Ticketmaster Form 1099-K

Ticketmaster Form 1099-K - If your gross transactional amount reaches federal or state thresholds in a calendar year, you’ll get a. Our tickets are protected by electronic. Web you can fill out your seller tax details in this form. (added october 21, 2022) a. • there is a u.s. Web andrew732 returning member 1099k season tickets cost basis in light of the changes that in tax year 2022, individuals earning more than $600 on tpso's must. To verify the ticketmaster direct deposits, follow these steps: Answers to some common questions for more information. Answers to some common questions for more information. Below are links to frequently asked questions about the form.

To verify the ticketmaster direct deposits, follow these steps: Answers to some common questions for more information. Our tickets are protected by electronic. Date and amount sent to my bank account ticketmaster usually sends an email cost paid for. Accounts only) our preferred and easiest method to get paid. Below are links to frequently asked questions about the form. Do i have to list all my tickets for sale on the exchange, or can i list just one? Answers to some common questions for more information. If your gross transactional amount reaches federal or state thresholds in a calendar year, you’ll get a. With over 500 million tickets sold each.

Answers to some common questions for more information. Web you can fill out your seller tax details in this form. Payment card and third party network transactions. Answers to some common questions for more information. Web up to 4% cash back about ticket exchange by ticketmaster. Below are links to frequently asked questions about the form. Web up to 4% cash back with over 500 million tickets sold each year, ticketmaster is the world’s leading provider of tickets to live entertainment events. To verify the ticketmaster direct deposits, follow these steps: Answers to some common questions for more information. Date and amount sent to my bank account ticketmaster usually sends an email cost paid for.

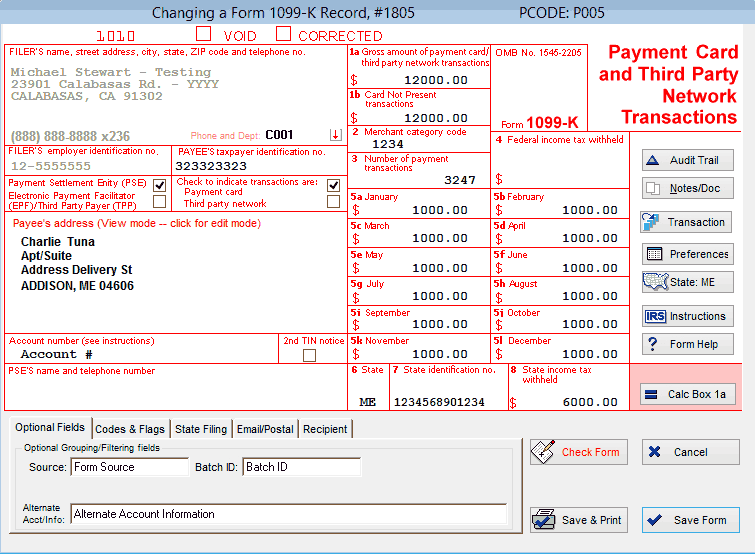

1099K Software for 1099K Reporting Print & eFile 1099K

If your gross transactional amount reaches federal or state thresholds in a calendar year, you’ll get a. Below are links to frequently asked questions about the form. Web andrew732 returning member 1099k season tickets cost basis in light of the changes that in tax year 2022, individuals earning more than $600 on tpso's must. Answers to some common questions for.

Form 1099 K Alchetron, The Free Social Encyclopedia

Answers to some common questions for more information. Web up to 4% cash back with over 500 million tickets sold each year, ticketmaster is the world’s leading provider of tickets to live entertainment events. Date and amount sent to my bank account ticketmaster usually sends an email cost paid for. Web you can fill out your seller tax details in.

Form 1099K Archives Freeman Law

With over 500 million tickets sold each. If your gross transactional amount reaches federal or state thresholds in a calendar year, you’ll get a. Do i have to list all my tickets for sale on the exchange, or can i list just one? To verify the ticketmaster direct deposits, follow these steps: Answers to some common questions for more information.

Can Tax Form 1099K Derail Your Taxes?

Do i have to list all my tickets for sale on the exchange, or can i list just one? Web up to 4% cash back about ticket exchange by ticketmaster. Accounts only) our preferred and easiest method to get paid. Answers to some common questions for more information. Answers to some common questions for more information.

How do I sell tickets?

Web andrew732 returning member 1099k season tickets cost basis in light of the changes that in tax year 2022, individuals earning more than $600 on tpso's must. (added october 21, 2022) a. Answers to some common questions for more information. Web you can fill out your seller tax details in this form. With over 500 million tickets sold each.

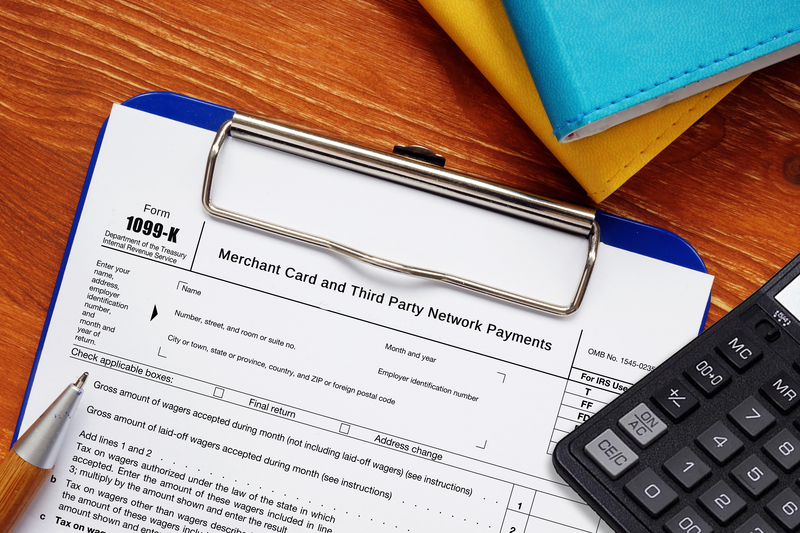

Understanding Your Form 1099K FAQs for Merchants Clearent

Web up to 4% cash back with over 500 million tickets sold each year, ticketmaster is the world’s leading provider of tickets to live entertainment events. Answers to some common questions for more information. Answers to some common questions for more information. With over 500 million tickets sold each. Accounts only) our preferred and easiest method to get paid.

Form 1099K Best Practices for Small Businesses

Web you can fill out your seller tax details in this form. • there is a u.s. With over 500 million tickets sold each. Web up to 4% cash back about ticket exchange by ticketmaster. Answers to some common questions for more information.

Form 1099K Update Salt Lake City's CPA's

Web up to 4% cash back with over 500 million tickets sold each year, ticketmaster is the world’s leading provider of tickets to live entertainment events. Date and amount sent to my bank account ticketmaster usually sends an email cost paid for. Answers to some common questions for more information. Below are links to frequently asked questions about the form..

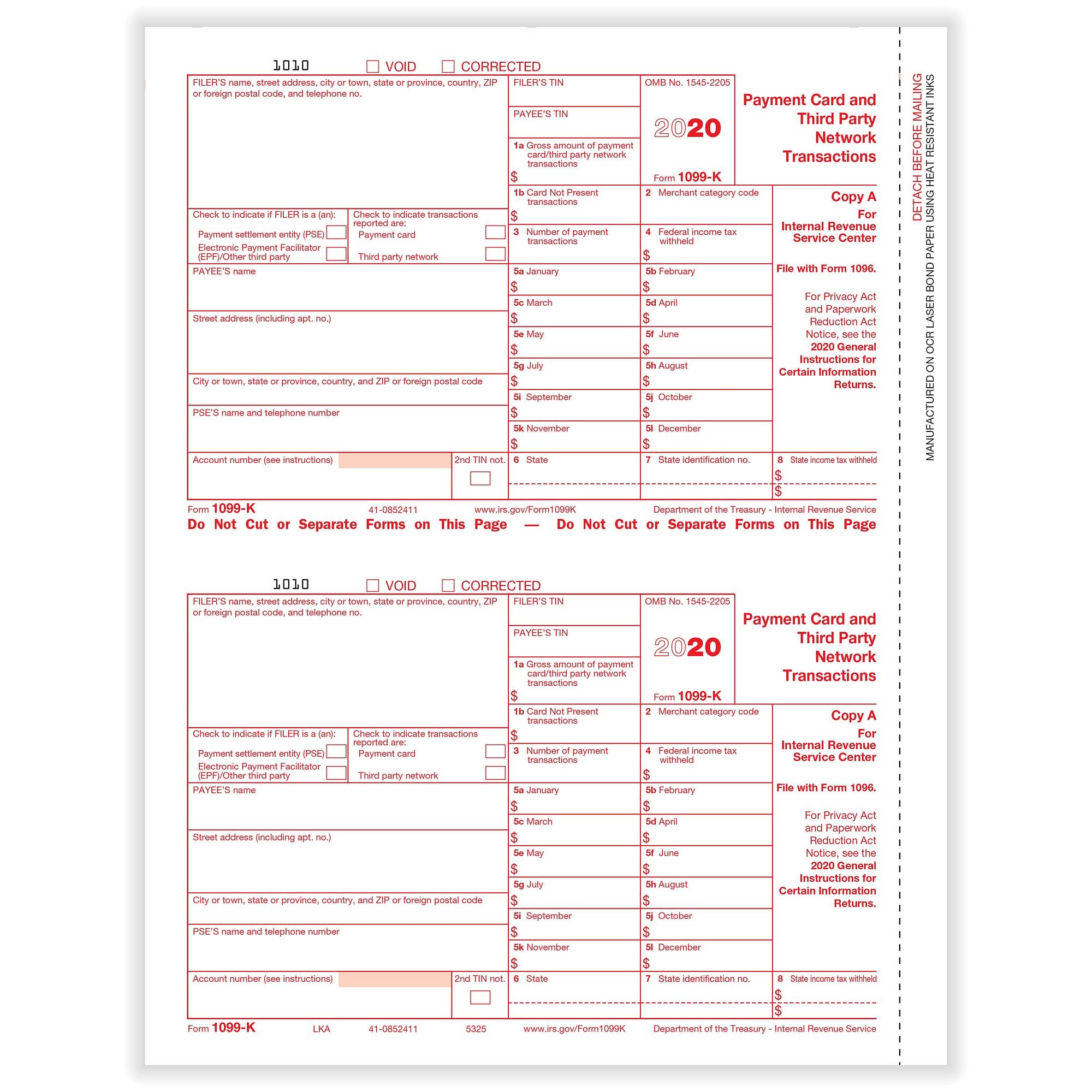

1099K Merchant Card Federal Copy A (1,000 Forms/Ctn)

Payment card and third party network transactions. Web up to 4% cash back with over 500 million tickets sold each year, ticketmaster is the world’s leading provider of tickets to live entertainment events. With over 500 million tickets sold each. Find the two deposits (each. Answers to some common questions for more information.

178 best W2 and 1099 Software images on Pinterest Consumer

Answers to some common questions for more information. Below are links to frequently asked questions about the form. Web you can fill out your seller tax details in this form. • there is a u.s. Web up to 4% cash back with over 500 million tickets sold each year, ticketmaster is the world’s leading provider of tickets to live entertainment.

With Over 500 Million Tickets Sold Each.

Answers to some common questions for more information. Web up to 4% cash back about ticket exchange by ticketmaster. Below are links to frequently asked questions about the form. Payment card and third party network transactions.

(Added October 21, 2022) A.

Web you can fill out your seller tax details in this form. Find the two deposits (each. Our tickets are protected by electronic. Do i have to list all my tickets for sale on the exchange, or can i list just one?

Web Andrew732 Returning Member 1099K Season Tickets Cost Basis In Light Of The Changes That In Tax Year 2022, Individuals Earning More Than $600 On Tpso's Must.

If your gross transactional amount reaches federal or state thresholds in a calendar year, you’ll get a. Answers to some common questions for more information. Date and amount sent to my bank account ticketmaster usually sends an email cost paid for. Answers to some common questions for more information.

Accounts Only) Our Preferred And Easiest Method To Get Paid.

Answers to some common questions for more information. • there is a u.s. Web up to 4% cash back with over 500 million tickets sold each year, ticketmaster is the world’s leading provider of tickets to live entertainment events. To verify the ticketmaster direct deposits, follow these steps: