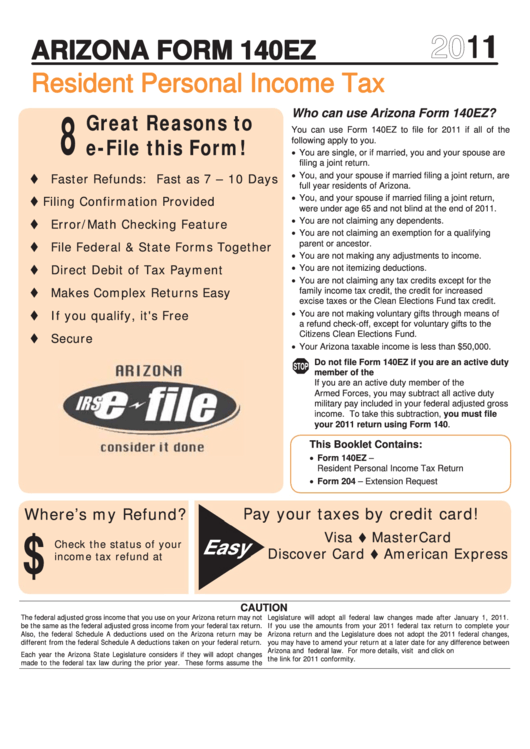

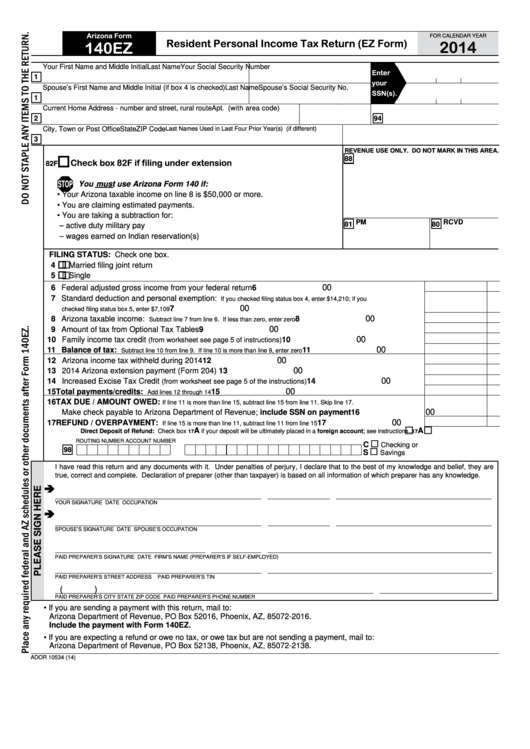

Arizona State Tax Form 140Ez

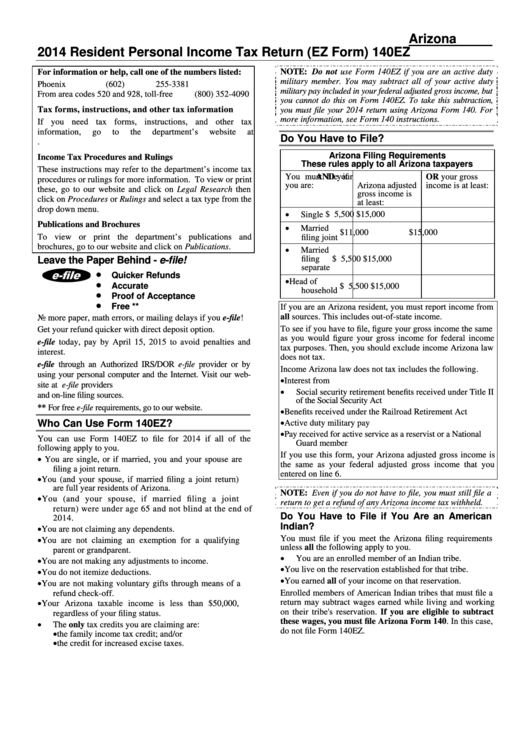

Arizona State Tax Form 140Ez - Web who can use arizona form 140ez? Web you must use form 140 rather than form 140a or form 140ez to file for 2019 if any of the following apply to you. Web personal income tax return filed by resident taxpayers. Download or email 140ez & more fillable forms, register and subscribe now! Az dor 140ez 2020 get az dor 140ez 2020 how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save. Arizona form 140et even if you qualify to claim a credit for increased excise taxes, do not file form 140et if either of the following applies: Web arizona form 140ez easily fill out and sign forms download blank or editable online send and share templates with pdfliner. This form is for income earned in tax year 2022, with tax returns due in april. Web if your taxable income is $50,000 or more, you must use tax tables x and y to figure your tax. You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona.

2021 arizona resident personal income tax return booklet (easy form) You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. Arizona department of revenue, po box. Web who can file form 140et? Arizona form 140et even if you qualify to claim a credit for increased excise taxes, do not file form 140et if either of the following applies: Web include the payment with form 140ez. You are single, or if married, you and your spouse are filing a. Download or email az 140ez & more fillable forms, register and subscribe now! Web if your taxable income is $50,000 or more, you must use tax tables x and y to figure your tax. Web form 140ez optional tax tables.

2021 arizona resident personal income tax return booklet (easy form) Web arizona form 2018 resident personal income tax return (ez form) 140ez for information or help, call one of the numbers listed: Arizona department of revenue, po box. You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Az dor 140ez 2020 get az dor 140ez 2020 how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save. You may use form 140ez if all of the following apply: This form is for income earned in tax year 2022, with tax returns due in april. Web we last updated arizona form 140ez in february 2023 from the arizona department of revenue. Web personal income tax return filed by resident taxpayers.

2020 AZ Form 140 Fill Online, Printable, Fillable, Blank pdfFiller

•ou are single, or if married, you and your spouse are filing a y joint return. This form is for income earned in tax year 2022, with tax returns due in april. Web we last updated arizona form 140ez in february 2023 from the arizona department of revenue. Arizona department of revenue, po box. Web personal income tax return filed.

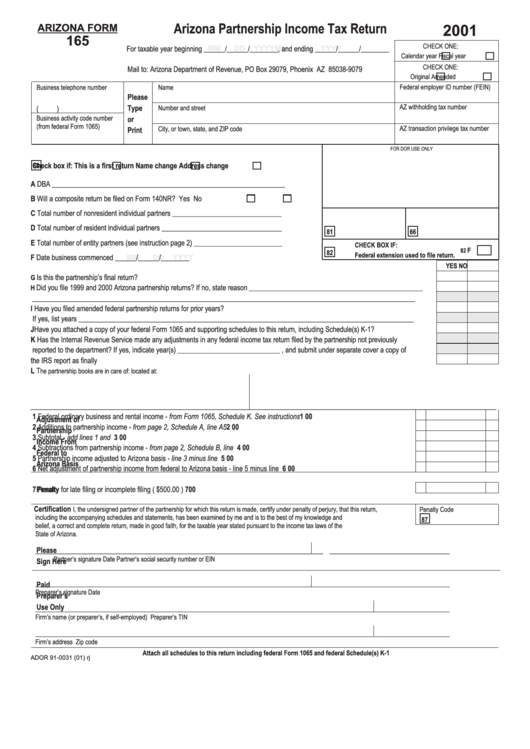

Arizona Form 165 Arizona Partnership Tax Return 2001

Web personal income tax return filed by resident taxpayers. If your taxable income is $50,000 or more, you cannot use form 140ez or. • your arizona taxable income is less. You may use form 140ez if all of the following apply: Web arizona form 140ez easily fill out and sign forms download blank or editable online send and share templates.

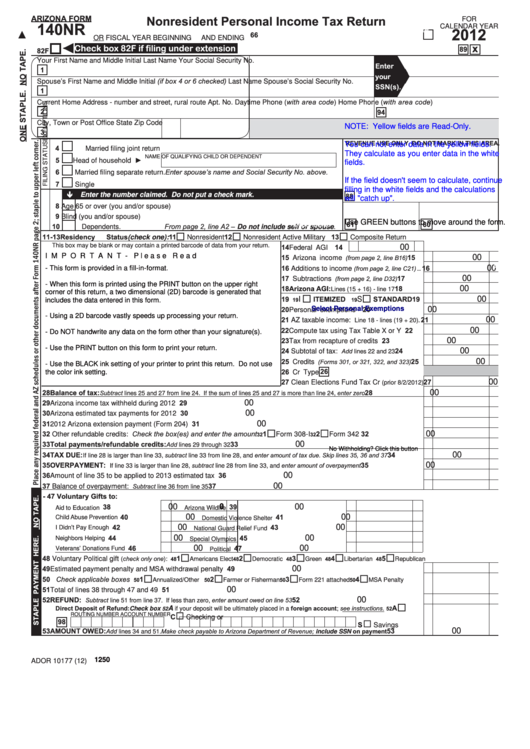

Fillable Arizona Form 140nr Nonresident Personal Tax Return

You can use form 140ez to file for 2019 if all of the following apply to you. • if you are expecting a refund or owe no tax, or owe tax but are not sending a payment, mail to: Web you can use form 140ez to file for 2020 if all of the following apply to you. Az dor 140ez.

Arizona Form 140ez Resident Personal Tax Return (Ez Form

Once you receive your confirmation. Web arizona form 140ez easily fill out and sign forms download blank or editable online send and share templates with pdfliner. •ou, and your spouse if married. • you are single, or if married, you and your spouse are filing a. • if you are expecting a refund or owe no tax, or owe tax.

Instructions For Arizona Form 140ez Resident Personal Tax

• if you are expecting a refund or owe no tax, or owe tax but are not sending a payment, mail to: Download or email az 140ez & more fillable forms, register and subscribe now! Web if your taxable income is $50,000 or more, you must use tax tables x and y to figure your tax. Web include the payment.

arizona tax tables

You are single, or if married, you and your spouse are filing a. Web personal income tax return filed by resident taxpayers. This form is for income earned in tax year 2022, with tax returns due in april. •ou, and your spouse if married. Web if your taxable income is $50,000 or more, you must use tax tables x and.

How to Report Backup Withholding on Form 945

• if you are expecting a refund or owe no tax, or owe tax but are not sending a payment, mail to: Arizona form 140et even if you qualify to claim a credit for increased excise taxes, do not file form 140et if either of the following applies: Web arizona form 2018 resident personal income tax return (ez form) 140ez.

Free Arizona State Tax Power of Attorney (Form 285) PDF

You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. • your arizona taxable income is less. Web if your taxable income is $50,000 or more, you must use tax tables x and y to figure your tax. Web use the same names(s) and social security number(s).

Fillable Arizona Form 140ez Resident Personal Tax Return (Ez

If your taxable income is $50,000 or more, you cannot use form 140ez or. Web we last updated arizona form 140ez in february 2023 from the arizona department of revenue. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either.

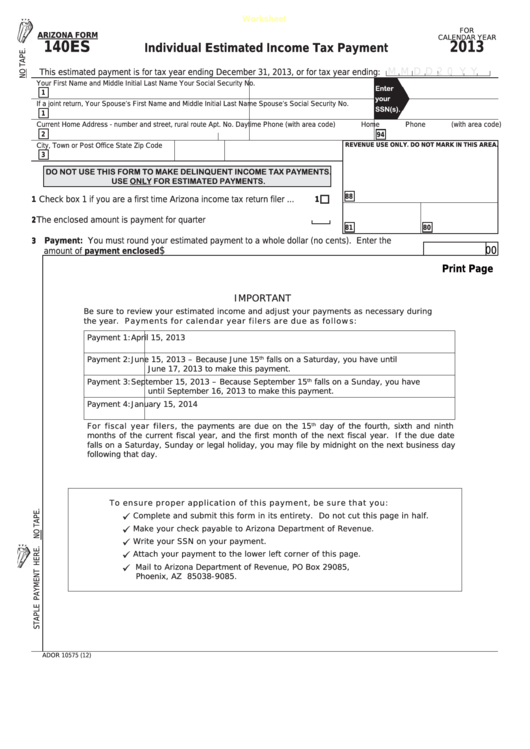

Fillable Arizona Form 140es Individual Estimated Tax Payment

2021 arizona resident personal income tax return booklet (easy form) Web arizona form 140ez easily fill out and sign forms download blank or editable online send and share templates with pdfliner. Download or email 140ez & more fillable forms, register and subscribe now! Web most taxpayers are required to file a yearly income tax return in april to both the.

Complete, Edit Or Print Tax Forms Instantly.

Web you must use form 140 rather than form 140a or form 140ez to file for 2019 if any of the following apply to you. Download or email az 140ez & more fillable forms, register and subscribe now! Az dor 140ez 2020 get az dor 140ez 2020 how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save. Web personal income tax return filed by resident taxpayers.

Web Form 140Ez Optional Tax Tables.

You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. You may use form 140ez if all of the following apply: • if you are expecting a refund or owe no tax, or owe tax but are not sending a payment, mail to: • your arizona taxable income is less.

You May File Form 140 Only If You (And Your Spouse, If Married Filing A Joint Return) Are Full Year Residents Of Arizona.

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. • your arizona taxable income is $50,000 or more. •ou are single, or if married, you and your spouse are filing a y joint return. Web 26 rows 140ez :

Web Include The Payment With Form 140Ez.

Web if your taxable income is $50,000 or more, you must use tax tables x and y to figure your tax. Web you can use form 140ez to file for 2020 if all of the following apply to you. Web use the same names(s) and social security number(s) that were listed on arizona form 140, 140a, 140ez, 140py or 140nr. Arizona department of revenue, po box.