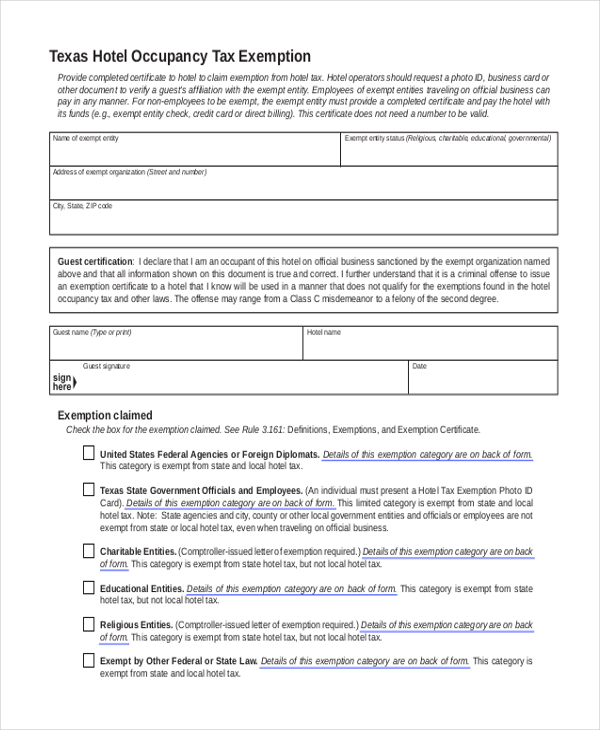

Tax Exempt Form Virginia

Tax Exempt Form Virginia - Are issued a certificate of exemption by virginia tax. To _____ date _____ name of supplier. When using the spouse tax adjustment, each spouse must claim his or her own personal exemption. Each filer is allowed one personal exemption. For married couples, each spouse is entitled to an exemption. Web apply for the exemption with virginia tax; Address _____ number and street or rural route city, town, or post office state zip code. You can find resale certificates for other states here. If any of these links are broken, or you can't find the form you need, please let us know. Web commonwealth of virginia sales and use tax certificate of exemption for use by a virginia dealer who purchases tangible personal property for resale, or for lease or rental, or who purchases materials or containers to package tangible personal property for sale this certificate of exemption

If any of these links are broken, or you can't find the form you need, please let us know. You must file this form with your employer when your employment begins. Web commonwealth of virginia sales and use tax certificate of exemption for use by a virginia dealer who purchases tangible personal property for resale, or for lease or rental, or who purchases materials or containers to package tangible personal property for sale this certificate of exemption Web we have five virginia sales tax exemption forms available for you to print or save as a pdf file. If you do not file this form, your employer must withhold virginia income tax as if you had no exemptions. When using the spouse tax adjustment, each spouse must claim his or her own personal exemption. Web exemptions you are allowed to claim. You can find resale certificates for other states here. Are issued a certificate of exemption by virginia tax. Purchases of prepared or catered meals and food are also covered by this exemption.

If you do not file this form, your employer must withhold virginia income tax as if you had no exemptions. You can find resale certificates for other states here. Purchases of prepared or catered meals and food are also covered by this exemption. Address _____ number and street or rural route city, town, or post office state zip code. If any of these links are broken, or you can't find the form you need, please let us know. Learn how to issue virginia resale certificates in. Web commonwealth of virginia sales and use tax certificate of exemption for use by a virginia dealer who purchases tangible personal property for resale, or for lease or rental, or who purchases materials or containers to package tangible personal property for sale this certificate of exemption Each filer is allowed one personal exemption. Are issued a certificate of exemption by virginia tax. For married couples, each spouse is entitled to an exemption.

FREE 8+ Sample Tax Exemption Forms in PDF MS Word

For married couples, each spouse is entitled to an exemption. Are issued a certificate of exemption by virginia tax. If you do not file this form, your employer must withhold virginia income tax as if you had no exemptions. Each filer is allowed one personal exemption. Web commonwealth of virginia sales and use tax certificate of exemption for use by.

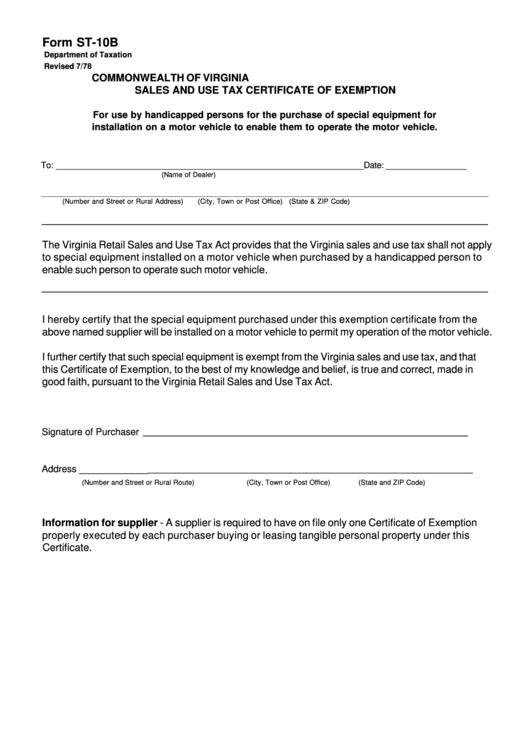

Form St10b Sales And Use Tax Certificate Of Exemption Commonwealth

Web a dealer is required to have on file only one certificate of exemption, properly executed by the governmental agency buying or leasing tax exempt tangible personal property under this certificate. Web commonwealth of virginia sales and use tax certificate of exemption for use by a virginia dealer who purchases tangible personal property for resale, or for lease or rental,.

Tax Exempt Form 2022 IRS Forms

Purchases of prepared or catered meals and food are also covered by this exemption. Learn how to issue virginia resale certificates in. You must file this form with your employer when your employment begins. Web we have five virginia sales tax exemption forms available for you to print or save as a pdf file. Each filer is allowed one personal.

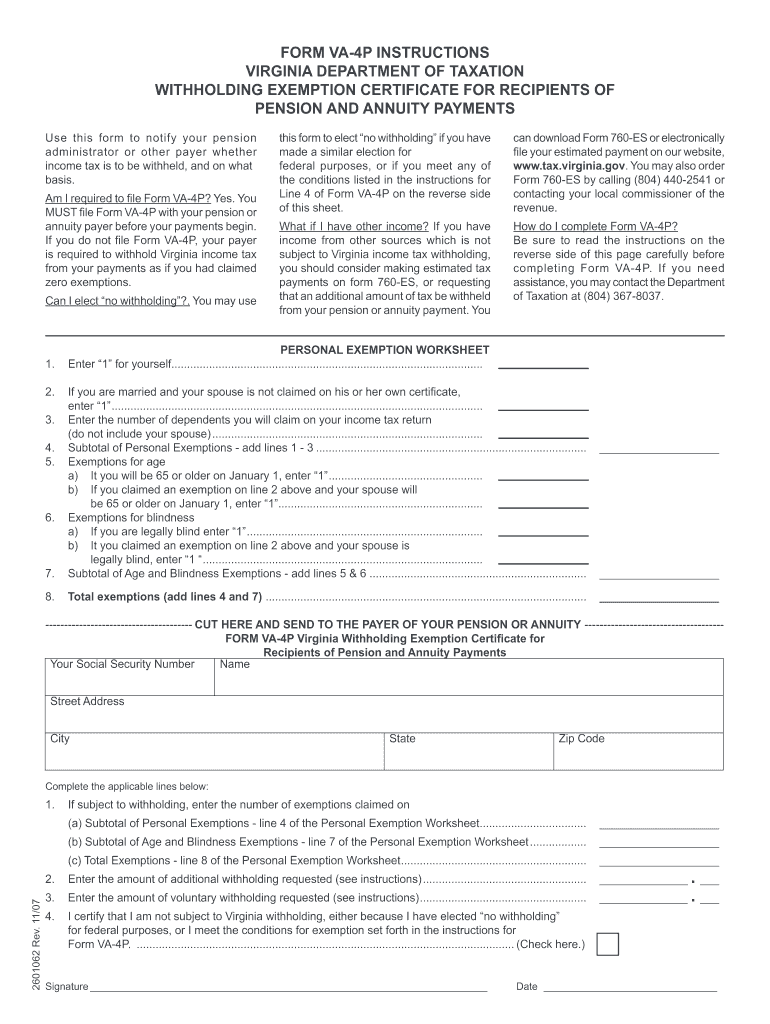

State Of Virginia Withholding Form Fill Out and Sign Printable PDF

If you do not file this form, your employer must withhold virginia income tax as if you had no exemptions. Address _____ number and street or rural route city, town, or post office state zip code. For married couples, each spouse is entitled to an exemption. Web virginia allows an exemption of $930* for each of the following: Purchases of.

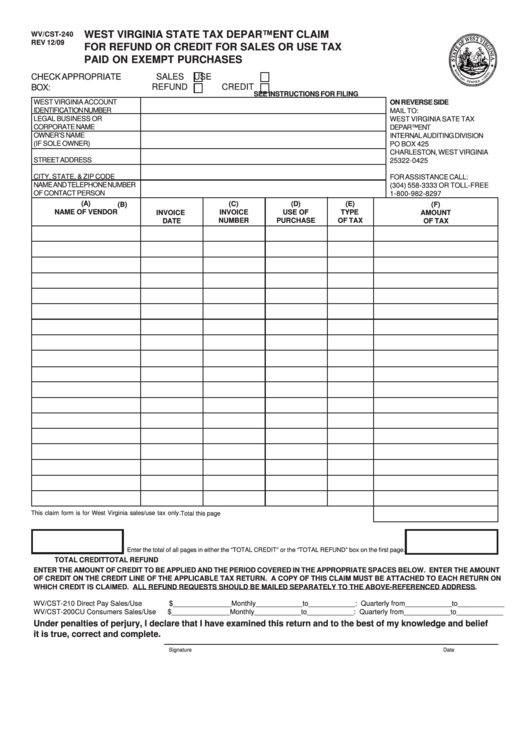

Form WvCst240 West Virginia State Tax Department Claim For Refund

If you do not file this form, your employer must withhold virginia income tax as if you had no exemptions. Web exemptions you are allowed to claim. Web a dealer is required to have on file only one certificate of exemption, properly executed by the governmental agency buying or leasing tax exempt tangible personal property under this certificate. When using.

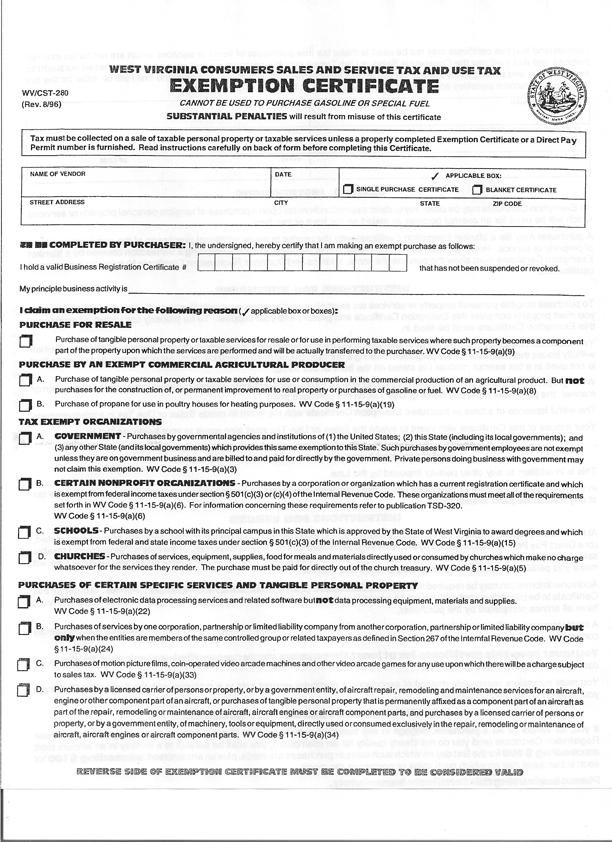

West Virginia Tax Exempt

You can find resale certificates for other states here. Web exemptions you are allowed to claim. To _____ date _____ name of supplier. Web a dealer is required to have on file only one certificate of exemption, properly executed by the governmental agency buying or leasing tax exempt tangible personal property under this certificate. Are issued a certificate of exemption.

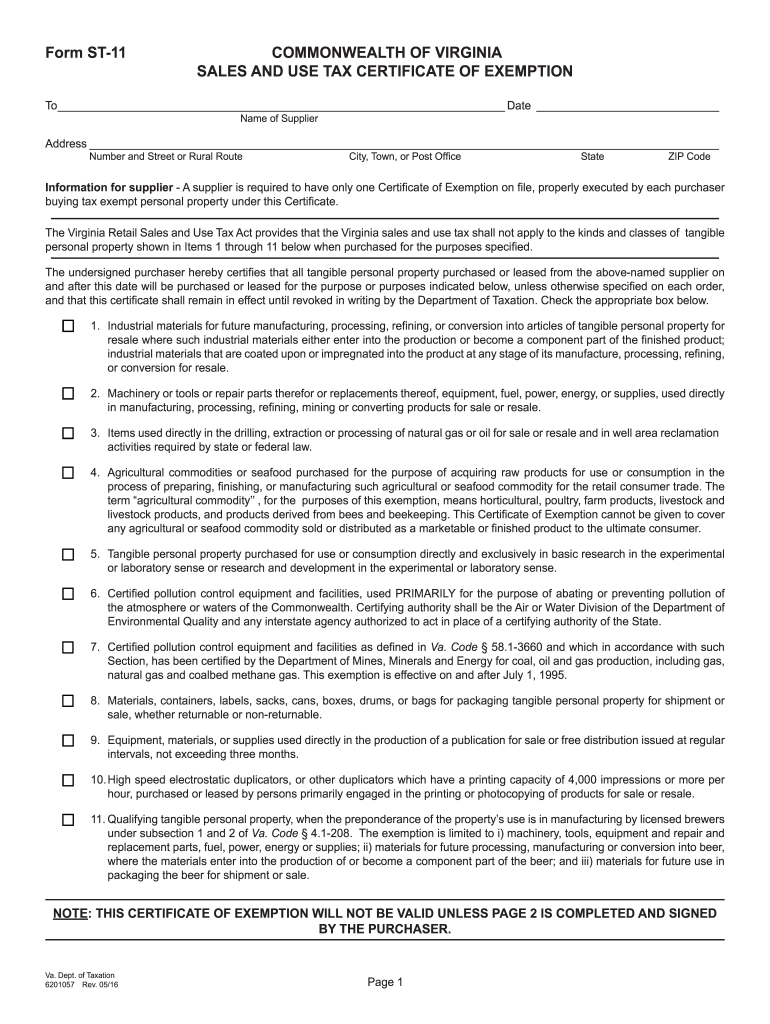

Virginia Sales Tax Exemption Form St 11 Fill Out and Sign Printable

Web a dealer is required to have on file only one certificate of exemption, properly executed by the governmental agency buying or leasing tax exempt tangible personal property under this certificate. Are issued a certificate of exemption by virginia tax. Web commonwealth of virginia sales and use tax certificate of exemption for use by a virginia dealer who purchases tangible.

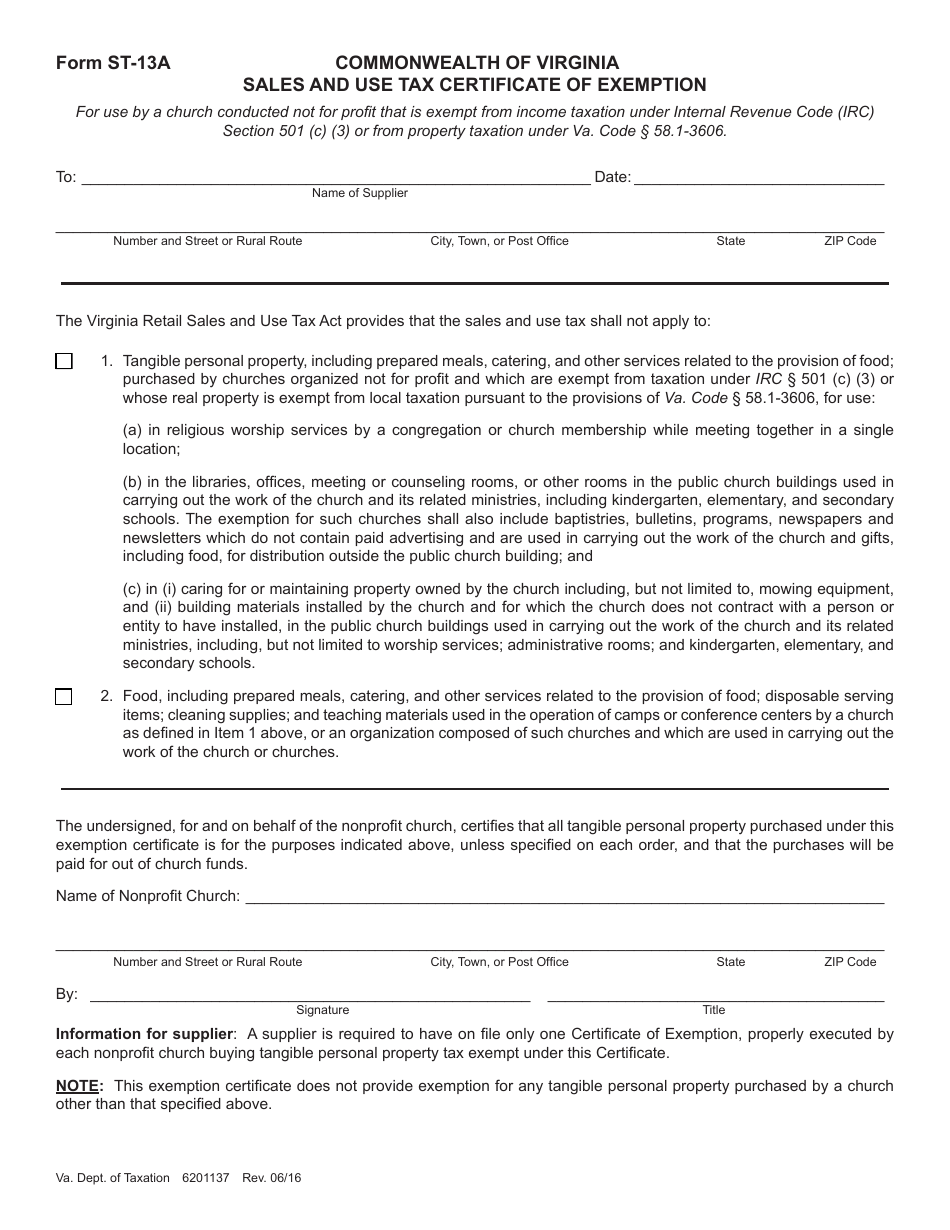

Form ST13A Download Fillable PDF or Fill Online Sales and Use Tax

Web virginia allows an exemption of $930* for each of the following: To _____ date _____ name of supplier. Purchases of prepared or catered meals and food are also covered by this exemption. Web exemptions you are allowed to claim. Address _____ number and street or rural route city, town, or post office state zip code.

2015 Form VA DoT ST11 Fill Online, Printable, Fillable, Blank pdfFiller

Web virginia allows an exemption of $930* for each of the following: Web we have five virginia sales tax exemption forms available for you to print or save as a pdf file. Each filer is allowed one personal exemption. Address _____ number and street or rural route city, town, or post office state zip code. Web commonwealth of virginia sales.

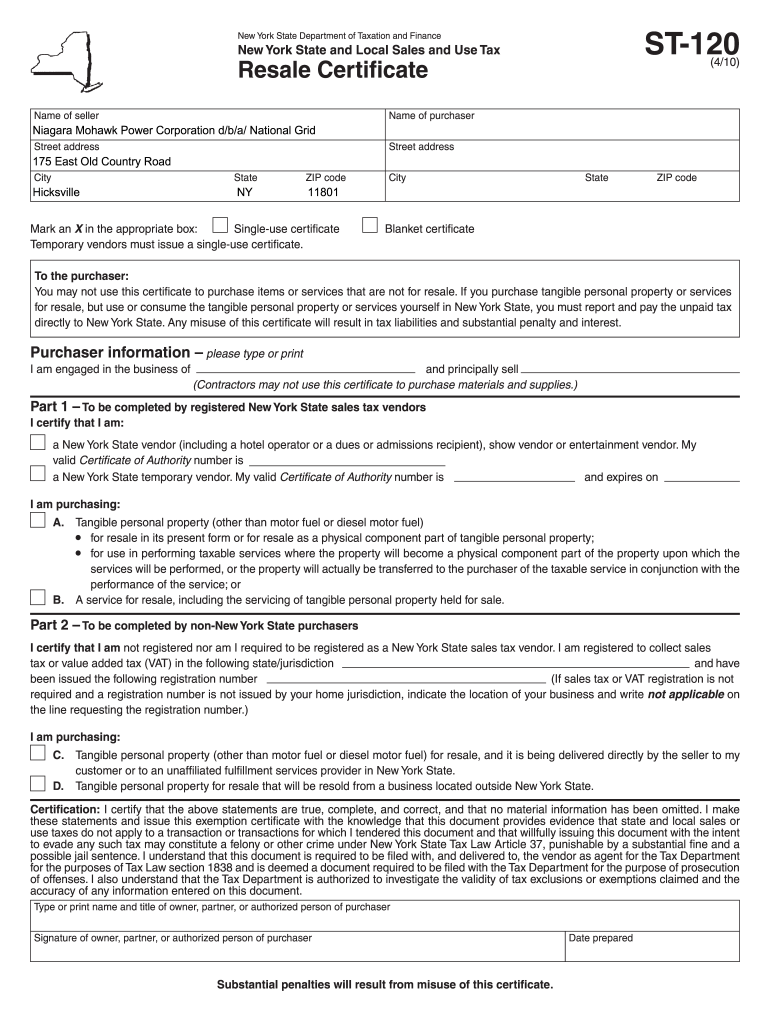

Tax Exempt Form Ny Fill and Sign Printable Template Online US Legal

Web apply for the exemption with virginia tax; You can find resale certificates for other states here. Address _____ number and street or rural route city, town, or post office state zip code. If any of these links are broken, or you can't find the form you need, please let us know. Web commonwealth of virginia sales and use tax.

Learn How To Issue Virginia Resale Certificates In.

Web exemptions you are allowed to claim. For married couples, each spouse is entitled to an exemption. You must file this form with your employer when your employment begins. Each filer is allowed one personal exemption.

Are Issued A Certificate Of Exemption By Virginia Tax.

To _____ date _____ name of supplier. Web apply for the exemption with virginia tax; If any of these links are broken, or you can't find the form you need, please let us know. Web commonwealth of virginia sales and use tax certificate of exemption for use by a virginia dealer who purchases tangible personal property for resale, or for lease or rental, or who purchases materials or containers to package tangible personal property for sale this certificate of exemption

Web We Have Five Virginia Sales Tax Exemption Forms Available For You To Print Or Save As A Pdf File.

When using the spouse tax adjustment, each spouse must claim his or her own personal exemption. If you do not file this form, your employer must withhold virginia income tax as if you had no exemptions. Address _____ number and street or rural route city, town, or post office state zip code. Web virginia allows an exemption of $930* for each of the following:

You Can Find Resale Certificates For Other States Here.

Purchases of prepared or catered meals and food are also covered by this exemption. Web a dealer is required to have on file only one certificate of exemption, properly executed by the governmental agency buying or leasing tax exempt tangible personal property under this certificate.