Payroll Deduction Form

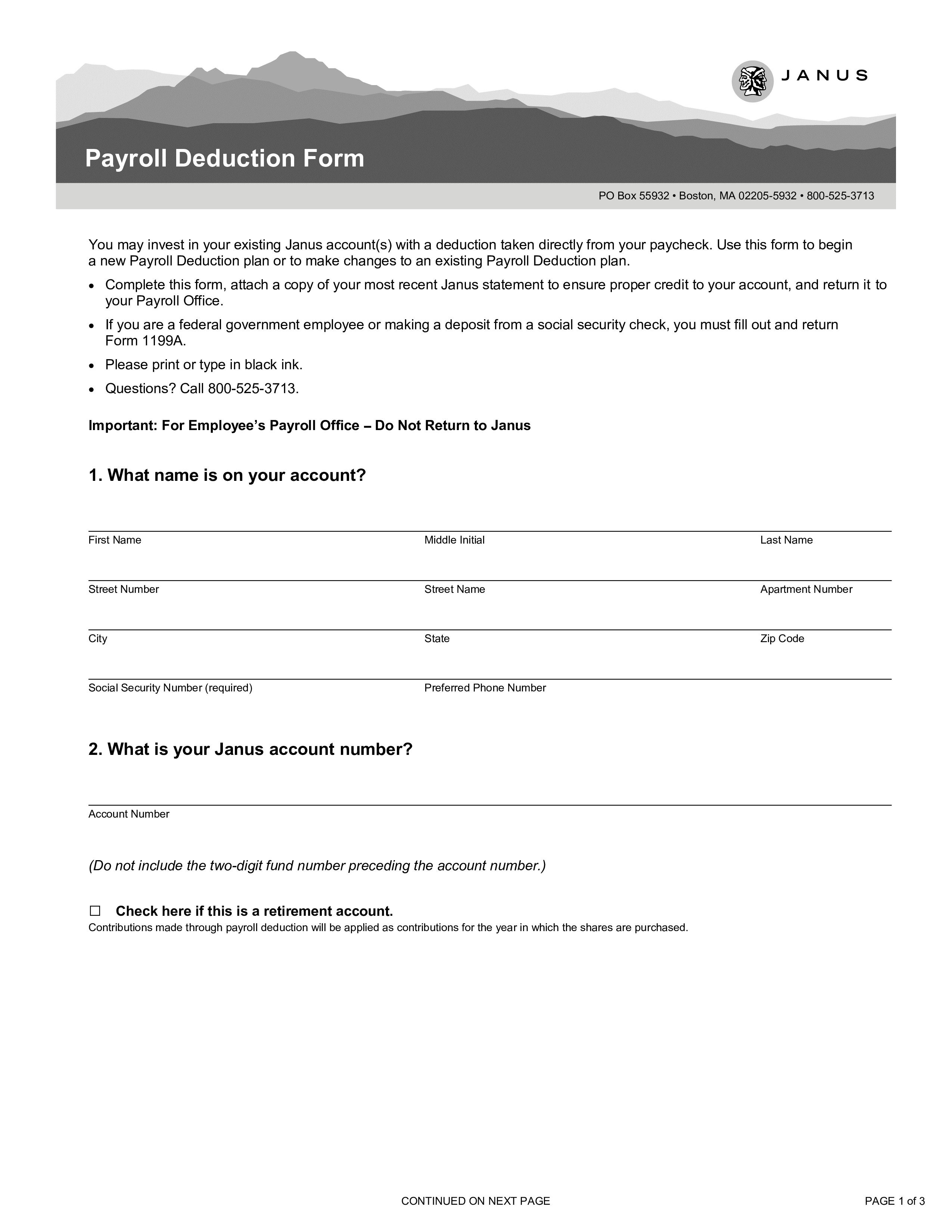

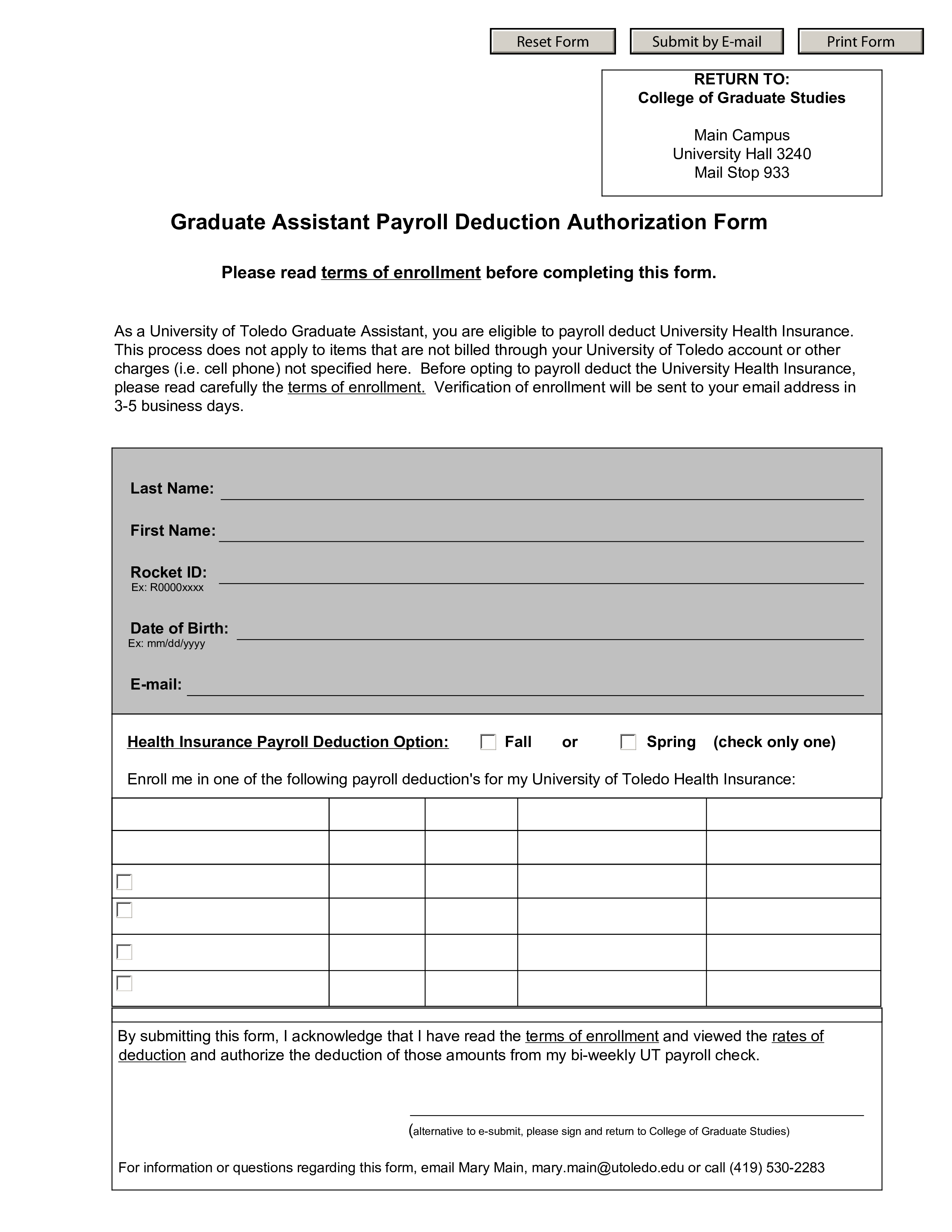

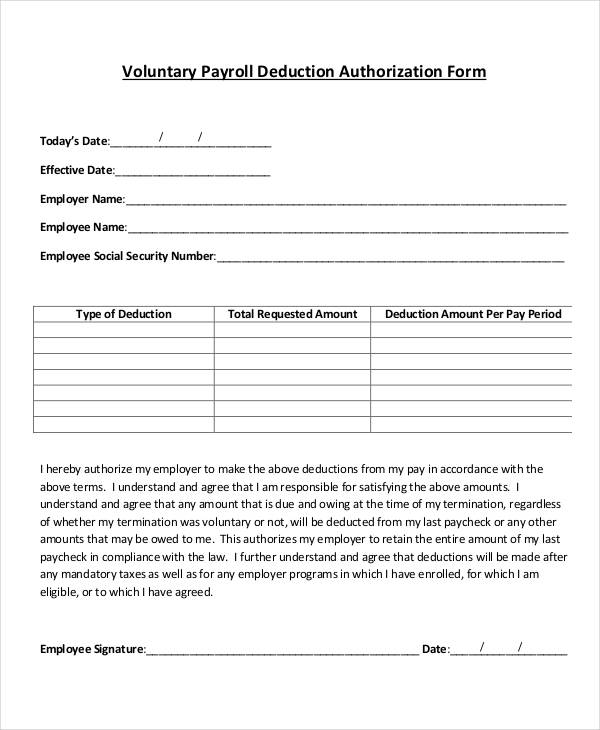

Payroll Deduction Form - It is useful for employees to keep track of what their paycheque is being reduced by. To make the above deductions from my paycheck. Web payroll deduction authorization employee name date / / department employee number pay frequency weekly biweekly semimonthly monthly effective date / /. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Best tool to create, edit & share pdfs. I hereby authorize the above deductions. Ad vast library of fillable legal documents. This is used to calculate the amounts to withhold from their employment income or other income, such as pension income. Type of deduction total requested amount deduction amount per pay period. Web a good free payroll software offers features to process payroll legally, namely the ability to create pay stubs, calculate key deductions, such as state and federal tax withholding, print tax.

Best tool to create, edit & share pdfs. Employee signature date / / title: Type of deduction total requested amount deduction amount per pay period. Web a good free payroll software offers features to process payroll legally, namely the ability to create pay stubs, calculate key deductions, such as state and federal tax withholding, print tax. Web payroll deduction authorization employee name date / / department employee number pay frequency weekly biweekly semimonthly monthly effective date / /. Web get the completed td1 forms. _____ type of deduction total amount requested deduction amount per pay period employee advances 401(k) loan other _____ other _____ other _____ i hereby authorize kymberly group payroll solutions, inc. To make the above deductions from my paycheck. Ad vast library of fillable legal documents. Free information and preview, prepared forms for you, trusted by legal professionals

Employee signature date / / title: Best tool to create, edit & share pdfs. Thanks to this form, you can easily control the process and make the progress boosted! Ad get access to the largest online library of legal forms for any state. I hereby authorize the university of delaware to deduct the amount indicated below from. Type of deduction total requested amount deduction amount per pay period. Web please deduct the amount your employee agreed to have deducted from each wage or salary payment due the employee. _____ type of deduction total amount requested deduction amount per pay period employee advances 401(k) loan other _____ other _____ other _____ i hereby authorize kymberly group payroll solutions, inc. Web payroll deduction authorization employee name date / / department employee number pay frequency weekly biweekly semimonthly monthly effective date / /. I hereby authorize the above deductions.

FREE 42+ Sample Payroll Forms in PDF Excel MS Word

_____ type of deduction total amount requested deduction amount per pay period employee advances 401(k) loan other _____ other _____ other _____ i hereby authorize kymberly group payroll solutions, inc. Free information and preview, prepared forms for you, trusted by legal professionals Thanks to this form, you can easily control the process and make the progress boosted! Ad vast library.

Payroll Deduction Form Templates at

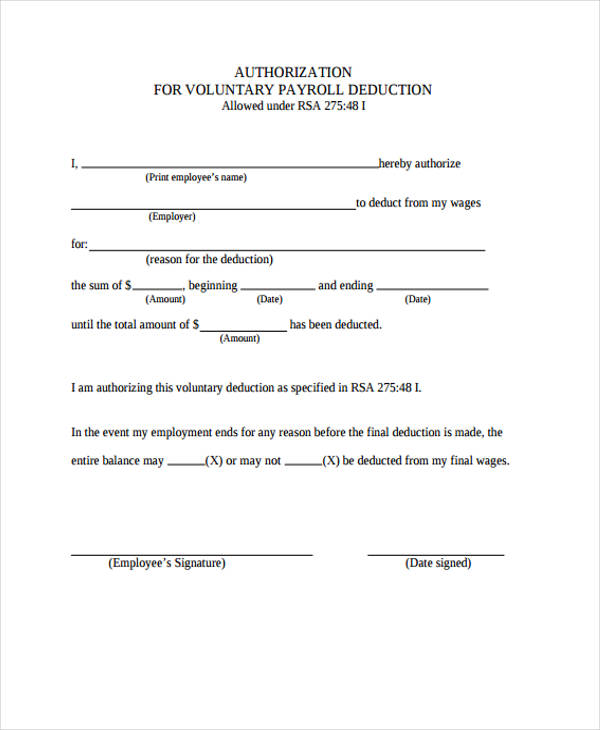

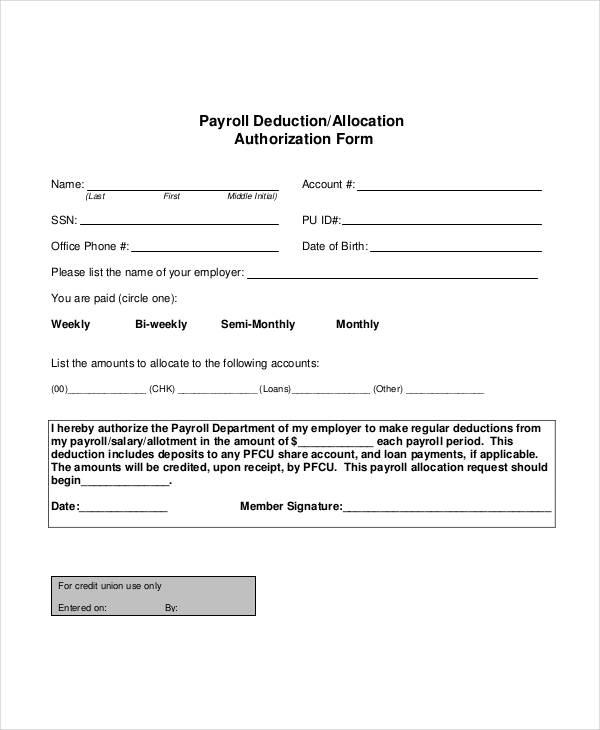

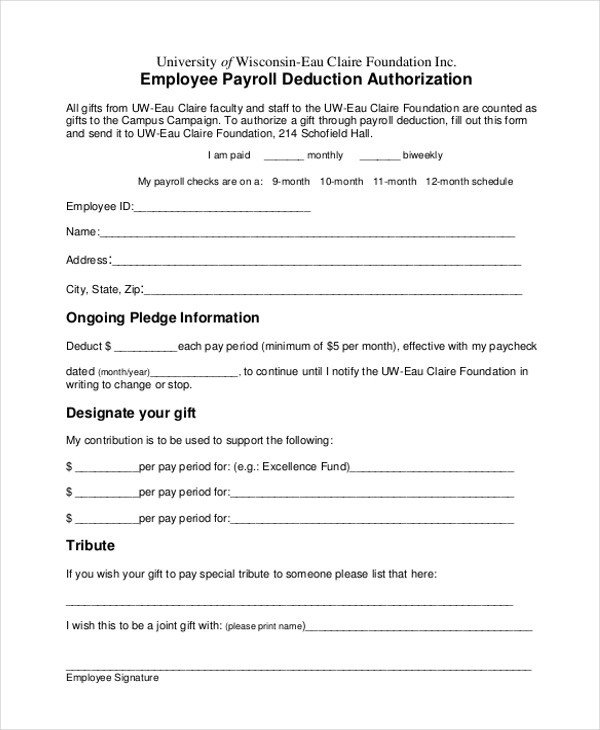

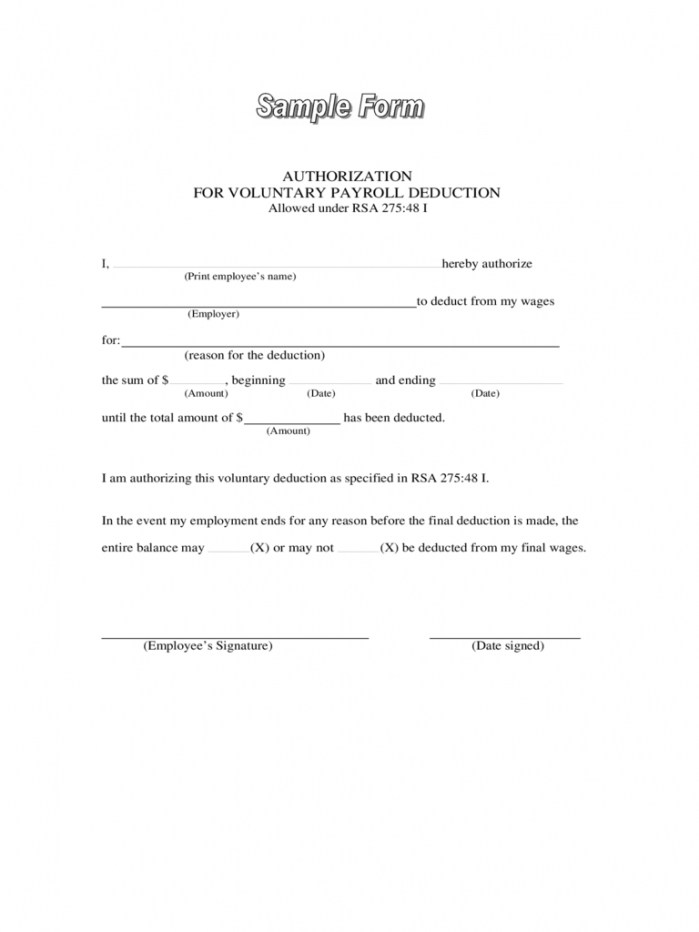

A payroll deduction form is a document that contains a list of items that are to be deducted from a paycheque. I hereby authorize the university of delaware to deduct the amount indicated below from. Free information and preview, prepared forms for you, trusted by legal professionals Web voluntary payroll deduction authorization form today’s date:_____ effective date:_____ employer name. Make.

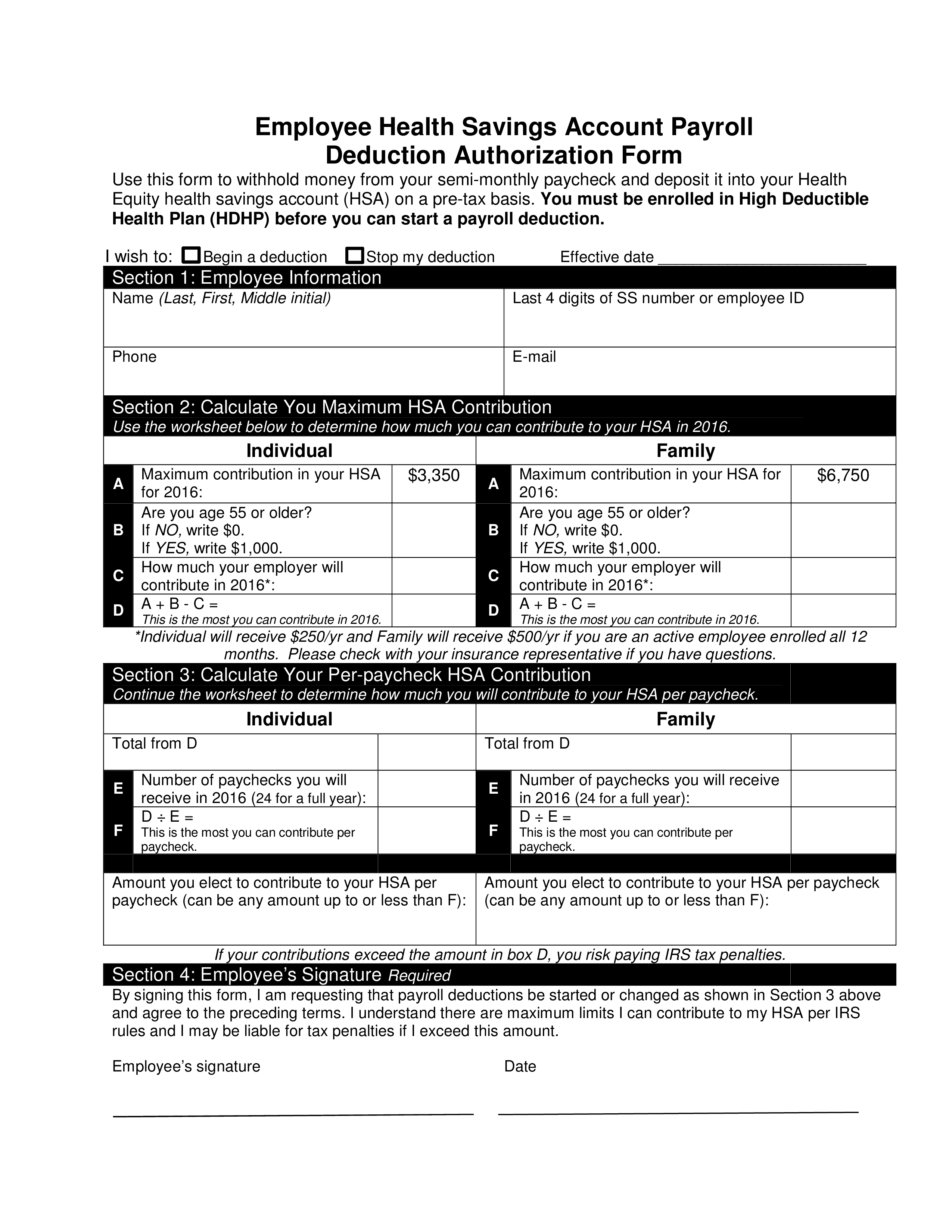

Employee Health Payroll Deduction Form Templates at

It is useful for employees to keep track of what their paycheque is being reduced by. Ad vast library of fillable legal documents. I hereby authorize the above deductions. Thanks to this form, you can easily control the process and make the progress boosted! Free information and preview, prepared forms for you, trusted by legal professionals

Payroll Deduction Form Template For Your Needs

A payroll deduction form is a document that contains a list of items that are to be deducted from a paycheque. Web get the completed td1 forms. Type of deduction total requested amount deduction amount per pay period. Ad vast library of fillable legal documents. I hereby authorize the university of delaware to deduct the amount indicated below from.

Payroll Deduction Form

Web payroll deduction authorization employee name date / / department employee number pay frequency weekly biweekly semimonthly monthly effective date / /. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. I hereby authorize the above deductions. Free information and preview, prepared forms for you, trusted by.

Payroll Deduction Form Template Business

Web a good free payroll software offers features to process payroll legally, namely the ability to create pay stubs, calculate key deductions, such as state and federal tax withholding, print tax. I hereby authorize the university of delaware to deduct the amount indicated below from. I hereby authorize the above deductions. Thanks to this form, you can easily control the.

Payroll Deduction Form Template 14+ Sample, Example, Format

Free information and preview, prepared forms for you, trusted by legal professionals A payroll deduction form is a document that contains a list of items that are to be deducted from a paycheque. Ad vast library of fillable legal documents. Web get the completed td1 forms. Web a good free payroll software offers features to process payroll legally, namely the.

Payroll Deduction Form Template 14+ Sample, Example, Format

Free information and preview, prepared forms for you, trusted by legal professionals I hereby authorize the university of delaware to deduct the amount indicated below from. Web get the completed td1 forms. Ad get access to the largest online library of legal forms for any state. A payroll deduction form is a document that contains a list of items that.

FREE 14+ Sample Payrolle Deduction Forms in PDF Excel Word

Web payroll deduction authorization employee name date / / department employee number pay frequency weekly biweekly semimonthly monthly effective date / /. This is used to calculate the amounts to withhold from their employment income or other income, such as pension income. Thanks to this form, you can easily control the process and make the progress boosted! Web voluntary payroll.

Payroll Deduction Form 2 Free Templates In Pdf Word Employee Payroll

Form td1, personal tax credits return, must be filled out when individuals start a new job or they want to increase income tax deductions. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Ad vast library of fillable legal documents. Web effective date of deduction: Web get.

Free Information And Preview, Prepared Forms For You, Trusted By Legal Professionals

This is used to calculate the amounts to withhold from their employment income or other income, such as pension income. Best tool to create, edit & share pdfs. Web get the completed td1 forms. Ad get access to the largest online library of legal forms for any state.

A Payroll Deduction Form Is A Document That Contains A List Of Items That Are To Be Deducted From A Paycheque.

Type of deduction total requested amount deduction amount per pay period. Ad vast library of fillable legal documents. Web please deduct the amount your employee agreed to have deducted from each wage or salary payment due the employee. Web voluntary payroll deduction authorization form today’s date:_____ effective date:_____ employer name.

Therefore, You May Need To Amend Your Income Tax Return (For Example, Forms 1040, 1065, 1120, Etc.) To Reflect That Reduced Deduction.

To make the above deductions from my paycheck. I hereby authorize the above deductions. Employee signature date / / title: _____ type of deduction total amount requested deduction amount per pay period employee advances 401(k) loan other _____ other _____ other _____ i hereby authorize kymberly group payroll solutions, inc.

Thanks To This Form, You Can Easily Control The Process And Make The Progress Boosted!

Web payroll deduction authorization employee name date / / department employee number pay frequency weekly biweekly semimonthly monthly effective date / /. Web a good free payroll software offers features to process payroll legally, namely the ability to create pay stubs, calculate key deductions, such as state and federal tax withholding, print tax. It is useful for employees to keep track of what their paycheque is being reduced by. I hereby authorize the university of delaware to deduct the amount indicated below from.