Payroll Enrollment Form

Payroll Enrollment Form - * required fields in run powered by adp® employee. Most dependable payroll solution for small businesses in 2023 by techradar editors. If this is your first time enrolling in eftps®, your information will need to be validated with the irs. Employees must attach a voided check for each of their accounts to help verify their account numbers and bank. 940, 941, 943, 944 and 945. Do not send this form to intuit. You must also complete these additional forms: It is secure and accurate. Once you have clicked on the submit button below, client hereby authorizes trucker. An employee enrollment form is used to gather data from new employees during the onboarding process.

Web 1 day agoyou can apply for save directly on the education department website. If this is your first time enrolling in eftps®, your information will need to be validated with the irs. Web to enroll in full service direct deposit, simply fill out this form and give to your payroll manager. * required fields in run powered by adp® employee. Your withholding is subject to review by the. Ad process payroll faster & easier with adp® payroll. You must also complete these additional forms: Let's talk adp® payroll, benefits, insurance, time, talent, hr, & more. Web a temporary employee payroll form is a document that gathers the information used to pay a temporary employee, such as their tax information and wages. Most dependable payroll solution for small businesses in 2023 by techradar editors.

Web to enroll, click on enrollment at the top of this page and follow the steps. Web a temporary employee payroll form is a document that gathers the information used to pay a temporary employee, such as their tax information and wages. Ein application [/one_four_first] [one_four] employee verification. Payroll so easy, you can set it up & run it yourself. Web company payroll enrollment form. You must also complete these additional forms: Get started with adp® payroll! Let's talk adp® payroll, benefits, insurance, time, talent, hr, & more. Quickbooks assisted payroll payroll services. Web later than 5 business days from submitting this enrollment form.

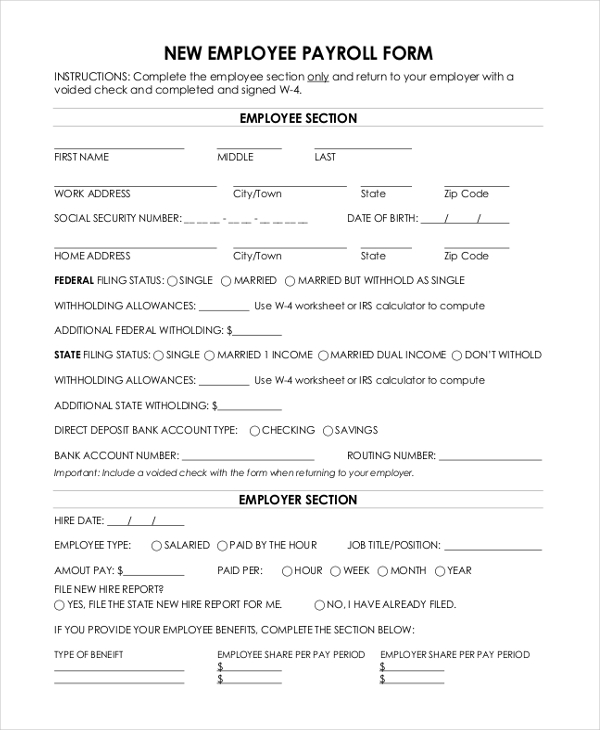

Employee Payroll New Employee Payroll Forms

Get started with adp® payroll! 940, 941, 943, 944 and 945. Payroll so easy, you can set it up & run it yourself. Let's talk adp® payroll, benefits, insurance, time, talent, hr, & more. Most dependable payroll solution for small businesses in 2023 by techradar editors.

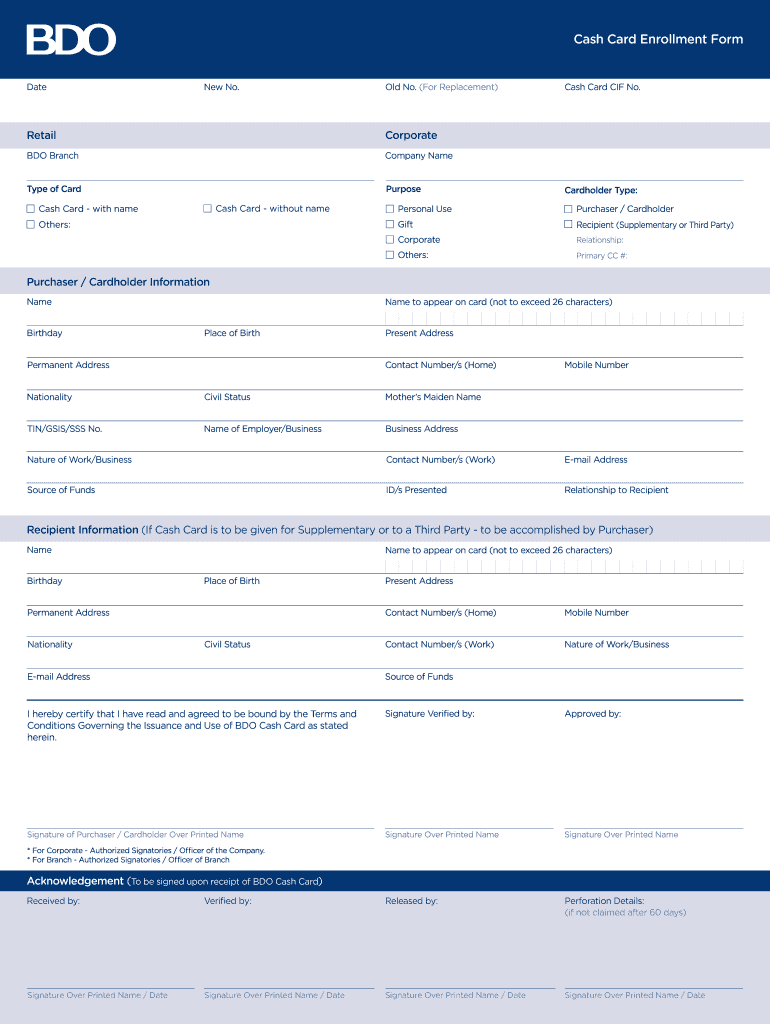

Bdo Cash Card Enrollment Form Pdf Fill and Sign Printable Template

Web 1 day agoyou can apply for save directly on the education department website. It is also used to update/revise or terminate classified, faculty, oa, and temporary. You must also complete these additional forms: Your withholding is subject to review by the. Ad process payroll faster & easier with adp® payroll.

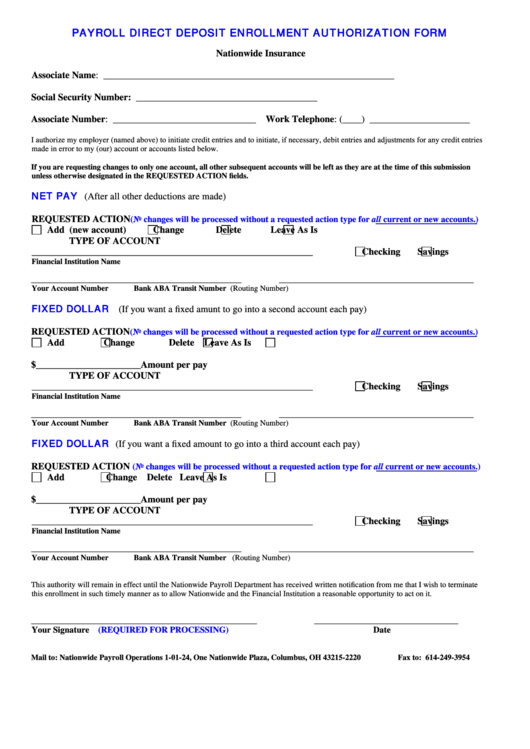

Payroll Direct Deposit Enrollment Authorization Form printable pdf download

Most dependable payroll solution for small businesses in 2023 by techradar editors. Payroll so easy, you can set it up & run it yourself. Employer identification number application for businesses. Quickbooks assisted payroll payroll services. Employees must attach a voided check for each of their accounts to help verify their account numbers and bank.

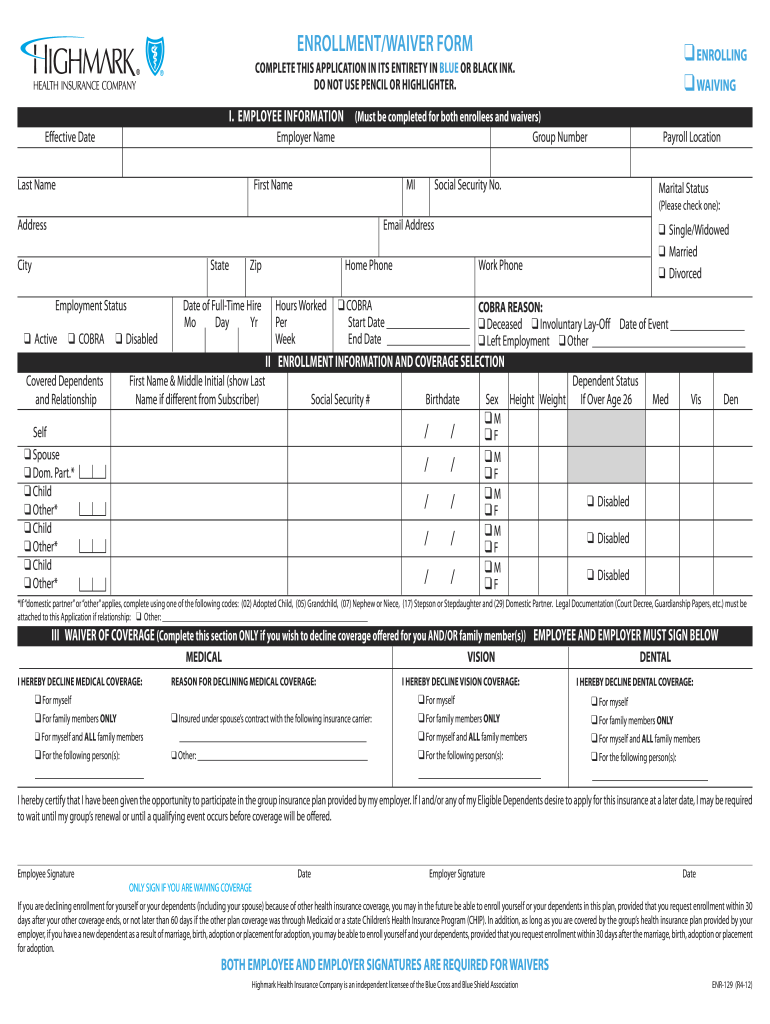

Highmark Enrollment Form Fill Online, Printable, Fillable, Blank

Web forms to obtain information from payees: It is secure and accurate. Web later than 5 business days from submitting this enrollment form. If this is your first time enrolling in eftps®, your information will need to be validated with the irs. You must also complete these additional forms:

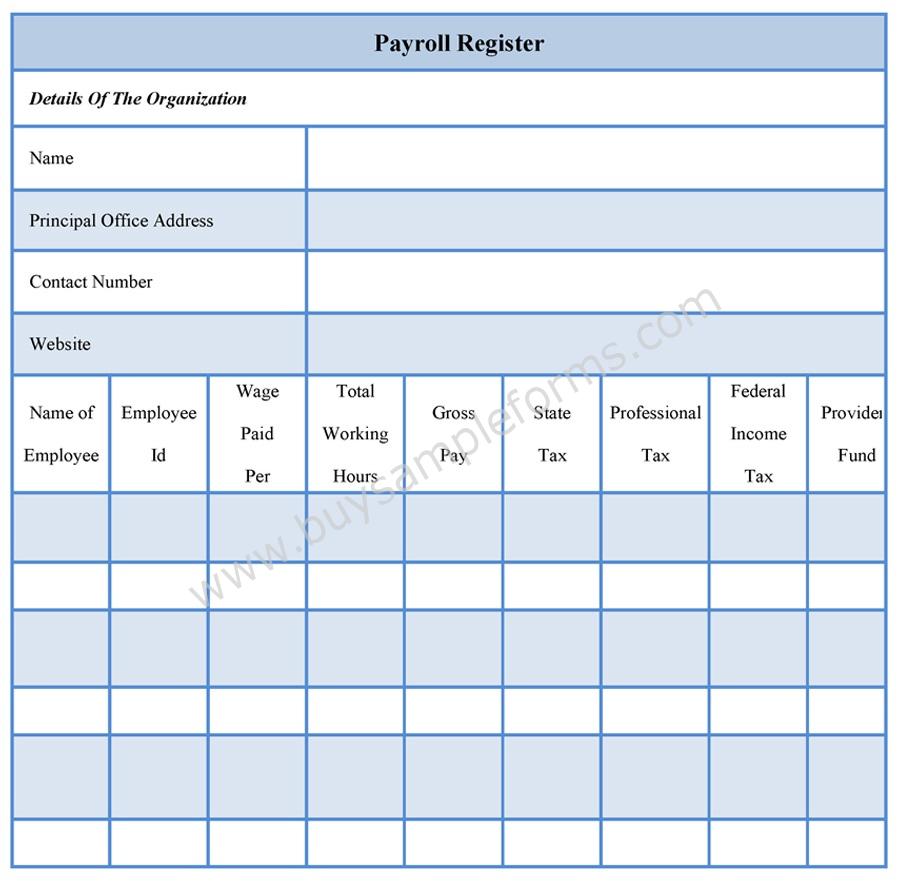

Payroll Register Forms Payroll Register Template

Web later than 5 business days from submitting this enrollment form. Agricultural employers (ui pub 210). Quickbooks assisted payroll payroll services. Web 1 day agoyou can apply for save directly on the education department website. Most dependable payroll solution for small businesses in 2023 by techradar editors.

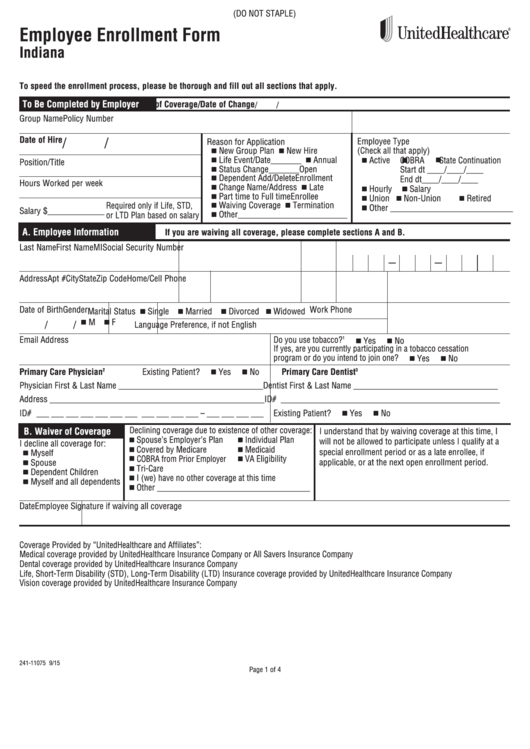

Fillable Employee Enrollment Form printable pdf download

It is secure and accurate. Web you must file this form with payroll when your employment begins. Web forms to obtain information from payees: Most dependable payroll solution for small businesses in 2023 by techradar editors. Once you have clicked on the submit button below, client hereby authorizes trucker.

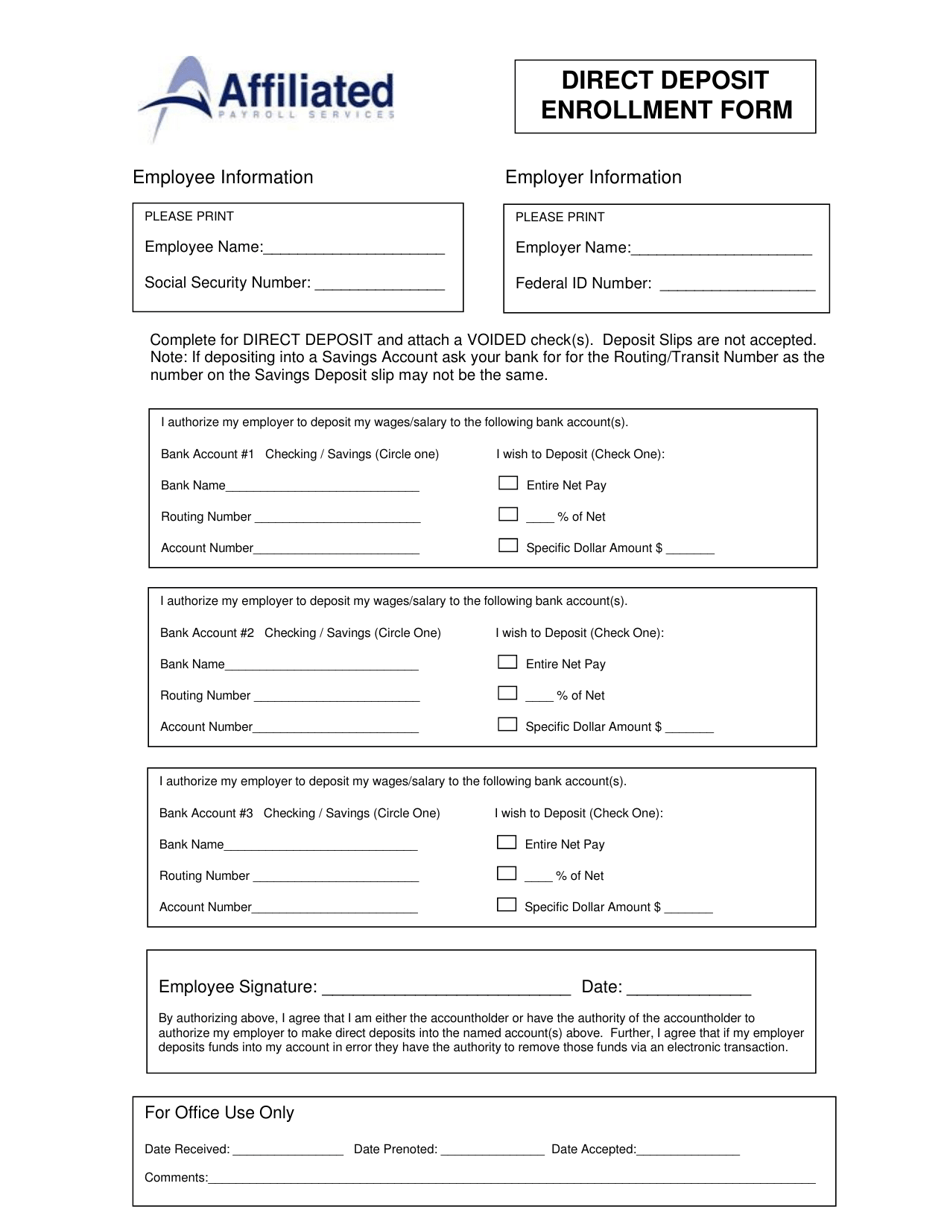

Direct Deposit Enrollment Form Affiliated Payroll Services Download

Employees must attach a voided check for each of their accounts to help verify their account numbers and bank. The form includes instructions for. Web you must file this form with payroll when your employment begins. Web 1 day agoyou can apply for save directly on the education department website. Web to enroll in full service direct deposit, simply fill.

PPT Enrollment Form PowerPoint Presentation, free download ID4538410

Ein application [/one_four_first] [one_four] employee verification. Web to enroll in full service direct deposit, simply fill out this form and give to your payroll manager. Once you have clicked on the submit button below, client hereby authorizes trucker. Web to enroll, click on enrollment at the top of this page and follow the steps. Get started with adp® payroll!

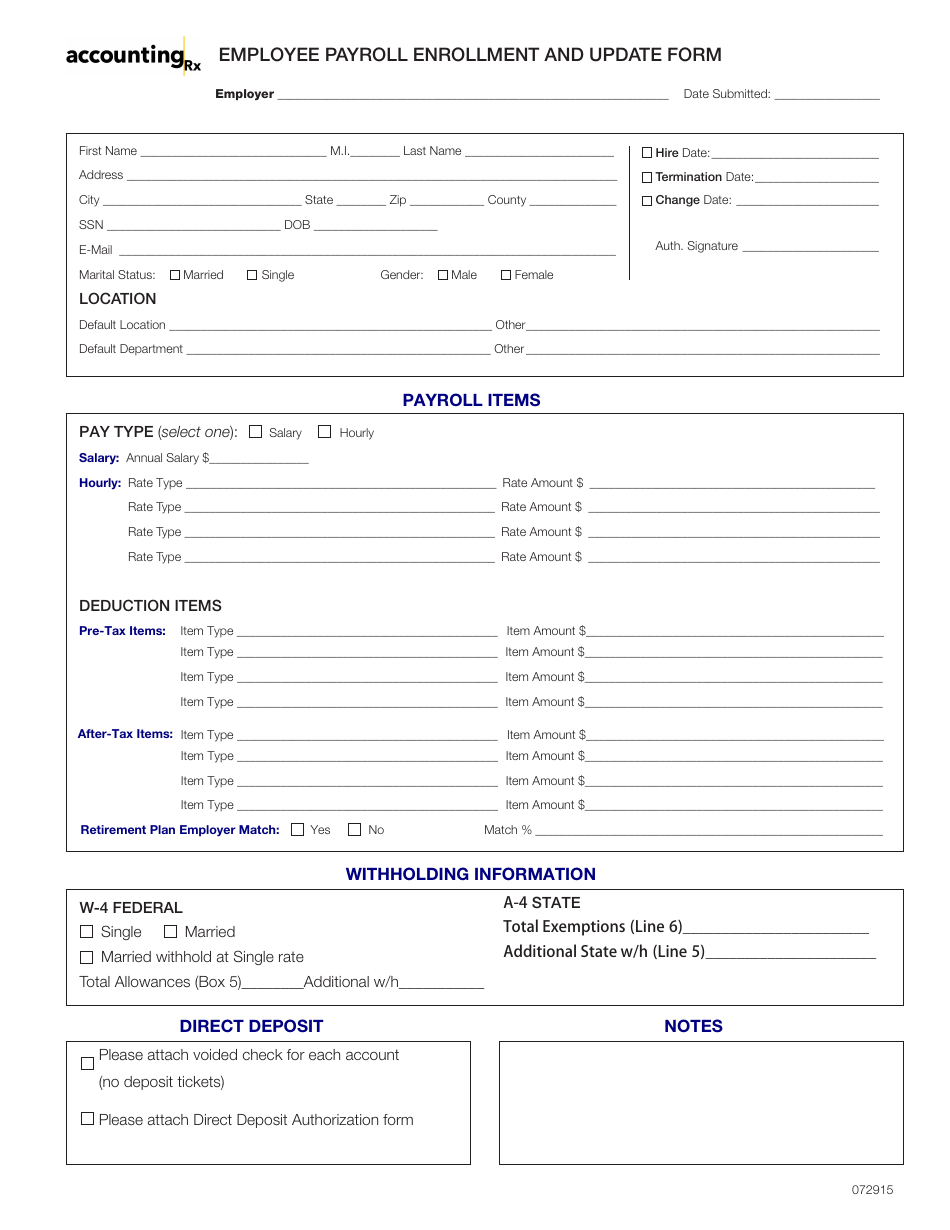

Employee Payroll Enrollment and Update Form Accounting Rx Download

940, 941, 943, 944 and 945. The form includes instructions for. Web later than 5 business days from submitting this enrollment form. Ad easy to run payroll, get set up & running in minutes! If this is your first time enrolling in eftps®, your information will need to be validated with the irs.

John Hancock 401k Hardship Withdrawal Form Form Resume Examples

It is secure and accurate. Employer identification number application for businesses. If this is your first time enrolling in eftps®, your information will need to be validated with the irs. The form includes instructions for. You must also complete these additional forms:

Ein Application [/One_Four_First] [One_Four] Employee Verification.

Web please fill out all required fields below. You must also complete these additional forms: Web a temporary employee payroll form is a document that gathers the information used to pay a temporary employee, such as their tax information and wages. Quickbooks assisted payroll payroll services.

Employer Identification Number Application For Businesses.

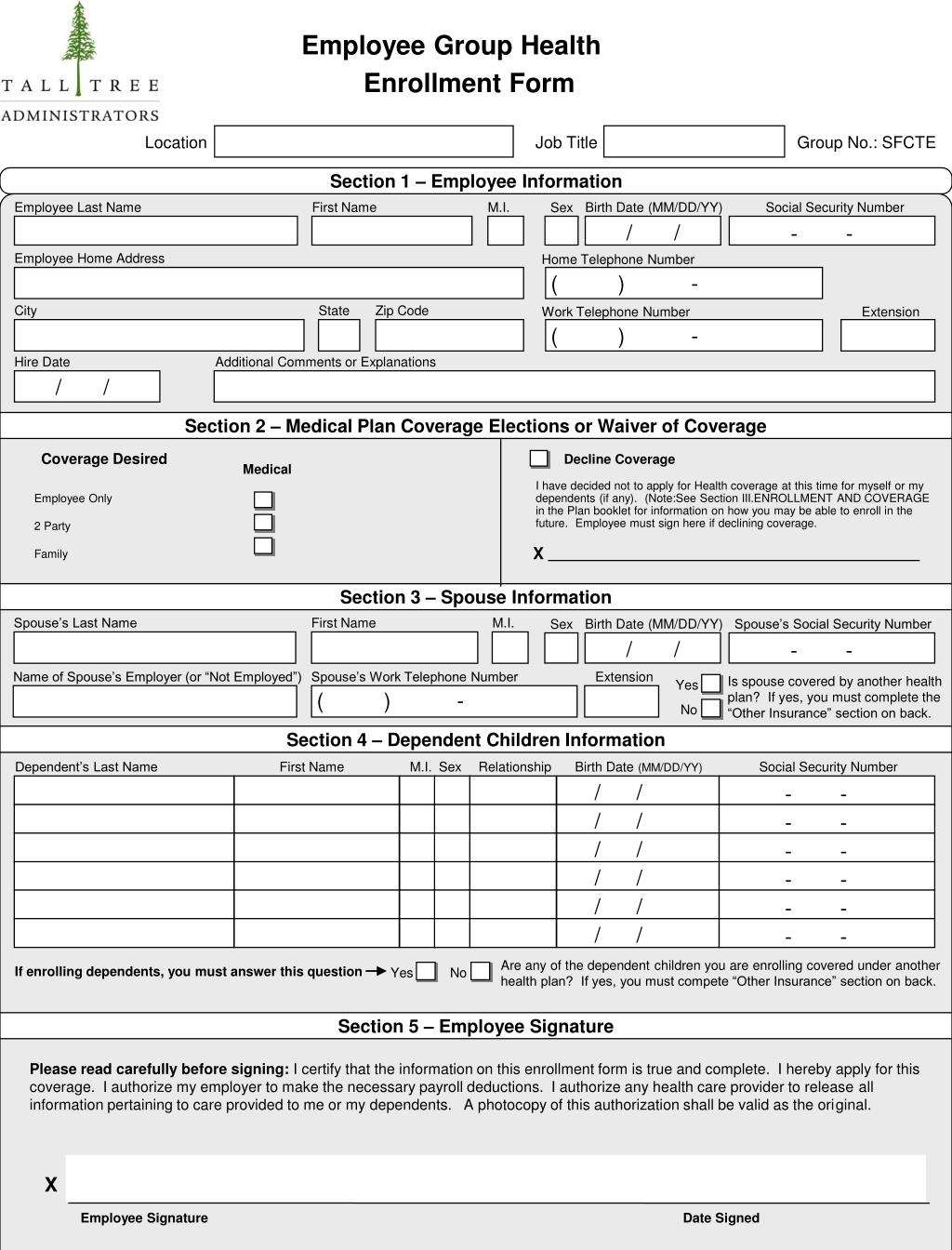

An employee enrollment form is used to gather data from new employees during the onboarding process. Web retained on file by the employer. The form includes instructions for. It is secure and accurate.

Web Company Payroll Enrollment Form.

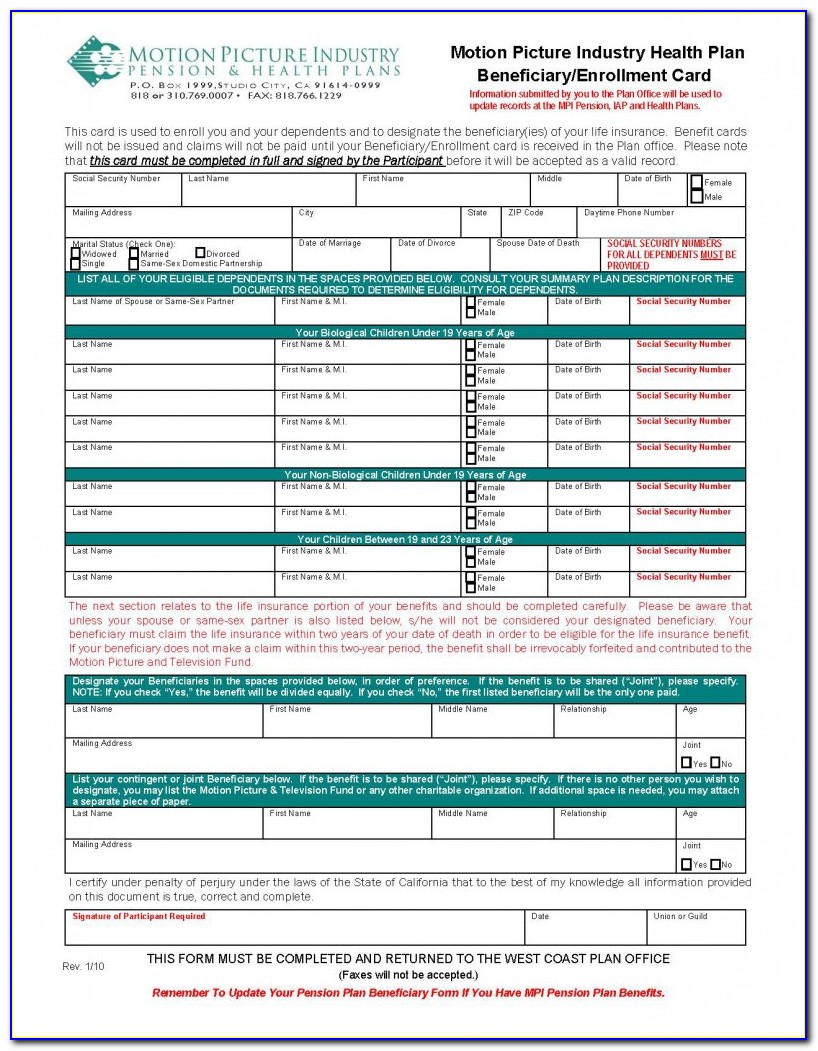

Hr/payroll offices will not begin benefits for these dependent(s) until all documentation has been given to. Most dependable payroll solution for small businesses in 2023 by techradar editors. Ad easy to run payroll, get set up & running in minutes! Agricultural employers (ui pub 210).

Web To Enroll In Full Service Direct Deposit, Simply Fill Out This Form And Give To Your Payroll Manager.

Ad process payroll faster & easier with adp® payroll. * required fields in run powered by adp® employee. Payroll so easy, you can set it up & run it yourself. If this is your first time enrolling in eftps®, your information will need to be validated with the irs.