to obtain funds when your assets are tied up in your property. Please sign the attached credit authorization form and include with the application. However, a lender may approve you for a loan with a lower score if certain requirements are met. Web a.

Talk To A Horizon Bank Loan Advisor About Finding The Right Loan Plan For Your Financial Needs!

Browse the online library of over 85,000 legal forms and find the ones that match your unique needs. However, a lender may approve you for a loan with a lower score if certain requirements are met. If you need to improve your credit score before applying for a loan, there are some things you can do. To increase your equity, you need to either boost the.

Web For Home Equity Line Of Credit Applications:

Typically, you can borrow up to a specified percentage of your equity. Web catch the top stories of the day on anc’s ‘top story’ (28 july 2023) To qualify for a home equity loan from discover, most applicants must be able to demonstrate: They’re generally offered at lower interest rates than other forms of consumer loans because they are secured by your home, just like your primary mortgage.

Web The Average National Rate On A Home Equity Loan Is 8.47% As Of July 25, According To Bankrate.

For purposes of this section, an annual percentage rate is the annual percentage rate corresponding to the periodic rate as determined under § 1026.14 (b). A credit score of 620 or better, and a responsible credit history; Home equity loans have a fixed interest rate. Please note, there is no application fee.

With Both, The Rate You Can Secure Will.

Web a home equity agreement (hea), sometimes called home equity sharing, home equity sharing agreement or home equity investment, is an arrangement between a homeowner and an investment company that allows the homeowner to access the some of the value of their home. 1 that rate will usually be lower than the borrower could get on other. It’s one of a few options homeowners can use to access some of the equity they’ve built in their homes without selling. A home equity line of credit (heloc) typically allows you to draw against an approved limit and comes with variable interest rates.