When Is Irs Form 712 Required

When Is Irs Form 712 Required - Web the irs form 712 is a statement that provides life insurance policy values as of the date of an insured’s or policy owner's death, or at a time a life insurance policy is transferred as a gift. The irs requires that this statement be included. Decedent tax return 1041 filing requirement 3. If your mother's estate was less than (approximately) $5.4 million, you are not required to file form 706. Web what is an irs form 712? Irs form 712 is a gift or estate tax form that may need to be filed with the deceased’s final estate tax return. At the request of the estate’s administrator/executor, we will complete this form to provide the. Web step by step instructions comments if you’re the executor of a decedent’s estate, you may be required to include the value of any life insurance proceeds in the gross estate for federal estate tax purposes. Web life insurance death proceeds form 712 did you mean: Web form 712 should be included with any form 709 gift tax return related to certain policy transfers during the insured’s lifetime to establish the value of the gift as well as with the form 706 estate tax return after death.

Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes. Web form 712 should be included with any form 709 gift tax return related to certain policy transfers during the insured’s lifetime to establish the value of the gift as well as with the form 706 estate tax return after death. If your mother's estate was less than (approximately) $5.4 million, you are not required to file form 706. Decedent tax return 1041 filing requirement 3. The irs requires that this statement be included. At the request of the estate’s administrator/executor, we will complete this form to provide the. Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file. Web step by step instructions comments if you’re the executor of a decedent’s estate, you may be required to include the value of any life insurance proceeds in the gross estate for federal estate tax purposes. Irs form 712 is a gift or estate tax form that may need to be filed with the deceased’s final estate tax return. Web the irs form 712 is a statement that provides life insurance policy values as of the date of an insured’s or policy owner's death, or at a time a life insurance policy is transferred as a gift.

Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file. Taxation of death benefits paid on a life insurance policy internal revenue service form 712 is primarily. Who must file an irs form 706? Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes. Web form 712 should be included with any form 709 gift tax return related to certain policy transfers during the insured’s lifetime to establish the value of the gift as well as with the form 706 estate tax return after death. In that case, you may need to become familiar with irs form 712, life insurance statement. Decedent tax return 1041 filing requirement 3. Web the irs form 712 is a statement that provides life insurance policy values as of the date of an insured’s or policy owner's death, or at a time a life insurance policy is transferred as a gift. Web what is an irs form 712? The irs requires that this statement be included.

Irs Form 7004 Required To Be E Filed Universal Network

The irs requires that this statement be included. If your mother's estate was less than (approximately) $5.4 million, you are not required to file form 706. Taxation of death benefits paid on a life insurance policy internal revenue service form 712 is primarily. Web what is an irs form 712? In that case, you may need to become familiar with.

Life Insurance Form 712 Realtors Can Save Up to 58 on Life Insurance

Web life insurance death proceeds form 712 did you mean: Decedent tax return 1041 filing requirement 3. Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes. The irs requires that this statement be included. Web form 712 should be included with any form 709 gift tax.

File IRS 2290 Form Online for 20222023 Tax Period

Taxation of death benefits paid on a life insurance policy internal revenue service form 712 is primarily. If your mother's estate was less than (approximately) $5.4 million, you are not required to file form 706. Web form 712 should be included with any form 709 gift tax return related to certain policy transfers during the insured’s lifetime to establish the.

IRS Form 712 A Guide to the Life Insurance Statement

The irs requires that this statement be included. In that case, you may need to become familiar with irs form 712, life insurance statement. Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file. Web form 712 should be included with any form 709 gift tax return related to certain policy.

Form 712 Life Insurance Statement (2006) Free Download

The irs requires that this statement be included. In that case, you may need to become familiar with irs form 712, life insurance statement. Web form 712 should be included with any form 709 gift tax return related to certain policy transfers during the insured’s lifetime to establish the value of the gift as well as with the form 706.

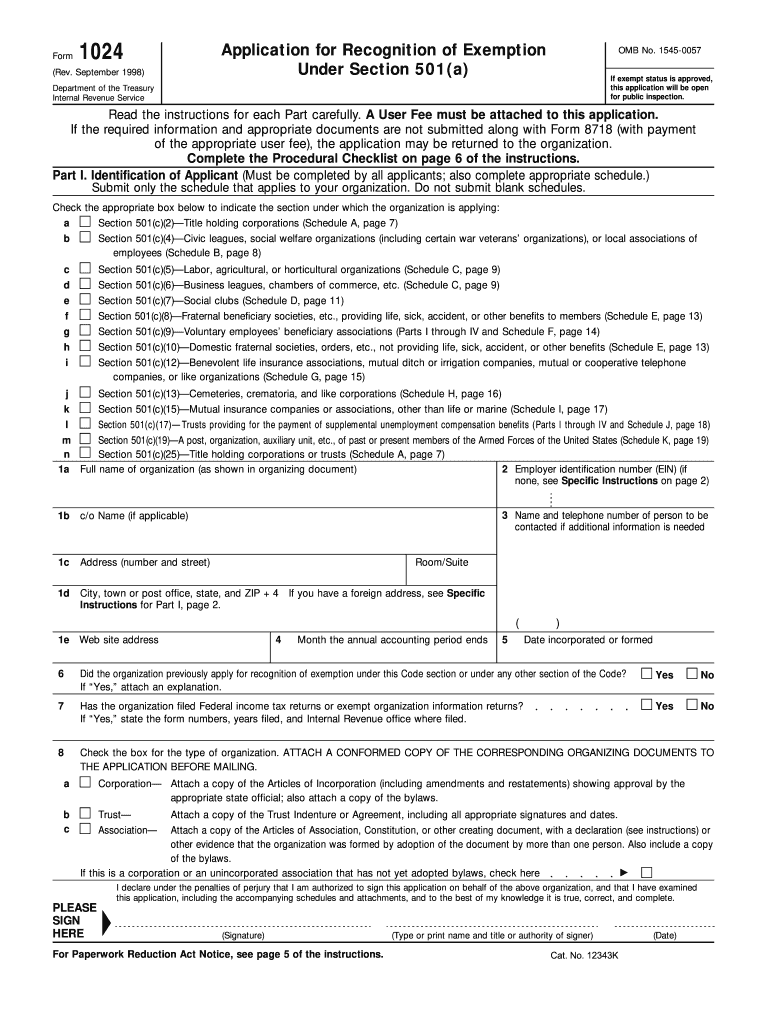

Irs Form 1024 Fill Out and Sign Printable PDF Template signNow

The irs requires that this statement be included. At the request of the estate’s administrator/executor, we will complete this form to provide the. Web form 712 should be included with any form 709 gift tax return related to certain policy transfers during the insured’s lifetime to establish the value of the gift as well as with the form 706 estate.

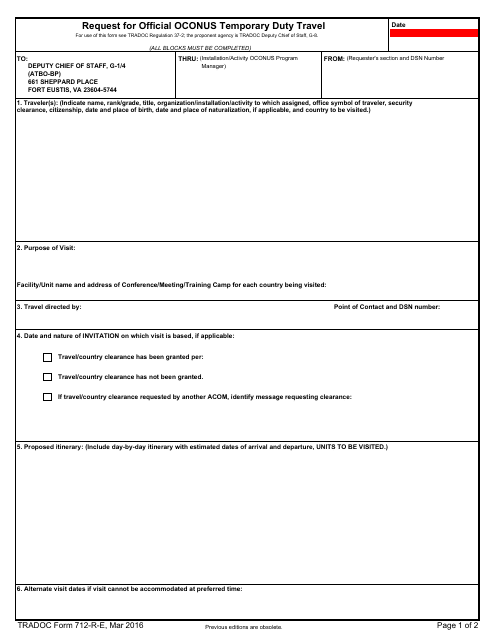

TRADOC Form 712RE Download Fillable PDF or Fill Online Request for

Irs form 712 is a gift or estate tax form that may need to be filed with the deceased’s final estate tax return. Decedent tax return 1041 filing requirement 3. Web form 712 should be included with any form 709 gift tax return related to certain policy transfers during the insured’s lifetime to establish the value of the gift as.

What is form 712? Protective Life

At the request of the estate’s administrator/executor, we will complete this form to provide the. The irs requires that this statement be included. Web life insurance death proceeds form 712 did you mean: Who must file an irs form 706? If your mother's estate was less than (approximately) $5.4 million, you are not required to file form 706.

Form 712 Life Insurance Statement (2006) Free Download

At the request of the estate’s administrator/executor, we will complete this form to provide the. Decedent tax return 1041 filing requirement 3. Web what is an irs form 712? If your mother's estate was less than (approximately) $5.4 million, you are not required to file form 706. Web information about form 712, life insurance statement, including recent updates, related forms,.

Life Insurance Form 712 Realtors Can Save Up to 58 on Life Insurance

Web what is an irs form 712? The irs requires that this statement be included. Irs form 712 is a gift or estate tax form that may need to be filed with the deceased’s final estate tax return. Who must file an irs form 706? Decedent tax return 1041 filing requirement 3.

Who Must File An Irs Form 706?

Web what is an irs form 712? Web step by step instructions comments if you’re the executor of a decedent’s estate, you may be required to include the value of any life insurance proceeds in the gross estate for federal estate tax purposes. Taxation of death benefits paid on a life insurance policy internal revenue service form 712 is primarily. The irs requires that this statement be included.

Web The Irs Form 712 Is A Statement That Provides Life Insurance Policy Values As Of The Date Of An Insured’s Or Policy Owner's Death, Or At A Time A Life Insurance Policy Is Transferred As A Gift.

Irs form 712 is a gift or estate tax form that may need to be filed with the deceased’s final estate tax return. Decedent tax return 1041 filing requirement 3. Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes. Web life insurance death proceeds form 712 did you mean:

Web Information About Form 712, Life Insurance Statement, Including Recent Updates, Related Forms, And Instructions On How To File.

In that case, you may need to become familiar with irs form 712, life insurance statement. If your mother's estate was less than (approximately) $5.4 million, you are not required to file form 706. Web form 712 should be included with any form 709 gift tax return related to certain policy transfers during the insured’s lifetime to establish the value of the gift as well as with the form 706 estate tax return after death. At the request of the estate’s administrator/executor, we will complete this form to provide the.