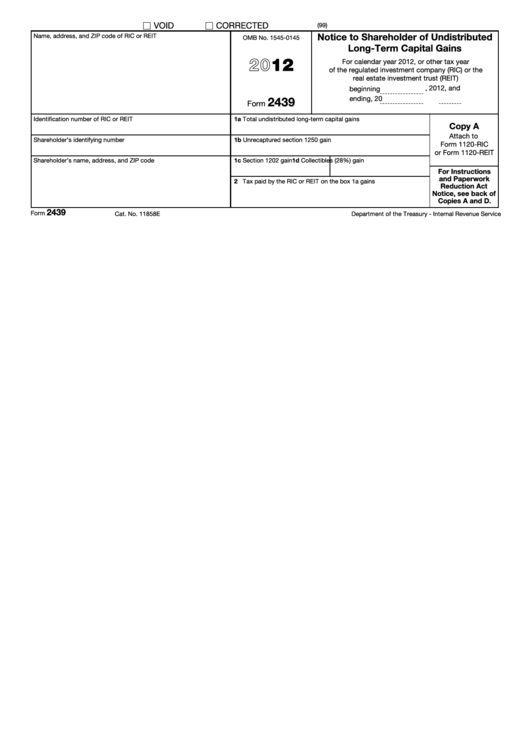

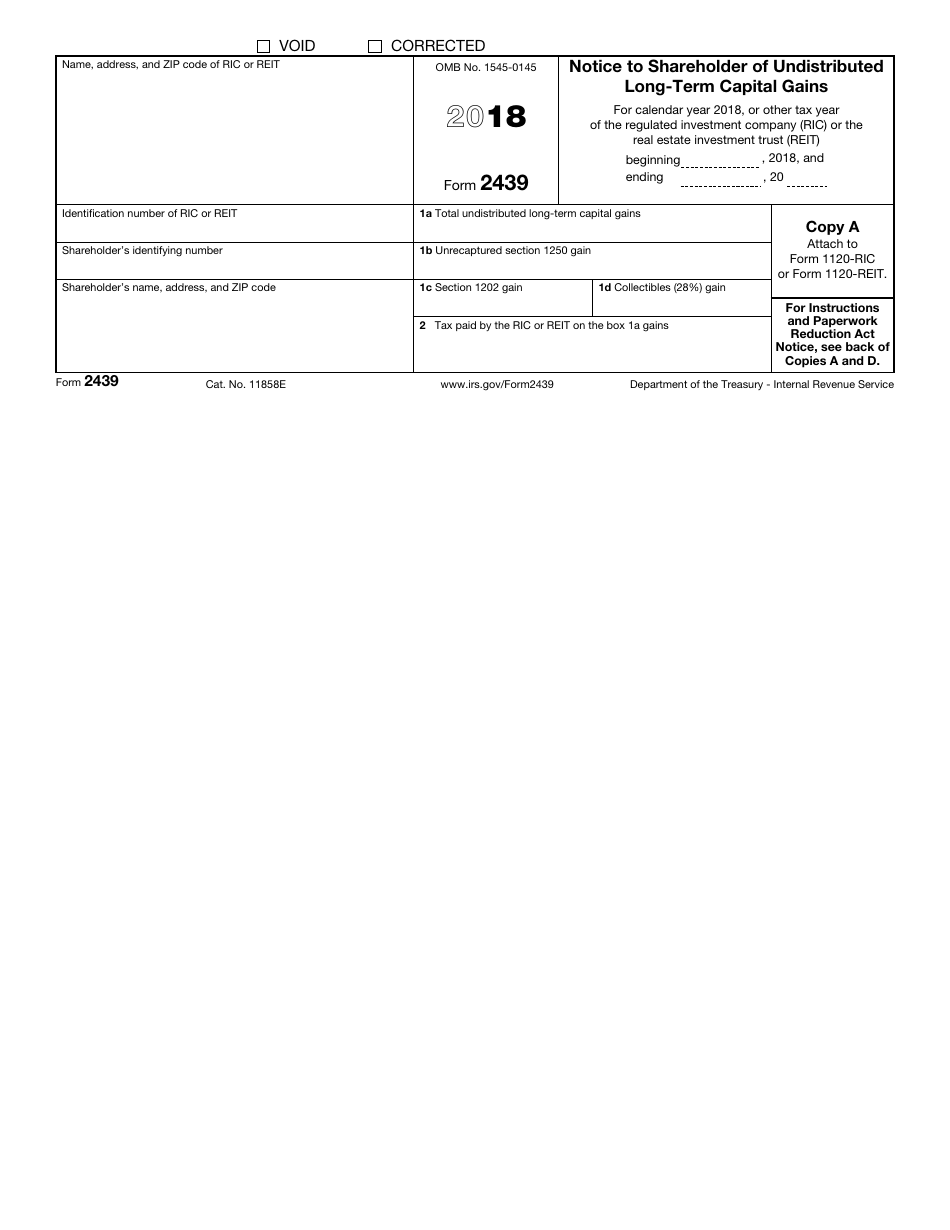

What Is Form 2439

What Is Form 2439 - The 2439 tax form (full title: Go to screen 17.1 dispositions (schedule d, 4797, etc.).; Turbotax online posted march 25, 2023 6:57 am last. All information you provide will be. The form is typically given to shareholders by. Web the deemed distribution is deemed paid to the stockholders of record as of march 31, 2020. Web the internal revenue service (irs) form 2439 must be given to shareholders by regulated investment companies (rics), mutual funds, exchange. Web form 2439 is a form used by the irs to request an extension of time to file a return. Web form 2439 is an irs form mutual fund companies or other investment managers are required to distribute to shareholders in order to report undistributed long. All relevant tax information will be included in internal revenue service.

Fish and wildlife service expiration date 09/30/2025. Web the internal revenue service (irs) form 2439 must be given to shareholders by regulated investment companies (rics), mutual funds, exchange. Web what is form 2439? From the dispositions section select form 2439.; What is this, and how do i report the info on my desktop turbo tax return? Web form 2439 is a form used by the irs to request an extension of time to file a return. Web to enter the 2439 in the individual module: Turbotax online posted march 25, 2023 6:57 am last. Web what is a form 2439? All relevant tax information will be included in internal revenue service.

Web what is a form 2439? Web to enter the 2439 in the individual module: What is this, and how do i report the info on my desktop turbo tax return? Web the internal revenue service (irs) form 2439 must be given to shareholders by regulated investment companies (rics), mutual funds, exchange. Fish and wildlife service expiration date 09/30/2025. Web the deemed distribution is deemed paid to the stockholders of record as of march 31, 2020. Web what is form 2439? Turbotax online posted march 25, 2023 6:57 am last. Go to screen 17.1 dispositions (schedule d, 4797, etc.).; All information you provide will be.

A pair of late 18th century Staffordshire enamel salts, each of

Web level 1 i got a new tax form 2439. Web the internal revenue service (irs) form 2439 must be given to shareholders by regulated investment companies (rics), mutual funds, exchange. Web to enter the 2439 in the individual module: Web form 2439 is a form used by the irs to request an extension of time to file a return..

Form 990T Exempt Organization Business Tax Return (and proxy…

Web the internal revenue service (irs) form 2439 must be given to shareholders by regulated investment companies (rics), mutual funds, exchange. Web the deemed distribution is deemed paid to the stockholders of record as of march 31, 2020. The form is typically given to shareholders by. Web level 1 i got a new tax form 2439. Fish and wildlife service.

Fillable Form 2439 Notice To Shareholder Of Undistributed LongTerm

Web the deemed distribution is deemed paid to the stockholders of record as of march 31, 2020. The 2439 tax form (full title: Fish and wildlife service expiration date 09/30/2025. Turbotax online posted march 25, 2023 6:57 am last. Web what is form 2439?

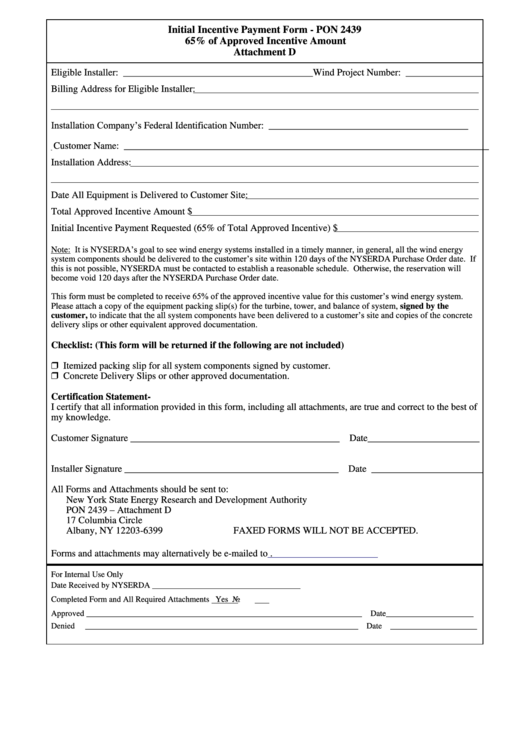

Fillable Form Pon 2439 Initial Incentive Payment Form New York

Web you can see it form 2439 (rev. Go to screen 17.1 dispositions (schedule d, 4797, etc.).; What is this, and how do i report the info on my desktop turbo tax return? Web level 1 i got a new tax form 2439. Web form 2439 is a form used by the irs to request an extension of time to.

IRS Form 2439 Download Fillable PDF or Fill Online Notice to

Web to enter the 2439 in the individual module: The 2439 tax form (full title: Use this form to provide shareholders of a regulated investment company. Web on the front of this form has elected under the internal revenue code to keep and pay income tax on certain net capital gain income it received during its tax year. Web you.

Breanna Form 24

Web level 1 i got a new tax form 2439. All relevant tax information will be included in internal revenue service. Web to enter the 2439 in the individual module: The form is typically given to shareholders by. Web the deemed distribution is deemed paid to the stockholders of record as of march 31, 2020.

Form 2439 Notice to Shareholder of Undistributed LongTerm Capital

From the dispositions section select form 2439.; Web form 2439 is a form used by the irs to request an extension of time to file a return. Web the deemed distribution is deemed paid to the stockholders of record as of march 31, 2020. What is this, and how do i report the info on my desktop turbo tax return?.

Fill Free fillable 2019 Form 1120REIT Tax Return for Real Estate

What is this, and how do i report the info on my desktop turbo tax return? Web form 2439 is a form used by the irs to request an extension of time to file a return. All relevant tax information will be included in internal revenue service. Web everything you need to know about the internal revenue service (irs) forms.

Publication 17 Your Federal Tax; Refundable Credits

Web everything you need to know about the internal revenue service (irs) forms required to pay your u.s. Web what is a form 2439? Web the internal revenue service (irs) form 2439 must be given to shareholders by regulated investment companies (rics), mutual funds, exchange. All information you provide will be. Fish and wildlife service expiration date 09/30/2025.

Breanna Form 2439 Instructions 2019

Web the deemed distribution is deemed paid to the stockholders of record as of march 31, 2020. What is this, and how do i report the info on my desktop turbo tax return? Web everything you need to know about the internal revenue service (irs) forms required to pay your u.s. Web to enter the 2439 in the individual module:.

Web The Internal Revenue Service (Irs) Form 2439 Must Be Given To Shareholders By Regulated Investment Companies (Rics), Mutual Funds, Exchange.

Go to screen 17.1 dispositions (schedule d, 4797, etc.).; Web what is a form 2439? The form is typically given to shareholders by. Web what is form 2439?

Web Level 1 I Got A New Tax Form 2439.

Use this form to provide shareholders of a regulated investment company. Fish and wildlife service expiration date 09/30/2025. Web form 2439 is an irs form mutual fund companies or other investment managers are required to distribute to shareholders in order to report undistributed long. The 2439 tax form (full title:

Web The Deemed Distribution Is Deemed Paid To The Stockholders Of Record As Of March 31, 2020.

All relevant tax information will be included in internal revenue service. Web everything you need to know about the internal revenue service (irs) forms required to pay your u.s. What is this, and how do i report the info on my desktop turbo tax return? Web on the front of this form has elected under the internal revenue code to keep and pay income tax on certain net capital gain income it received during its tax year.

All Information You Provide Will Be.

Turbotax online posted march 25, 2023 6:57 am last. Web form 2439 is a form used by the irs to request an extension of time to file a return. Web you can see it form 2439 (rev. Web to enter the 2439 in the individual module: