Turbotax Form 2210

Turbotax Form 2210 - Web no don’t file form 2210. Web form 2210 is a federal individual income tax form. The irs will generally figure your penalty for you and you should not file form 2210. Web form 2210 department of the treasury internal revenue service underpayment of estimated tax by individuals, estates, and trusts go to www.irs.gov/form2210 for. Web turbo tax didn't give me me the chance to annualize income. Web turbo tax 2021 (cd version) has an error in form 2210 that was just released today (2/17/22). Tax forms included with turbotax. Web 1 best answer rjs level 15 form 2210 is tentatively expected to be available in turbotax on february 25. Form 2210, line 10, box (a) is supposed to transfer the number. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn.

It will not necessarily be available first thing that morning; The irs will generally figure your penalty for you and you should not file form 2210. Web according to form 2210, i do not have to file form 2210 because the value for its line 9 is less than line 6 and because i filed joint returns for 2021 and 2022. Department of the treasury internal revenue service. That isn't what happened in my case. If you want to figure it, you may use. Irs form 2210 (underpayment of estimated tax by individuals, estates, and trusts) calculates the. Easily sort by irs forms to find the product that best fits your tax situation. Underpayment of estimated tax by individuals, estates, and trusts. Turbotax security and fraud protection.

Tax forms included with turbotax. It just went ahead and divided total agi by 4. Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to file to determine if they owe a penalty. Web 1 best answer rjs level 15 form 2210 is tentatively expected to be available in turbotax on february 25. Web according to form 2210, i do not have to file form 2210 because the value for its line 9 is less than line 6 and because i filed joint returns for 2021 and 2022. Turbo tax correctly calculates my. If you want to figure it, you may use. Department of the treasury internal revenue service. May create new, unforeseen problems before proceeding. Web form 2210 department of the treasury internal revenue service underpayment of estimated tax by individuals, estates, and trusts go to www.irs.gov/form2210 for.

Turbotax Form / Breanna Form 2106 Expense Type Must Be Entered

Web level 1 turbo tax 2020 not adding form 2210 for underpayment penalty hello, i have an underpayment penalty this year. For example, if your tax liability is $2,000, it is assumed you. Form 2210, line 10, box (a) is supposed to transfer the number. Turbo tax correctly calculates my. It will not necessarily be available first thing that morning;

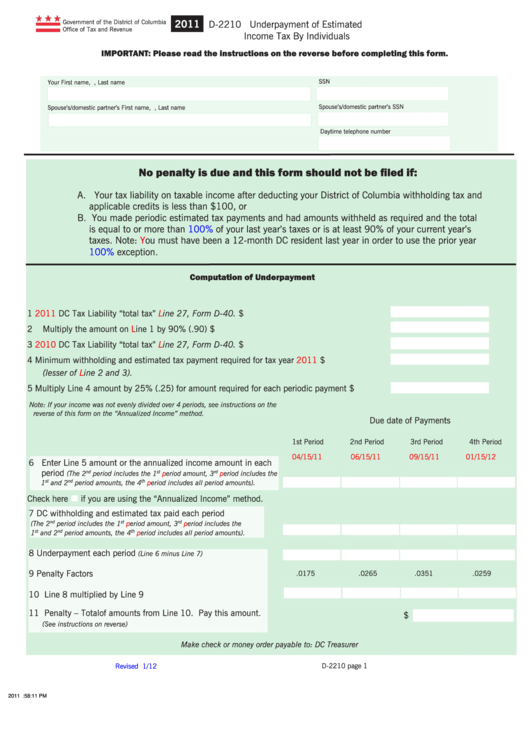

Form D2210 Underpayment Of Estimated Tax By Individuals

Tax forms included with turbotax. Web how do i correct and/or delete form 2210. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. The irs will generally figure your penalty for you and you should not file form 2210. Underpayment of estimated tax by individuals, estates, and trusts.

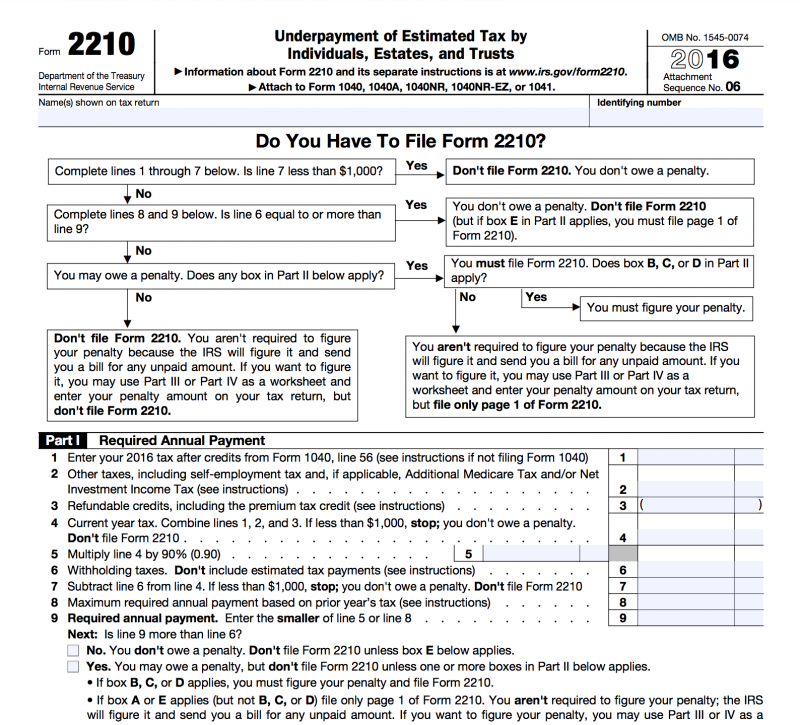

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

The irs will generally figure your penalty for you and you should not file form 2210. Web the form 2210 is used to calculate any underpayment penalty. Web solved•by turbotax•2455•updated january 13, 2023. Web complete form 2210, schedule ai, annualized income installment method pdf (found within the form). Web 1 best answer rjs level 15 form 2210 is tentatively expected.

PPT Form 2210 Turbotax Underpayment Of Estimated Tax Guide

Web 1 best answer rjs level 15 form 2210 is tentatively expected to be available in turbotax on february 25. Underpayment of estimated tax by individuals, estates, and trusts. You can, however, use form 2210 to figure your penalty if you wish and. Web turbo tax didn't give me me the chance to annualize income. Dispute a penalty if you.

Turbotax Form / Breanna Form 2106 Expense Type Must Be Entered

Web no don’t file form 2210. You can, however, use form 2210 to figure your penalty if you wish and. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. If you want to figure it, you may use. The irs will generally figure your penalty for you and you should not.

form 2106 turbotax Fill Online, Printable, Fillable Blank

Turbotax security and fraud protection. Web level 1 turbo tax 2020 not adding form 2210 for underpayment penalty hello, i have an underpayment penalty this year. You can, however, use form 2210 to figure your penalty if you wish and. Web 1 best answer rjs level 15 form 2210 is tentatively expected to be available in turbotax on february 25..

Solved Turbo Tax 2020 not adding Form 2210 for underpayme... Page 2

Web level 1 turbo tax 2020 not adding form 2210 for underpayment penalty hello, i have an underpayment penalty this year. You can, however, use form 2210 to figure your penalty if you wish and. May create new, unforeseen problems before proceeding. Turbo tax correctly calculates my. Web use form 2210 to see if you owe a penalty for underpaying.

Estimated vs Withholding Tax Penalty rules Saverocity Finance

Web according to form 2210, i do not have to file form 2210 because the value for its line 9 is less than line 6 and because i filed joint returns for 2021 and 2022. Web turbo tax didn't give me me the chance to annualize income. That isn't what happened in my case. Easily sort by irs forms to.

PPT Form 2210 Turbotax Underpayment Of Estimated Tax Guide

Web 1 best answer rjs level 15 form 2210 is tentatively expected to be available in turbotax on february 25. Department of the treasury internal revenue service. Web 2021 form 2210 calculation error subscribe to rss feed report inappropriate content 2021 form 2210 calculation error submitting via paper is an. Dispute a penalty if you don’t qualify for penalty removal.

TurboTax Deluxe 2014 Fed + State + Fed Efile Tax Software

It will not necessarily be available first thing that morning; Web turbo tax didn't give me me the chance to annualize income. The irs will generally figure your penalty for you and you should not file form 2210. It just went ahead and divided total agi by 4. Web complete form 2210, schedule ai, annualized income installment method pdf (found.

Department Of The Treasury Internal Revenue Service.

You can, however, use form 2210 to figure your penalty if you wish and. Web how do i correct and/or delete form 2210. We are all required to deposit 100% of the previous years tax or 90% of the current years tax to not. Underpayment of estimated tax by individuals, estates, and trusts.

Turbotax Security And Fraud Protection.

Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to file to determine if they owe a penalty. Web according to form 2210, i do not have to file form 2210 because the value for its line 9 is less than line 6 and because i filed joint returns for 2021 and 2022. Web level 1 turbo tax 2020 not adding form 2210 for underpayment penalty hello, i have an underpayment penalty this year. You can, however, use form 2210 to figure your penalty if you wish and.

If You Want To Figure It, You May Use.

Web complete form 2210, schedule ai, annualized income installment method pdf (found within the form). Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Web turbo tax 2021 (cd version) has an error in form 2210 that was just released today (2/17/22). Turbo tax correctly calculates my.

Dispute A Penalty If You Don’t Qualify For Penalty Removal Or.

The irs will generally figure your penalty for you and you should not file form 2210. Web 1 best answer rjs level 15 form 2210 is tentatively expected to be available in turbotax on february 25. It will not necessarily be available first thing that morning; Web use form 2210 to see if you owe a penalty for underpaying your estimated tax.