When Is Form 5498 Issued

When Is Form 5498 Issued - Web may show the kind of ira reported on this form 5498. Web when is the irs form 5498 mailed? Web this year, some custodians are still sending the 5498 in may anyway, probably because their systems are programmed to do so. However, the taxpayer is most likely to get any substantial. The filing deadline takes into account the fact that contributions to iras can be applied towards the. There are two form 5498 mailing periods: Web form 5498 is issued by the financial institution responsible for the ira for informational purposes. The trustee or custodian of your ira reports. Web the rmd must start by age 72 to avoid costly penalties. Show sep (box 8) and simple (box 9) contributions made in 2022, including contributions made in 2022.

Due to carryback contributions that can be made up until tax filing date (typically april 15) of the following year, the irs does not require irs. Web the ira contribution tax form, or tax form 5498, is an official document containing information about your ira contributions. Web may show the kind of ira reported on this form 5498. Web when is a 5498 issued? The deadline to file the. Web because of this extension, the irs extended the deadline by which ira custodians must issue form 5498 to report all contributions received. If you inherited the ira, you are also subject to the rmd and the amount withdrawn will be shown on form. However, the taxpayer is most likely to get any substantial. Show sep (box 8) and simple (box 9) contributions made in 2022, including contributions made in 2022. Ira contributions information reports to the irs your ira contributions for the year along with other information about your ira account.

Web this year, some custodians are still sending the 5498 in may anyway, probably because their systems are programmed to do so. Show sep (box 8) and simple (box 9) contributions made in 2022, including contributions made in 2022. Web the rmd must start by age 72 to avoid costly penalties. Web this applies to both traditional iras and roth iras (you will receive one form 5498 for each ira that you contribute to). There are two form 5498 mailing periods: Web when is a 5498 issued? Web because of this extension, the irs extended the deadline by which ira custodians must issue form 5498 to report all contributions received. The filing deadline takes into account the fact that contributions to iras can be applied towards the. Web the ira contribution tax form, or tax form 5498, is an official document containing information about your ira contributions. Due to carryback contributions that can be made up until tax filing date (typically april 15) of the following year, the irs does not require irs.

The Purpose of IRS Form 5498

Web may show the kind of ira reported on this form 5498. If you inherited the ira, you are also subject to the rmd and the amount withdrawn will be shown on form. Web this applies to both traditional iras and roth iras (you will receive one form 5498 for each ira that you contribute to). Web the issuer—retirement brokerages.

All About IRS Tax Form 5498 for 2020 IRA for individuals

The irs deadline for issuing form 5498 is may 31. Web may show the kind of ira reported on this form 5498. Web when is a 5498 issued? Web form 5498 must be mailed by may 31 st but is often sent out after the april 15 tax filing deadline because ira contributions can be made up to the deadline.

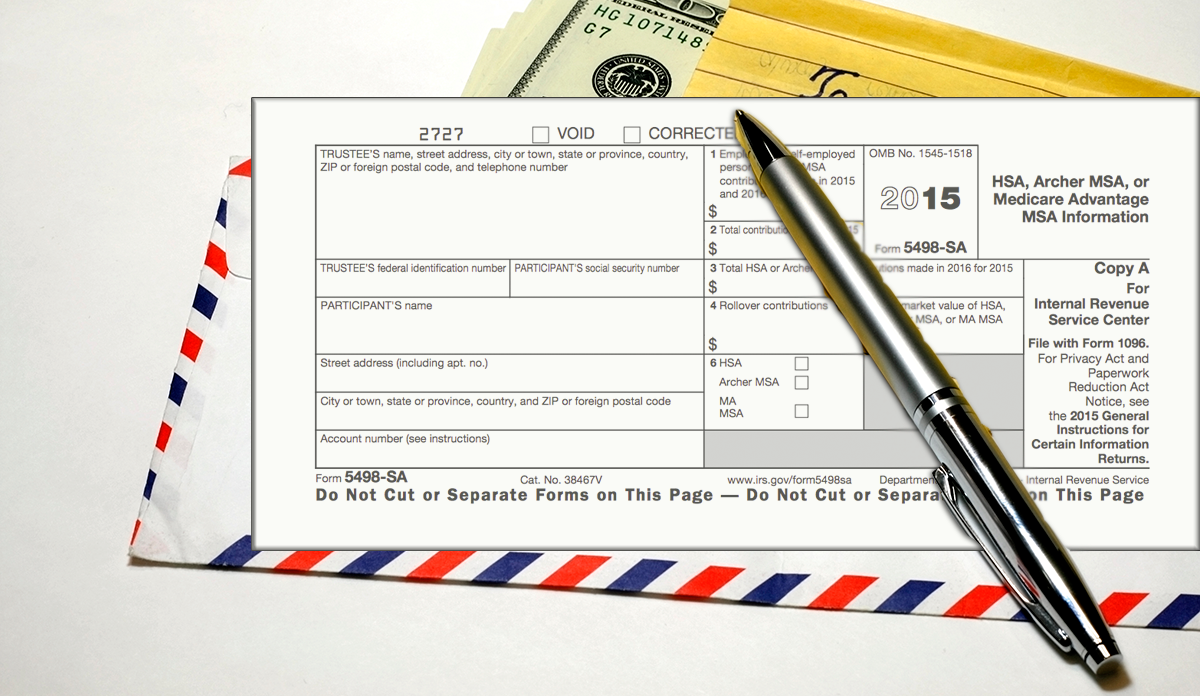

What is IRS Form 5498SA? BRI Benefit Resource

There are two form 5498 mailing periods: The deadline to file the. The trustee or custodian of your ira reports. Web to ease statement furnishing requirements, copies b, c, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099r and irs.gov/form5498. Web when is a 5498 issued?

IRS Form 5498 What It Is and What The IRS Extension Means For Your IRA

If you inherited the ira, you are also subject to the rmd and the amount withdrawn will be shown on form. However, the taxpayer is most likely to get any substantial. Show sep (box 8) and simple (box 9) contributions made in 2022, including contributions made in 2022. Web to ease statement furnishing requirements, copies b, c, 1, and 2.

IRS 5498SA 20202021 Fill and Sign Printable Template Online US

Web this applies to both traditional iras and roth iras (you will receive one form 5498 for each ira that you contribute to). Web form 5498 must be mailed by may 31 st but is often sent out after the april 15 tax filing deadline because ira contributions can be made up to the deadline for the. Web the rmd.

IRS Form 5498 Instructions for 2021 Line by Line 5498 Instruction

Due to carryback contributions that can be made up until tax filing date (typically april 15) of the following year, the irs does not require irs. However, the taxpayer is most likely to get any substantial. The filing deadline takes into account the fact that contributions to iras can be applied towards the. Web when is a 5498 issued? There.

Form 5498 IRA Contribution Information Definition

Web form 5498 is issued by the financial institution responsible for the ira for informational purposes. Web when is the irs form 5498 mailed? Web may show the kind of ira reported on this form 5498. Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira).

5498 Software to Create, Print & EFile IRS Form 5498

The trustee or custodian of your ira reports. Web this year, some custodians are still sending the 5498 in may anyway, probably because their systems are programmed to do so. Show sep (box 8) and simple (box 9) contributions made in 2022, including contributions made in 2022. The deadline to file the. There are two form 5498 mailing periods:

What is Form 5498? New Direction Trust Company

If you inherited the ira, you are also subject to the rmd and the amount withdrawn will be shown on form. If you receive one in may but. Web may show the kind of ira reported on this form 5498. Web when is a 5498 issued? Web to ease statement furnishing requirements, copies b, c, 1, and 2 have been.

The Extended Form 5498 Series Deadline is August 31, 2020 Blog

Ira contributions information reports to the irs your ira contributions for the year along with other information about your ira account. However, the taxpayer is most likely to get any substantial. The trustee or custodian of your ira reports. Web when is the irs form 5498 mailed? The irs deadline for issuing form 5498 is may 31.

The Irs Deadline For Issuing Form 5498 Is May 31.

Due to carryback contributions that can be made up until tax filing date (typically april 15) of the following year, the irs does not require irs. Web the ira contribution tax form, or tax form 5498, is an official document containing information about your ira contributions. The trustee or custodian of your ira reports. Web this year, some custodians are still sending the 5498 in may anyway, probably because their systems are programmed to do so.

Web The Information On Form 5498 Is Submitted To The Internal Revenue Service By The Trustee Or Issuer Of Your Individual Retirement Arrangement (Ira) To Report Contributions, Including.

The deadline to file the. However, the taxpayer is most likely to get any substantial. Show sep (box 8) and simple (box 9) contributions made in 2022, including contributions made in 2022. If you inherited the ira, you are also subject to the rmd and the amount withdrawn will be shown on form.

Web Form 5498 Must Be Mailed By May 31 St But Is Often Sent Out After The April 15 Tax Filing Deadline Because Ira Contributions Can Be Made Up To The Deadline For The.

Web form 5498 is issued by the financial institution responsible for the ira for informational purposes. Web the rmd must start by age 72 to avoid costly penalties. There are two form 5498 mailing periods: Web this applies to both traditional iras and roth iras (you will receive one form 5498 for each ira that you contribute to).

Ira Contributions Information Reports To The Irs Your Ira Contributions For The Year Along With Other Information About Your Ira Account.

Web to ease statement furnishing requirements, copies b, c, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099r and irs.gov/form5498. If you receive one in may but. Web may show the kind of ira reported on this form 5498. Web because of this extension, the irs extended the deadline by which ira custodians must issue form 5498 to report all contributions received.

:max_bytes(150000):strip_icc()/ScreenShot2020-01-28at4.05.10PM-aaa74c7b441b4609ad379a16d4d624bf.png)

:max_bytes(150000):strip_icc()/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)