Instructions For Form 8812

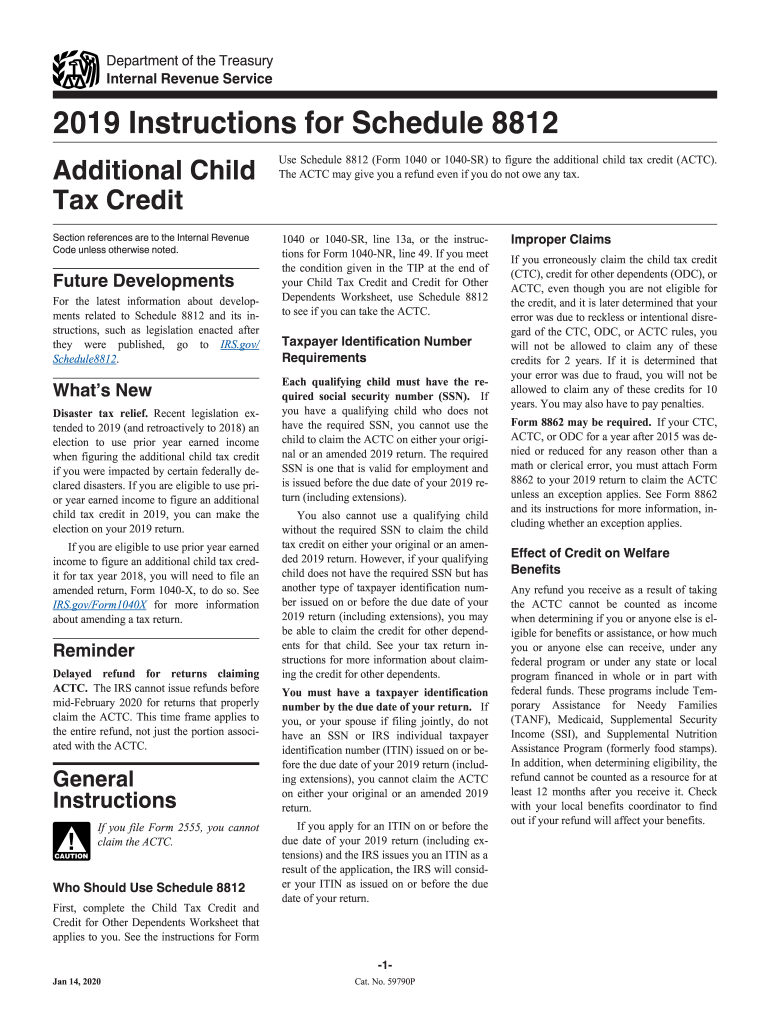

Instructions For Form 8812 - Get ready for tax season deadlines by completing any required tax forms today. Sign it in a few clicks. From july 2021 to december 2021, taxpayers may have received an advance payment of the child tax credit equal to 50%. Web future developments for the latest information about developments related to schedule 8812 and its instructions, such as legislation enacted after they were published, go to. How to claim the additional child tax credit? Web if you filed federal form 2555, stop here; Web handy tips for filling out 8812 instructions tax form online. Insert graphics, crosses, check and text boxes, if you want. Web for instructions and the latest information. Printing and scanning is no longer the best way to manage documents.

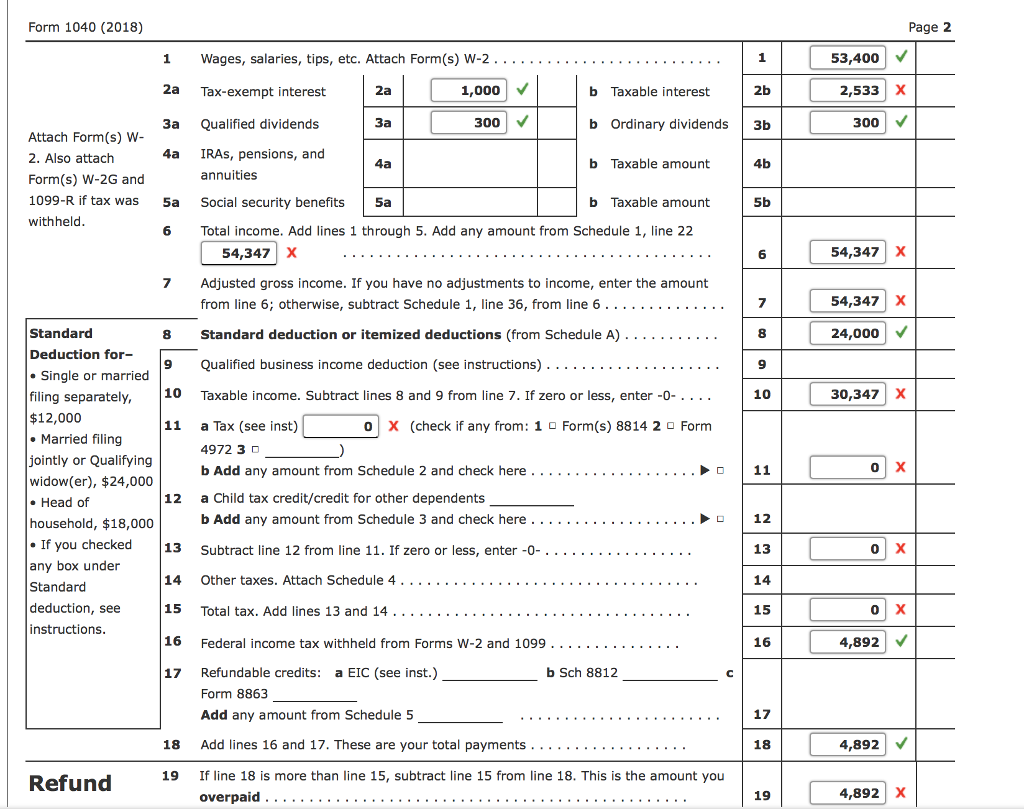

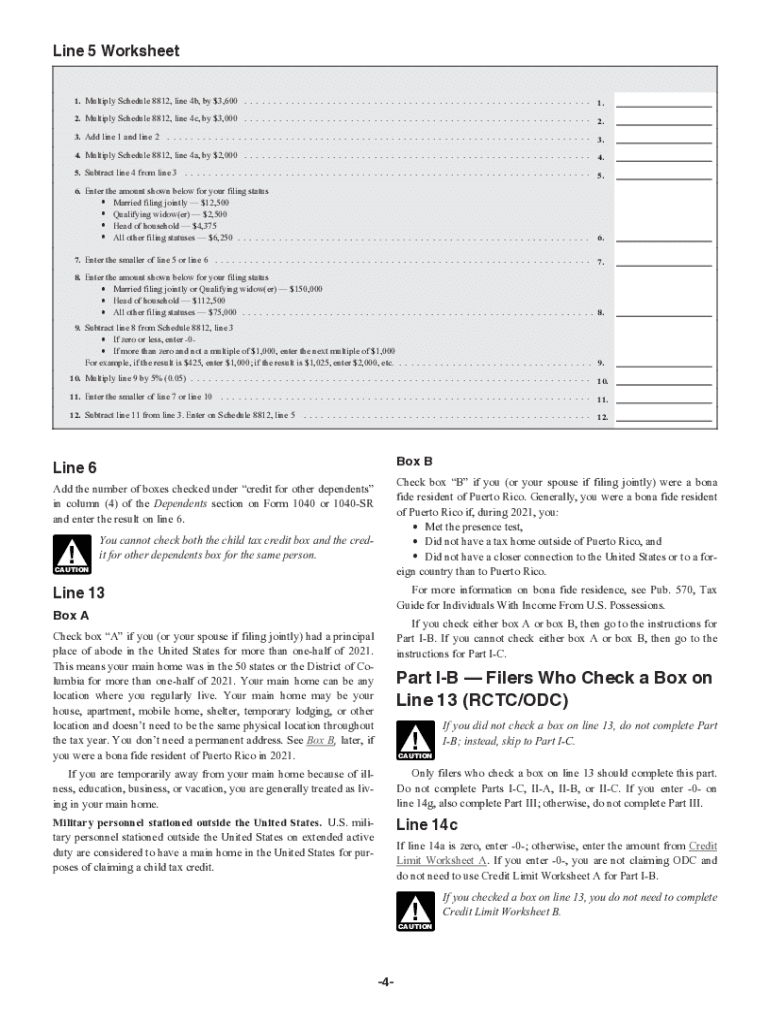

Schedule 8812 is automatically generated in. Filing for schedule 8812 (form 1040) is relatively easy, and you do not need to complete a separate application to receive the credit. Web handy tips for filling out 8812 instructions tax form online. Sign it in a few clicks. Web irs instructions for form 8812. You will need your completed 2022 federal schedule. Child tax credit and credit for other dependents. Web the refundable additional child tax credit is calculated on schedule 8812 and is reported in the tax credits section of form 1040. Web up to 10% cash back schedule 8812 and its instructions calculate the credit for taxpayers in several different situations. Go digital and save time with signnow, the.

Edit your 8812 instructions child tax credit online. How to claim the additional child tax credit? Child tax credit and credit for other dependents. Web how to file form 8812 you will first need to complete the form using the schedule 8812 instructions and then enter the results on your form 1040. Sign it in a few clicks. Filing for schedule 8812 (form 1040) is relatively easy, and you do not need to complete a separate application to receive the credit. Get ready for tax season deadlines by completing any required tax forms today. Web the refundable additional child tax credit is calculated on schedule 8812 and is reported in the tax credits section of form 1040. Do not complete worksheet c. Web fill in the information required in irs 1040 schedule 8812 instructions, making use of fillable fields.

schedule 8812 instructions Fill Online, Printable, Fillable Blank

Child tax credit and credit for other dependents. Web if you meet the condition given in the tip at the end of your child tax credit and credit for other dependents worksheet, use schedule 8812 to see if you can take the actc. Sign it in a few clicks. Web how to file form 8812 you will first need to.

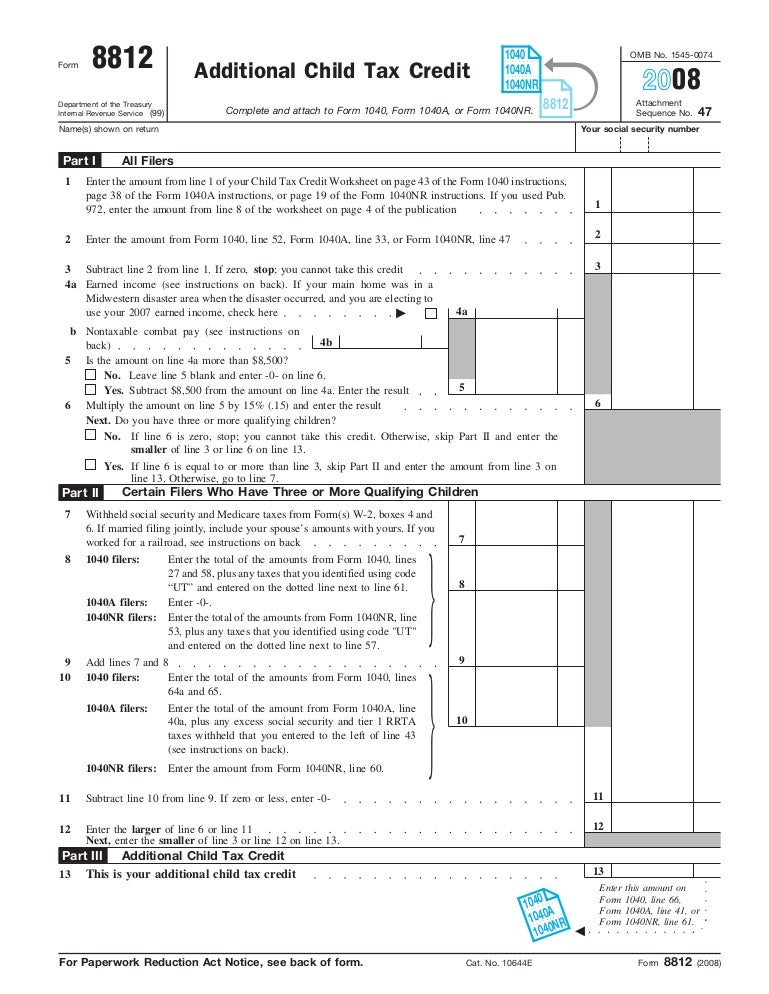

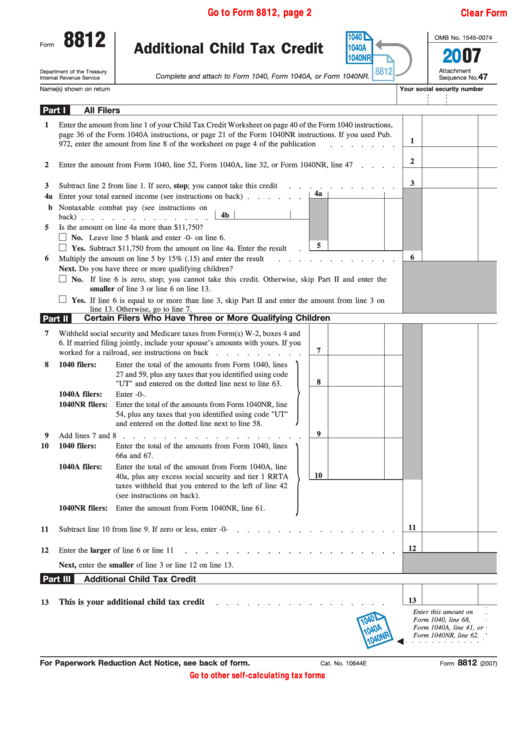

Fillable Form 8812 Additional Child Tax Credit printable pdf download

Printing and scanning is no longer the best way to manage documents. Type text, add images, blackout confidential details, add comments, highlights and more. Web fill in the information required in irs 1040 schedule 8812 instructions, making use of fillable fields. Web if you meet the condition given in the tip at the end of your child tax credit and.

ISO 88121999 Earthmoving machinery Backhoe loaders

Web for instructions and the latest information. Web if you filed federal form 2555, stop here; Type text, add images, blackout confidential details, add comments, highlights and more. Complete, edit or print tax forms instantly. Web form 1040 instructions schedule 8812 instructions the american rescue plan act increased the amount per qualifying child, and is fully refundable for tax year.

Form 8812 Credit Limit Worksheet A

Filing for schedule 8812 (form 1040) is relatively easy, and you do not need to complete a separate application to receive the credit. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any. Web how to file schedule 8812. Complete, edit or print.

Instructions Comprehensive Problem 21 Beverly and

Do not complete worksheet c. Schedule 8812 is automatically generated in. Web up to 10% cash back schedule 8812 and its instructions calculate the credit for taxpayers in several different situations. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any. Web for.

Schedule 8812 Instructions Fill Out and Sign Printable PDF Template

Edit your 8812 instructions child tax credit online. Sign it in a few clicks. Child tax credit and credit for other dependents. Web the refundable additional child tax credit is calculated on schedule 8812 and is reported in the tax credits section of form 1040. Complete, edit or print tax forms instantly.

8812 Instructions Tax Form Fill Out and Sign Printable PDF Template

Complete, edit or print tax forms instantly. Go digital and save time with signnow, the. Web for instructions and the latest information. Filing for schedule 8812 (form 1040) is relatively easy, and you do not need to complete a separate application to receive the credit. Web how to file form 8812 you will first need to complete the form using.

Form 8812Additional Child Tax Credit

Web handy tips for filling out 8812 instructions tax form online. Insert graphics, crosses, check and text boxes, if you want. Web form 1040 instructions schedule 8812 instructions the american rescue plan act increased the amount per qualifying child, and is fully refundable for tax year 2021 only. Web how to file schedule 8812. Web if you filed federal form.

Top 8 Form 8812 Templates free to download in PDF format

Web the refundable additional child tax credit is calculated on schedule 8812 and is reported in the tax credits section of form 1040. Complete, edit or print tax forms instantly. How to claim the additional child tax credit? Get ready for tax season deadlines by completing any required tax forms today. Schedule 8812 credit calculations taxpayers who.

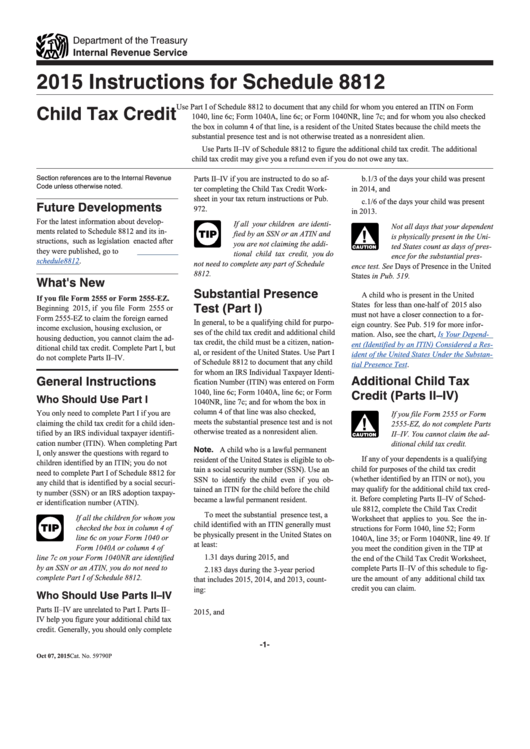

Instructions For Schedule 8812 Child Tax Credit 2015 printable pdf

Web if you filed federal form 2555, stop here; Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any. Web the refundable additional child tax credit is calculated on schedule 8812 and is reported in the tax credits section of form 1040. Go.

Web If You Meet The Condition Given In The Tip At The End Of Your Child Tax Credit And Credit For Other Dependents Worksheet, Use Schedule 8812 To See If You Can Take The Actc.

Web if you filed federal form 2555, stop here; Web how to file form 8812 you will first need to complete the form using the schedule 8812 instructions and then enter the results on your form 1040. Web up to 10% cash back schedule 8812 and its instructions calculate the credit for taxpayers in several different situations. Get ready for tax season deadlines by completing any required tax forms today.

Type Text, Add Images, Blackout Confidential Details, Add Comments, Highlights And More.

Web fill in the information required in irs 1040 schedule 8812 instructions, making use of fillable fields. Schedule 8812 credit calculations taxpayers who. Do not complete worksheet c. Web form 1040 instructions schedule 8812 instructions the american rescue plan act increased the amount per qualifying child, and is fully refundable for tax year 2021 only.

From July 2021 To December 2021, Taxpayers May Have Received An Advance Payment Of The Child Tax Credit Equal To 50%.

How to claim the additional child tax credit? Web for instructions and the latest information. Web how to file schedule 8812. Web the refundable additional child tax credit is calculated on schedule 8812 and is reported in the tax credits section of form 1040.

Web Handy Tips For Filling Out 8812 Instructions Tax Form Online.

Schedule 8812 is automatically generated in. Insert graphics, crosses, check and text boxes, if you want. Web future developments for the latest information about developments related to schedule 8812 and its instructions, such as legislation enacted after they were published, go to. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any.