What Is Form 8978

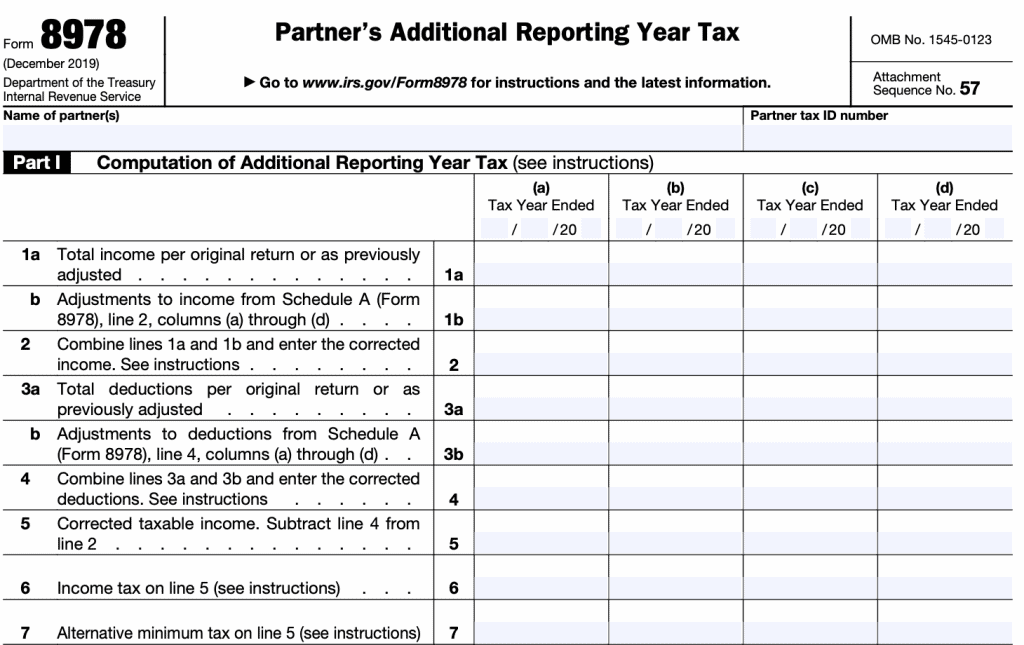

What Is Form 8978 - Go to www.irs.gov/form8978 for the latest information. Web form 8978 (december 2019) partner’s additional reporting year tax department of the treasury internal revenue service ' go to www.irs.gov/form8978 for instructions and. Web if the partnership elects an aar push out or the aar contains adjustments that do not result in an iu, it must include form 8985 and forms 8986 with the aar submission. Any and all input is done directly on the government form in the blue fields. Web audited partnership, for purposes of form 8978, is a bba partnership that made the election under section 6226 to have its partners take into account their share of adjustments for. Web when to file. Web the schedule a (form 8978) lists all the adjustments a partner receives on form 8986. Web form 8978 is a library form meaning there is no specific input for it. Web form 8978 is a tax form used by foreign financial institutions (ffis) to report information about their us account holders to the internal revenue service (irs). Schedule a is also used to report any related amounts and adjustments not reported on.

Web partner a’s 2020 form 8978, which will be attached to the partner’s income tax return, reports a $37,000 credit (37% x $100,000). You should include the following elements: Web when to file. Web form 8978 is a tax form used by foreign financial institutions (ffis) to report information about their us account holders to the internal revenue service (irs). Web form 8978 is a library form meaning there is no specific input for it. Web audited partnership, for purposes of form 8978, is a bba partnership that made the election under section 6226 to have its partners take into account their share of adjustments for. Web department of the treasury internal revenue service attach to form 8978. Web here are major form 8978 schedule a instructions. Web form 8978 (december 2019) partner’s additional reporting year tax department of the treasury internal revenue service ' go to www.irs.gov/form8978 for instructions and. A reviewed year partner or affected partner must file form 8978 with a timely filed federal income tax return for the partner’s reporting year.

Web if the partnership elects an aar push out or the aar contains adjustments that do not result in an iu, it must include form 8985 and forms 8986 with the aar submission. Web form 8979, partnership representative revocation, designation, and resignation, is used to revoke a pr or di, resign as a pr or di, or designate a pr where no designation of a. Web when to file. Web partner a’s 2020 form 8978, which will be attached to the partner’s income tax return, reports a $37,000 credit (37% x $100,000). Web the schedule a (form 8978) lists all the adjustments a partner receives on form 8986. Web here are major form 8978 schedule a instructions. Web form 8978 is a tax form used by foreign financial institutions (ffis) to report information about their us account holders to the internal revenue service (irs). Web department of the treasury internal revenue service attach to form 8978. Because partner a has no 2020. Any and all input is done directly on the government form in the blue fields.

8978 Rashan Program Registration Ehsaas Web Portal Check Result by

Web if the partnership elects an aar push out or the aar contains adjustments that do not result in an iu, it must include form 8985 and forms 8986 with the aar submission. Web partner a’s 2020 form 8978, which will be attached to the partner’s income tax return, reports a $37,000 credit (37% x $100,000). Web department of the.

Download Instructions for IRS Form 8978 Partner's Additional Reporting

You should include the following elements: Web partner a’s 2020 form 8978, which will be attached to the partner’s income tax return, reports a $37,000 credit (37% x $100,000). Web audited partnership, for purposes of form 8978, is a bba partnership that made the election under section 6226 to have its partners take into account their share of adjustments for..

Form 8978 Partner`s Additional Reporting Year Tax Inscription on the

Web audited partnership, for purposes of form 8978, is a bba partnership that made the election under section 6226 to have its partners take into account their share of adjustments for. A reviewed year partner or affected partner must file form 8978 with a timely filed federal income tax return for the partner’s reporting year. Schedule a is also used.

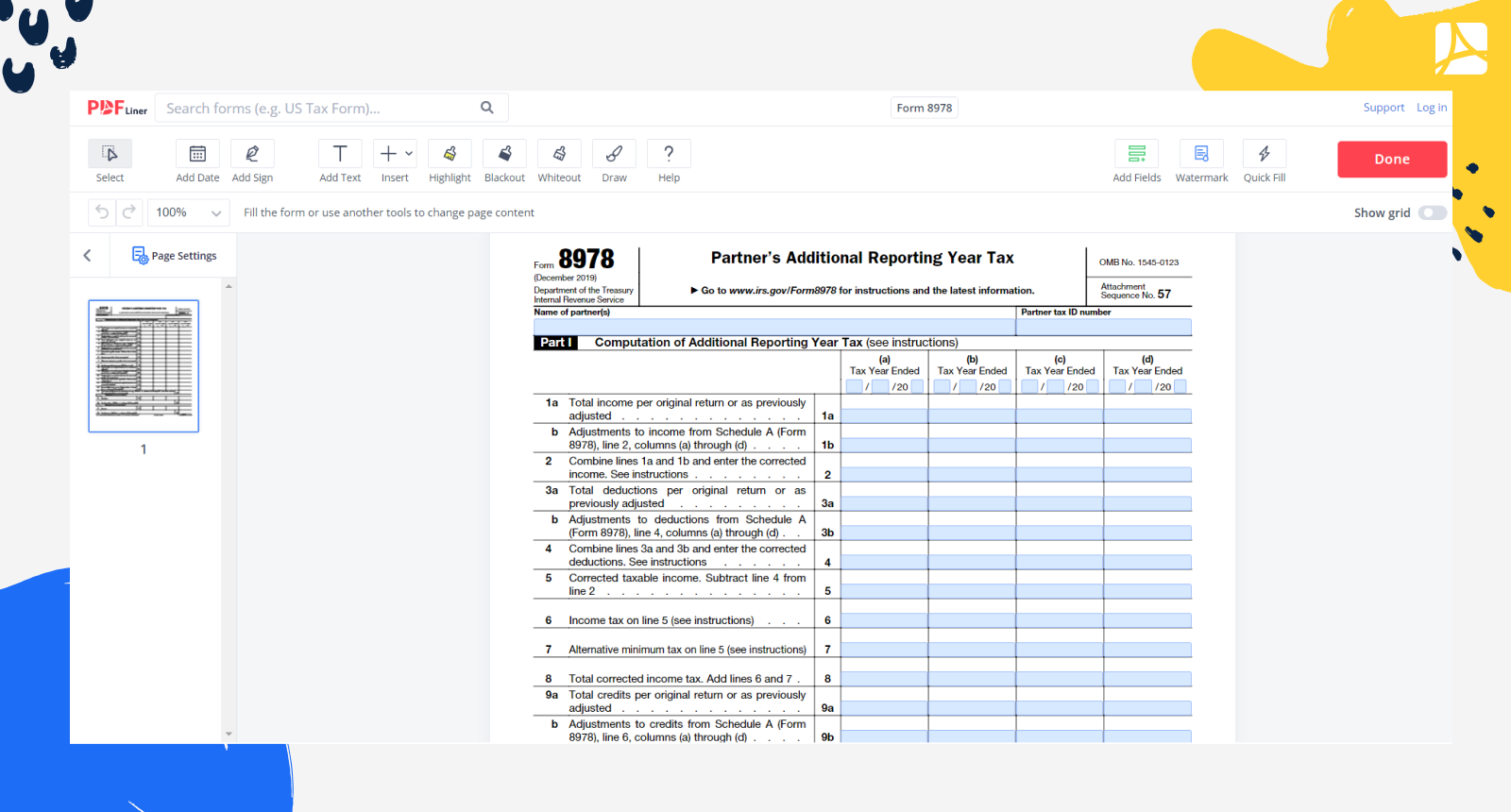

Form 8978 Printable Form 8978 blank, sign forms online — PDFliner

Web audited partnership, for purposes of form 8978, is a bba partnership that made the election under section 6226 to have its partners take into account their share of adjustments for. You should include the following elements: Web form 8978 is a library form meaning there is no specific input for it. Go to www.irs.gov/form8978 for the latest information. Web.

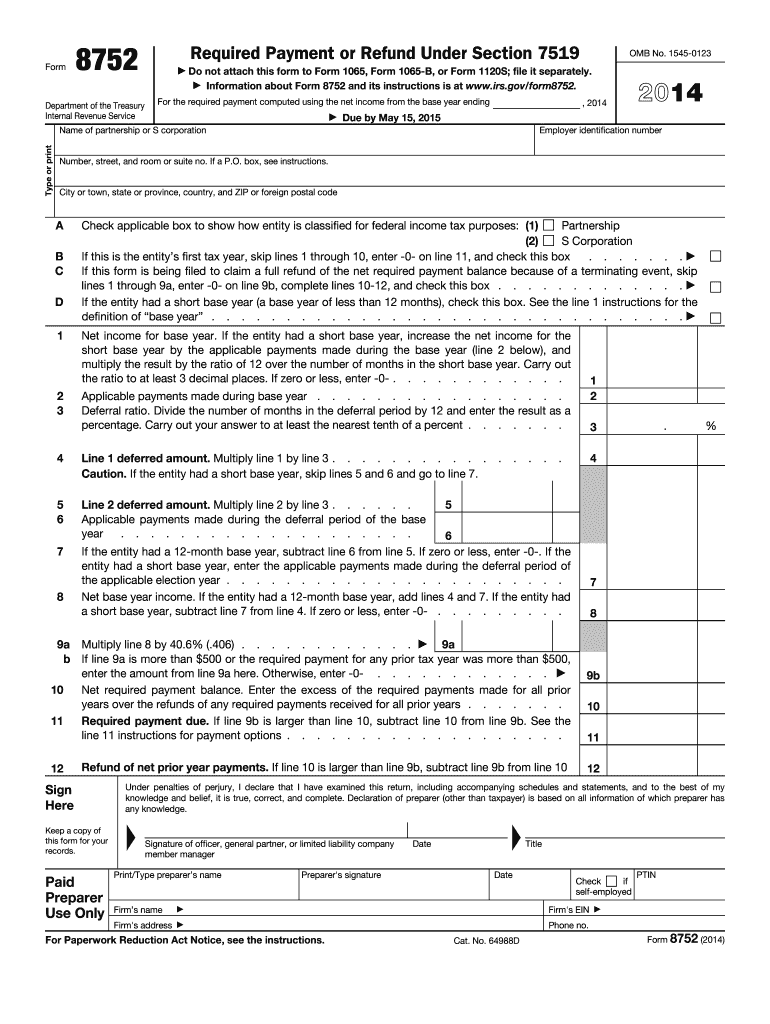

2014 Form IRS 8752 Fill Online, Printable, Fillable, Blank pdfFiller

Web here are major form 8978 schedule a instructions. Web form 8978 is a tax form used by foreign financial institutions (ffis) to report information about their us account holders to the internal revenue service (irs). Web when to file. Web the partner must attach form 8978 to her 2021 income tax return to pick up the adjustments. Web form.

IRS Form 8938 Statute of Limitations 6Year Audit Risk (6501)

Web audited partnership, for purposes of form 8978, is a bba partnership that made the election under section 6226 to have its partners take into account their share of adjustments for. You should include the following elements: Web form 8978 (december 2019) partner’s additional reporting year tax department of the treasury internal revenue service ' go to www.irs.gov/form8978 for instructions.

Instructions for Form 8978 (Including Schedule A) (12/2021) Internal

Web form 8978 (december 2019) partner’s additional reporting year tax department of the treasury internal revenue service ' go to www.irs.gov/form8978 for instructions and. A reviewed year partner or affected partner must file form 8978 with a timely filed federal income tax return for the partner’s reporting year. Web when to file. Web here are major form 8978 schedule a.

va form 268978 pdf Fill Online, Printable, Fillable Blank vaform

Web the schedule a (form 8978) lists all the adjustments a partner receives on form 8986. Any and all input is done directly on the government form in the blue fields. Schedule a is also used to report any related amounts and adjustments not reported on. Web if the partnership elects an aar push out or the aar contains adjustments.

The Naked Watchmaker

Definitions aar partnership is a bba. Web partner a’s 2020 form 8978, which will be attached to the partner’s income tax return, reports a $37,000 credit (37% x $100,000). What happens when a partnership has a net negative adjustment? Go to www.irs.gov/form8978 for the latest information. Web here are major form 8978 schedule a instructions.

IRS Form 8978 A Guide to Partner's Additional Reporting Year Tax

Web form 8978 is a tax form used by foreign financial institutions (ffis) to report information about their us account holders to the internal revenue service (irs). Web form 8978 (december 2019) partner’s additional reporting year tax department of the treasury internal revenue service ' go to www.irs.gov/form8978 for instructions and. Web the schedule a (form 8978) lists all the.

Web Audited Partnership, For Purposes Of Form 8978, Is A Bba Partnership That Made The Election Under Section 6226 To Have Its Partners Take Into Account Their Share Of Adjustments For.

Web when to file. Because partner a has no 2020. Schedule a is also used to report any related amounts and adjustments not reported on. Definitions aar partnership is a bba.

Web The Schedule A (Form 8978) Lists All The Adjustments A Partner Receives On Form 8986.

Web audited partnership, for purposes of form 8978, is a bba partnership that made the election under section 6226 to have its partners take into account their share of adjustments for. Web the partner must attach form 8978 to her 2021 income tax return to pick up the adjustments. Web form 8979, partnership representative revocation, designation, and resignation, is used to revoke a pr or di, resign as a pr or di, or designate a pr where no designation of a. You should include the following elements:

Web Partner A’s 2020 Form 8978, Which Will Be Attached To The Partner’s Income Tax Return, Reports A $37,000 Credit (37% X $100,000).

The amendment is already complex enough,. What happens when a partnership has a net negative adjustment? Web form 8978 (december 2019) partner’s additional reporting year tax department of the treasury internal revenue service ' go to www.irs.gov/form8978 for instructions and. Go to www.irs.gov/form8978 for the latest information.

Any And All Input Is Done Directly On The Government Form In The Blue Fields.

Web if the partnership elects an aar push out or the aar contains adjustments that do not result in an iu, it must include form 8985 and forms 8986 with the aar submission. Web department of the treasury internal revenue service attach to form 8978. Web form 8978 is a tax form used by foreign financial institutions (ffis) to report information about their us account holders to the internal revenue service (irs). Web here are major form 8978 schedule a instructions.