What Is A Beneficial Owner Form

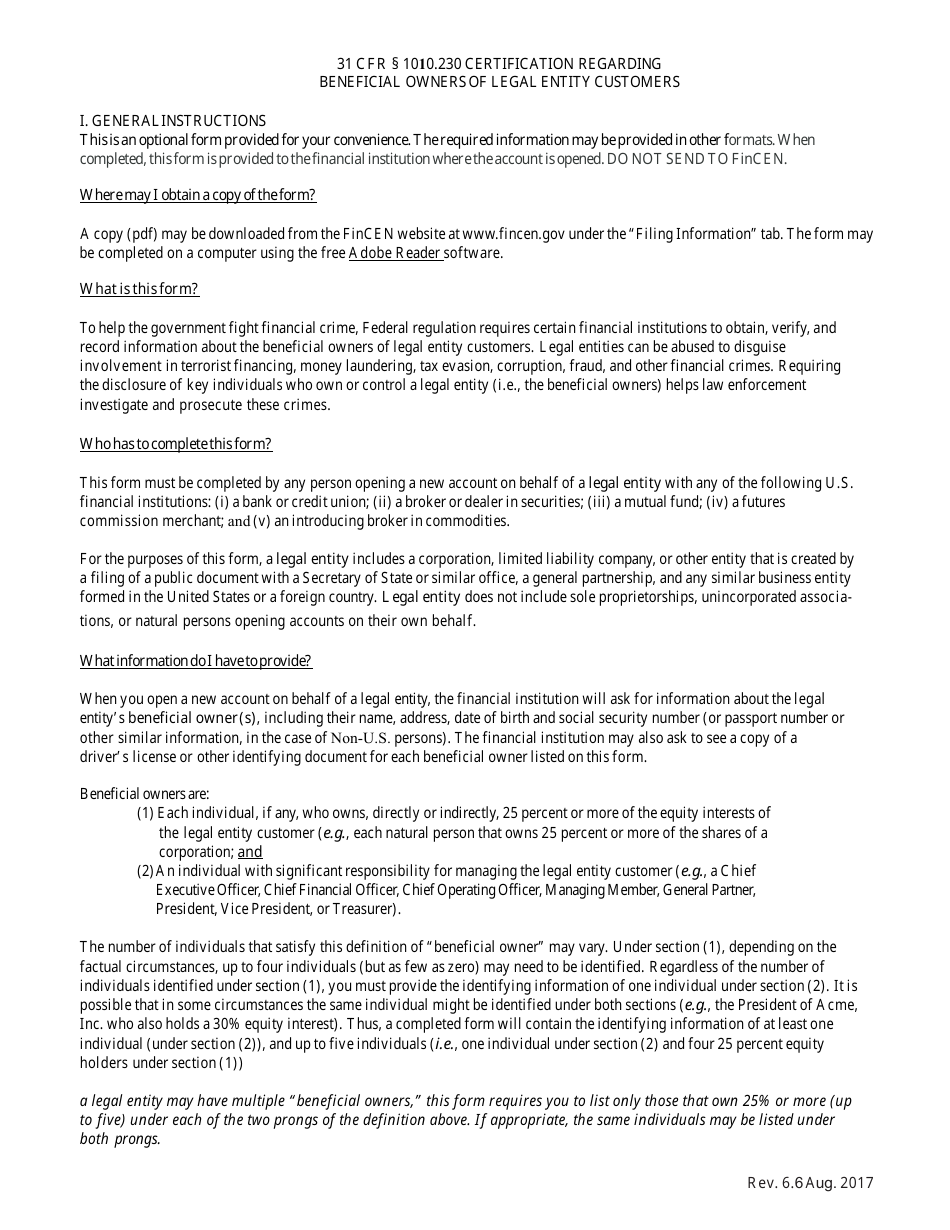

What Is A Beneficial Owner Form - Web under the proposed rule, a beneficial owner would include any individual who (1) exercises substantial control over a reporting company, or (2) owns or controls at least 25 percent of the ownership interests of a reporting company. The beneficial owners of the entity, and individuals who have filed an application with specified governmental authorities to create the entity or register it to do. A final rule implementing the beneficial ownership information reporting requirements of the corporate transparency act (cta) was issued in september 2022. Where such an interest is held through a trust, the trustee (s) or anyone who controls the trust will be registered as the beneficial owner (s). When opening an account at fifth third bank, national assocation, the beneficial ownership form must be completed by the nap. Web this form must be completed by the person opening a new account on behalf of a legal entity with any of the following u.s. Web a beneficial owner is an individual who ultimately owns or controls more than 25% of a company’s shares or voting rights, or who otherwise exercises control over the company or its management. (iv) a futures commission merchant; The rule defines the terms “substantial control” and “ownership interest.” (i) a bank or credit union;

Web fincen is issuing a final rule requiring certain entities to file with fincen reports that identify two categories of individuals: (iv) a futures commission merchant; These regulations go into effect on january 1, 2024. When opening an account at fifth third bank, national assocation, the beneficial ownership form must be completed by the nap. Beneficial ownership information will not be accepted prior to january 1, 2024. The form requires, among other information, the name, business address or primary residence address, date of birth, social security number (as applicable), the name of the issuing. The beneficial owners of the entity, and individuals who have filed an application with specified governmental authorities to create the entity or register it to do. Web under the proposed rule, a beneficial owner would include any individual who (1) exercises substantial control over a reporting company, or (2) owns or controls at least 25 percent of the ownership interests of a reporting company. Web the beneficial owner form. Or (v) an introducing broker in commodities.

Or (v) an introducing broker in commodities. Beneficial ownership information will not be accepted prior to january 1, 2024. Web a beneficial owner is an individual who ultimately owns or controls more than 25% of a company’s shares or voting rights, or who otherwise exercises control over the company or its management. Web this form must be completed by the person opening a new account on behalf of a legal entity with any of the following u.s. Where such an interest is held through a trust, the trustee (s) or anyone who controls the trust will be registered as the beneficial owner (s). When opening an account at fifth third bank, national assocation, the beneficial ownership form must be completed by the nap. The form to use depends on the type of certification being made. A final rule implementing the beneficial ownership information reporting requirements of the corporate transparency act (cta) was issued in september 2022. (ii) a broker or dealer in securities; The form requires, among other information, the name, business address or primary residence address, date of birth, social security number (as applicable), the name of the issuing.

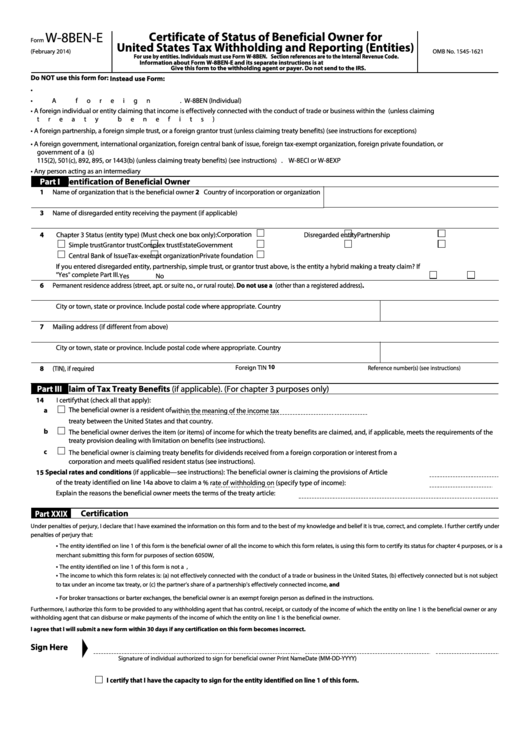

Fillable Form W8benE Certificate Of Status Of Beneficial Owner For

Web this form must be completed by the person opening a new account on behalf of a legal entity with any of the following u.s. Where such an interest is held through a trust, the trustee (s) or anyone who controls the trust will be registered as the beneficial owner (s). A final rule implementing the beneficial ownership information reporting.

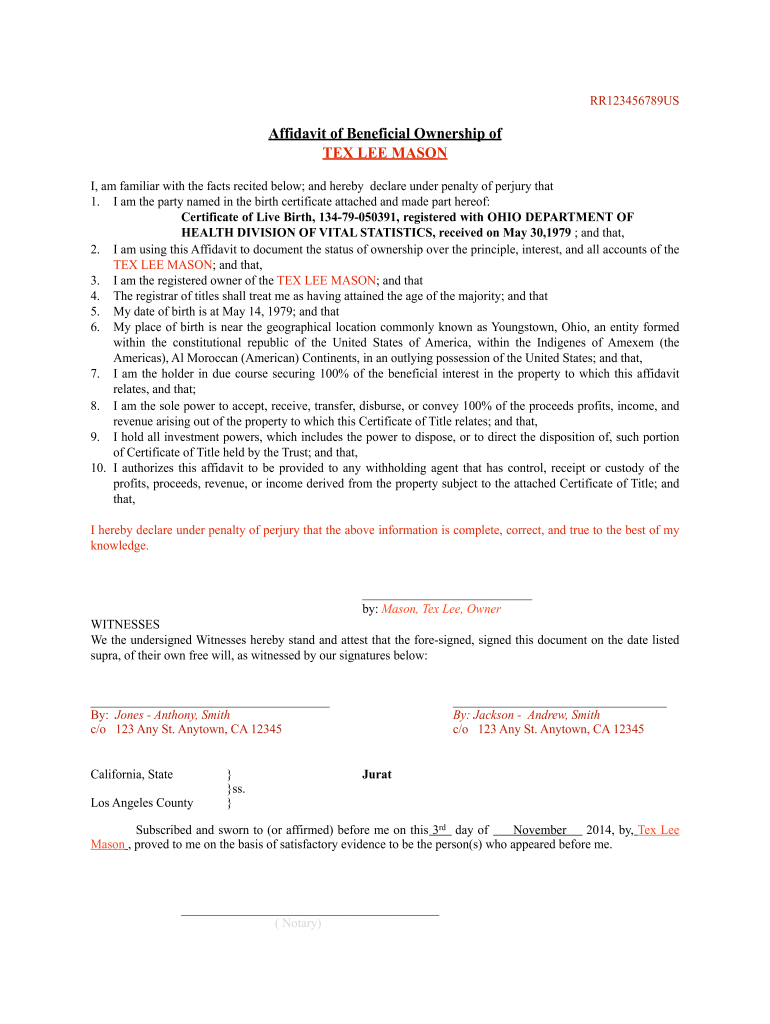

Rule 220 Affidavit Of Ownership Fill Out and Sign Printable PDF

Web new standards for teaching black history in florida’s public schools were approved wednesday that include teaching pupils how slaves developed beneficial skills. Web the beneficial owner form. When opening an account at fifth third bank, national assocation, the beneficial ownership form must be completed by the nap. Web a beneficial owner is an individual who ultimately owns or controls.

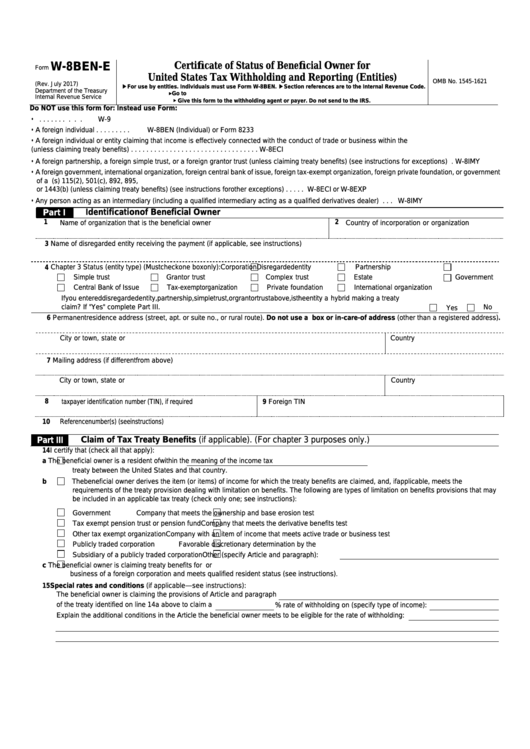

Do you need a Beneficial Owner Tax Transparency Certification for your

These regulations go into effect on january 1, 2024. Or (v) an introducing broker in commodities. Beneficial ownership information will not be accepted prior to january 1, 2024. (ii) a broker or dealer in securities; Web this form must be completed by the person opening a new account on behalf of a legal entity with any of the following u.s.

Form W8BENE Certificate of Entities Status of Beneficial Owner for

A final rule implementing the beneficial ownership information reporting requirements of the corporate transparency act (cta) was issued in september 2022. The beneficial owners of the entity, and individuals who have filed an application with specified governmental authorities to create the entity or register it to do. (ii) a broker or dealer in securities; The rule defines the terms “substantial.

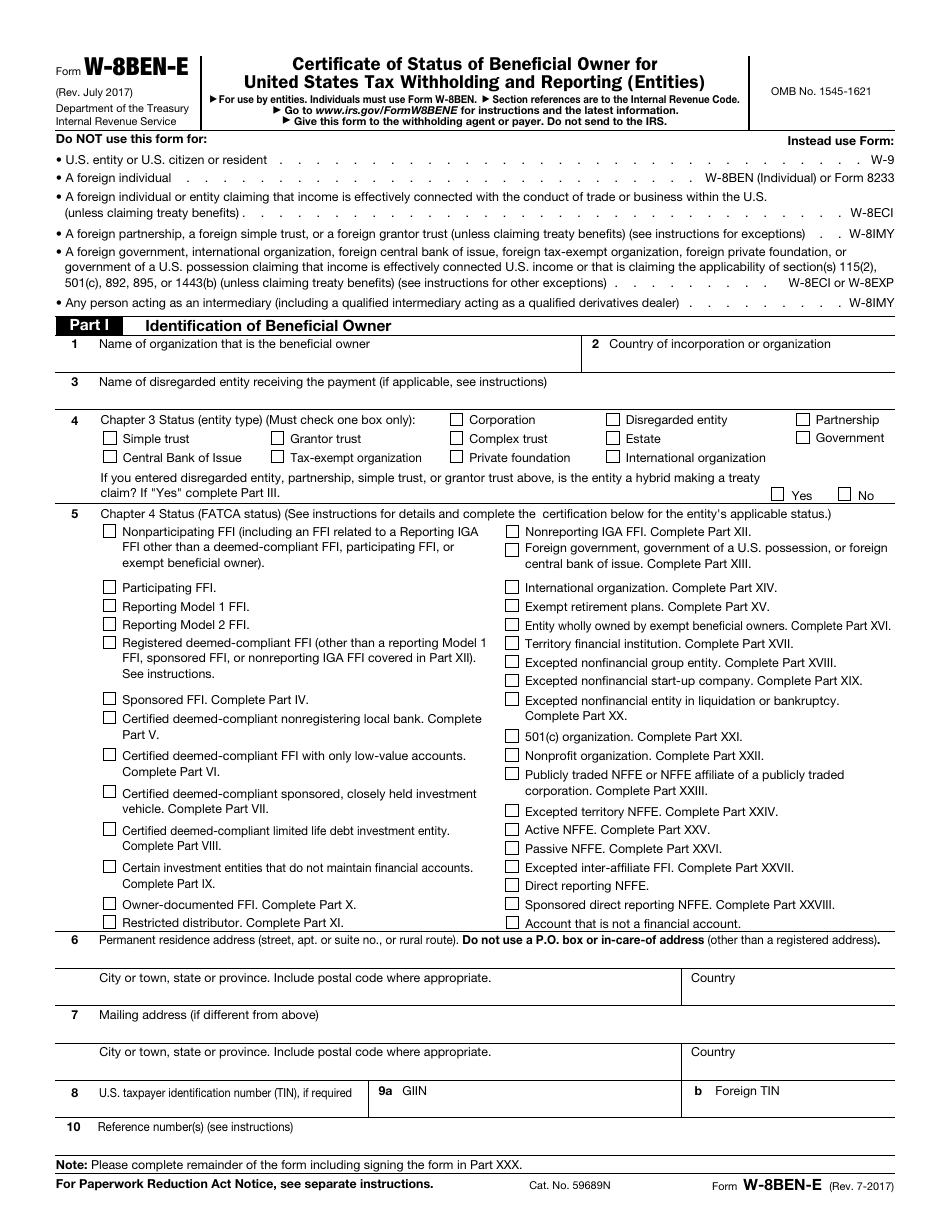

Form W8BENE Certificate of Entities Status of Beneficial Owner for

A final rule implementing the beneficial ownership information reporting requirements of the corporate transparency act (cta) was issued in september 2022. (ii) a broker or dealer in securities; (iv) a futures commission merchant; Web beneficial ownership information reporting. When opening an account at fifth third bank, national assocation, the beneficial ownership form must be completed by the nap.

Form W8benE Certificate Of Status Of Beneficial Owner For United

The beneficial owners of the entity, and individuals who have filed an application with specified governmental authorities to create the entity or register it to do. Where such an interest is held through a trust, the trustee (s) or anyone who controls the trust will be registered as the beneficial owner (s). Web under the proposed rule, a beneficial owner.

IRS Form W8BENE Download Fillable PDF or Fill Online Certificate of

Beneficial ownership information will not be accepted prior to january 1, 2024. Web a beneficial owner is an individual who ultimately owns or controls more than 25% of a company’s shares or voting rights, or who otherwise exercises control over the company or its management. Web new standards for teaching black history in florida’s public schools were approved wednesday that.

Certification of Beneficial Owner(S) Download Fillable PDF Templateroller

Web the beneficial owner form. (iv) a futures commission merchant; When opening an account at fifth third bank, national assocation, the beneficial ownership form must be completed by the nap. Or (v) an introducing broker in commodities. Web a beneficial owner is an individual who ultimately owns or controls more than 25% of a company’s shares or voting rights, or.

Beneficial Ownership Form Blank Fill Online, Printable, Fillable

Web a beneficial owner is an individual who ultimately owns or controls more than 25% of a company’s shares or voting rights, or who otherwise exercises control over the company or its management. (ii) a broker or dealer in securities; Web this form must be completed by the person opening a new account on behalf of a legal entity with.

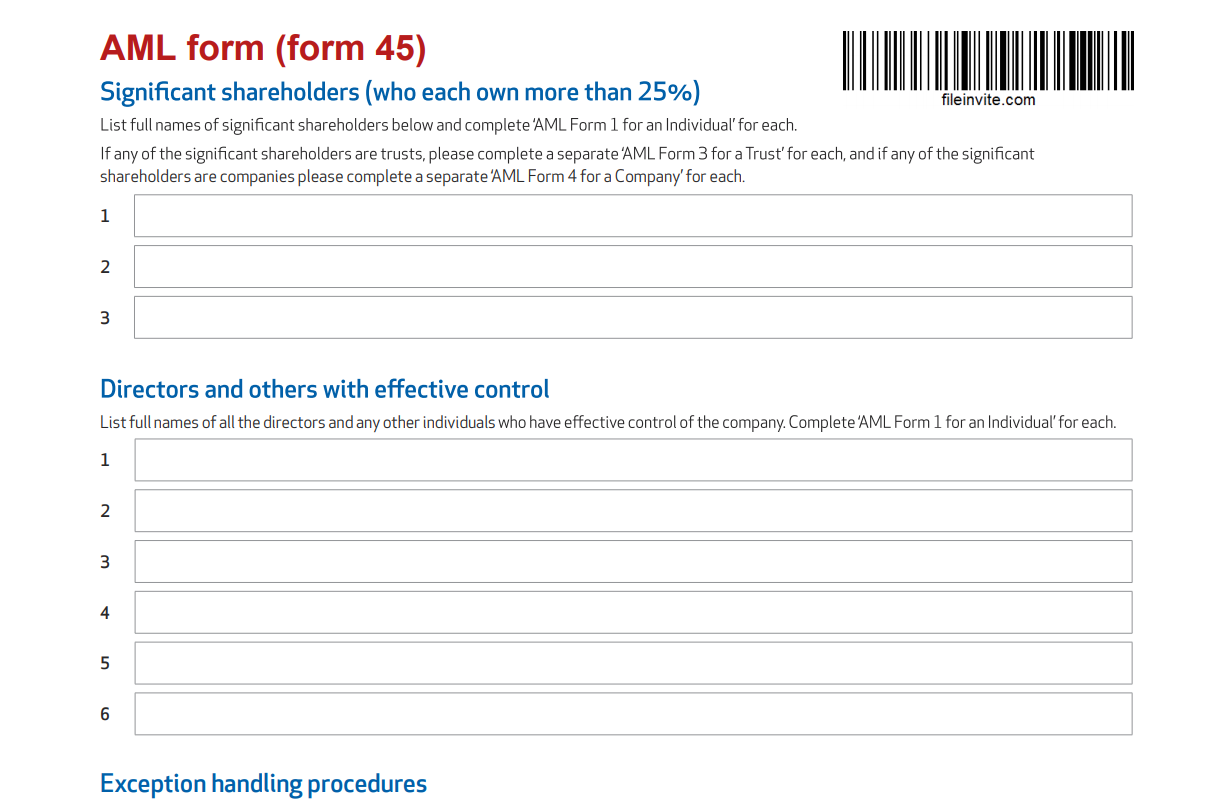

Create an online Beneficial Ownership Declaration Form with FileInvite

(ii) a broker or dealer in securities; (iv) a futures commission merchant; Web under the proposed rule, a beneficial owner would include any individual who (1) exercises substantial control over a reporting company, or (2) owns or controls at least 25 percent of the ownership interests of a reporting company. Where such an interest is held through a trust, the.

Web Under The Rule, A Beneficial Owner Includes Any Individual Who, Directly Or Indirectly, Either (1) Exercises Substantial Control Over A Reporting Company, Or (2) Owns Or Controls At Least 25 Percent Of The Ownership Interests Of A Reporting Company.

Web new standards for teaching black history in florida’s public schools were approved wednesday that include teaching pupils how slaves developed beneficial skills. The form to use depends on the type of certification being made. These regulations go into effect on january 1, 2024. When opening an account at fifth third bank, national assocation, the beneficial ownership form must be completed by the nap.

Web Under The Proposed Rule, A Beneficial Owner Would Include Any Individual Who (1) Exercises Substantial Control Over A Reporting Company, Or (2) Owns Or Controls At Least 25 Percent Of The Ownership Interests Of A Reporting Company.

(i) a bank or credit union; The beneficial owners of the entity, and individuals who have filed an application with specified governmental authorities to create the entity or register it to do. (iv) a futures commission merchant; Web this form must be completed by the person opening a new account on behalf of a legal entity with any of the following u.s.

A Final Rule Implementing The Beneficial Ownership Information Reporting Requirements Of The Corporate Transparency Act (Cta) Was Issued In September 2022.

Beneficial ownership information will not be accepted prior to january 1, 2024. Web the beneficial owner form. Web beneficial ownership information reporting. Where such an interest is held through a trust, the trustee (s) or anyone who controls the trust will be registered as the beneficial owner (s).

Web Fincen Is Issuing A Final Rule Requiring Certain Entities To File With Fincen Reports That Identify Two Categories Of Individuals:

The form requires, among other information, the name, business address or primary residence address, date of birth, social security number (as applicable), the name of the issuing. The rule defines the terms “substantial control” and “ownership interest.” Web a beneficial owner is an individual who ultimately owns or controls more than 25% of a company’s shares or voting rights, or who otherwise exercises control over the company or its management. (ii) a broker or dealer in securities;